Gold Futures Under Pressure

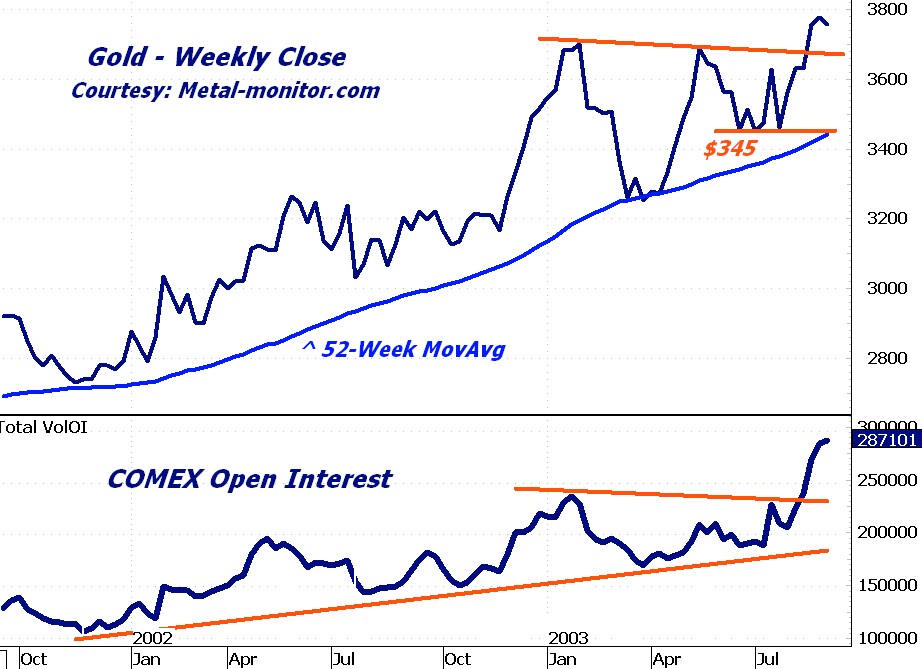

The story in the gold market is unfolding in the futures maket, and the stakes are enormously high for those of you who have positions in gold stocks. I'll give you my conclusions up front, and the analysis for you to peruse. Concusion: gold is overbought short-term, and there are some powerful forces lining up that could lead to a gold-sell off and a rally in the broader indexes. Conservative investors should be braced for a gold sell-off with stop-losses, and look to buy back in at lower prices. This could be a bump in the road on the way to a quadruple digit spot gold price. But it may be an uncomfortably large bump. The large speculators and commercial traders and hedgers have been waging an epic battle in the gold futures market. The commercials/hedgers have a huge net short position in gold. They’ve been selling. The latest Commitment of Traders report shows that commercials are net short 157,940 contracts . On the other hand, large speculators still have a massively long position, long net 115,092 contracts according to the latest COT report. Presumably the hedgers and commercial traders “know” something about gold that the speculators don’t. The commercials mine and process gold and are closer to supply/demand dynamics than the market. But is their large net short position bearish for gold? Or are the speculators ahead of the gold industry in getting long bullion when all paper currencies are racing to devalue relative to the dollar? In short, who’s right here, and is gold at a major turning point? My conclusion is that it’s a very dangerous time to be long gold stocks or gold futures without…if you’ll pardon the pun, hedging your risk. Gold open interest has exploded in the last three months. The shorts are putting out more and more supply. As the longs eat it up, prices rise. But by creating supply, the commercials put pressure on the speculators to buy futures faster than the shorts can put them out. Check out the chart from my metals go-to guy Greg Weldon. You can find more about Greg's private research products in the metals sector by going to http://www.metal-monitor.com/. Greg's charts show the huge increase in open interest that's putting near-term pressure on the gold longs and the technical pressure spot gold might encounter. Open Interest Explodes

Once the buying dries up, poof, buying power disappears amid growing supply and the prices fall. The shorts will cover at some point. But the question is, how far could the gold price fall if the turning point comes?

Gold, Technically Speaking

Once the buying dries up, poof, buying power disappears amid growing supply and the prices fall. The shorts will cover at some point. But the question is, how far could the gold price fall if the turning point comes?

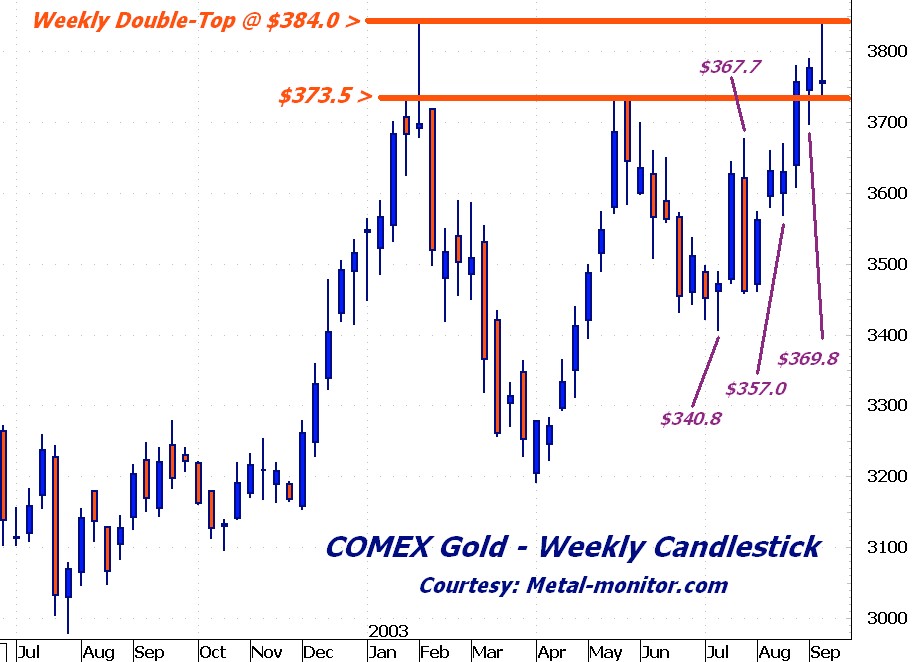

Gold, Technically Speaking

Spot gold will test support at $375 and should it crash through that, July 14th’s $340 level is next…and should it break that, April’s $325 level. The big danger is that the large specs are so massively long and commercials are so massively short that the resolution of the battle could send spot gold below $300 and then some--while equity markets soar.

Most vulnerable is the XAU. It could decline to 75 easily if spot gold falls to July's level. Puts would be in order.

Spot gold will test support at $375 and should it crash through that, July 14th’s $340 level is next…and should it break that, April’s $325 level. The big danger is that the large specs are so massively long and commercials are so massively short that the resolution of the battle could send spot gold below $300 and then some--while equity markets soar.

Most vulnerable is the XAU. It could decline to 75 easily if spot gold falls to July's level. Puts would be in order.

0 Comments:

Post a Comment

<< Home