S&P Breaking Out? Or Breaking Down?

The chart and comments below courtesy of John Kosar at Bianco Research. The fact: S&P moving up. The question: why? Commercial traders are bearish. But up goes the index anyway. Denning Take: The market is floating on a sea of money. It's the only kind of inlfation the Fed can cause right now....asset inflation--and even that's breaking down in the housing market. So if it can't get businesses to borrow and if consumers can no longer refinance and cash out because long-term rates are rising...the last best bet is to keep bidding up stocks, stoking up confidence...and praying to the monetary gods for...for...well what exactly IS the Fed praying for now? Or are they stuck in a fruitless game of "forestall the correction at all costs?" If that's the case, Fed action essentially has a negative goal, not to produce anything, but to prevent something. And that something would be falling asset prices...and deflation. TODAY'S MARKET: PRICED FOR TOMORROW'S PERFECTION

Here's the Kosar comment:

"As of Friday's latest report (current through August 26), Commercials have increased their net short position to 62,609 contracts from 50,716 contracts a week earlier. This is Commercials' largest net short position since they initially went net short on June 24, and suggests they have renewed bearish conviction following a few weeks of uncertainty. moreover, this is Commercials' largest net short position since December 17, 2002 (see chart), which preceded the decline into the March 2003 low.

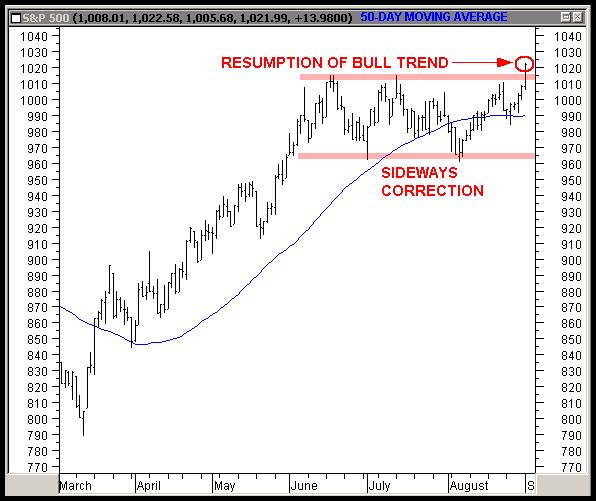

"However, despite an apparent bearish directional bet by Commercial traders, the S&P 500 broke out higher Tuesday from ten weeks of sideways price activity (see chart below). We now interpret this ten-week period as a correction within the bull trend that began at the October 2002 low. Tuesday's close above the 1,015 upper boundary of this correction area indicates the bull trend has resumed, and targets a move to at least 1,065.

Here's the Kosar comment:

"As of Friday's latest report (current through August 26), Commercials have increased their net short position to 62,609 contracts from 50,716 contracts a week earlier. This is Commercials' largest net short position since they initially went net short on June 24, and suggests they have renewed bearish conviction following a few weeks of uncertainty. moreover, this is Commercials' largest net short position since December 17, 2002 (see chart), which preceded the decline into the March 2003 low.

"However, despite an apparent bearish directional bet by Commercial traders, the S&P 500 broke out higher Tuesday from ten weeks of sideways price activity (see chart below). We now interpret this ten-week period as a correction within the bull trend that began at the October 2002 low. Tuesday's close above the 1,015 upper boundary of this correction area indicates the bull trend has resumed, and targets a move to at least 1,065.

9 Comments:

This comment has been removed by a blog administrator.

This comment has been removed by a blog administrator.

This comment has been removed by a blog administrator.

This comment has been removed by a blog administrator.

This comment has been removed by a blog administrator.

This comment has been removed by a blog administrator.

This comment has been removed by a blog administrator.

This comment has been removed by a blog administrator.

This comment has been removed by a blog administrator.

Post a Comment

<< Home