Sell the Dollar

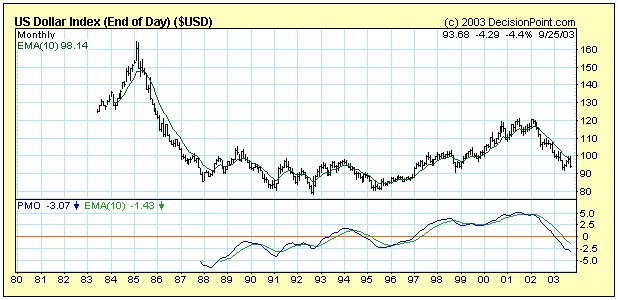

I’ve just realized that a good chunk of “Insider” readers may not be familiar with the overall investment position of Strategic Investment (the mother ship of the Strategic Group.) So I’m writing a post that I’ll have done later today which shows, graphically, theoretically, experientially, and cosmologically, my basic macro investment observation: namely the huge structural imbalances in the global economy that come from a dollar-centric world. However, at this very moment, I want to try and an answer a question I get from readers who are sold on the trade of the decade (sell the dollar, buy gold) and want to know a simple thing: HOW DO I SELL THE DOLLAR? I’ve got a three-part answer for you. I do not suggest that you actively enter the foreign exchange markets and actually sell dollars and use the proceeds to buy, for example, the euro. Some of you may be doing this, and probably don’t need my advice to figure out. But what I’m looking for is a relatively inexpensive way to profit from the investment position that the dollar is going to fall a lot more than it already has. What is the easiest, least expensive way for you to profit? First, there is obviously gold, both gold stocks and physical gold, coins, or bullion based trusts like the one in Australia in which shares are redeemable for actual gold (hopefully there will be two new bullion-based gold trusts that trade just like stock funds by the end of next month). I’ve written so much about gold in other places I won’t do it here except to say that while it’s not a direct way to profit from a falling dollar, it is a likely way. Options on U.S. Dollar Index Futures That said, is there a way to be directly short, or bearish on the dollar? One way you can do it is by buying an option on a dollar index futures contract. And obviously, if you’re bearish on the dollar, you’d be betting the dollar index is going to go down, so you’d buy puts. If you’re not interested in finding out what the dollar index is and how it works, skip the section below and go straight to interest rates and the 10-year bond--your other two vehicles for being short the dollar. What exactly is the U.S. Dollar Index? It trades on the New York Board of Trade under the symbol DX. The index measures the market value of the dollar versus the trade-weighted geo-metric average of six currencies (although 17 countries are represented in the index because there are 12 counties which use the euro). Here are the six currencies and their most recent weightings: Currency Currency Weight % Euro 57.6% Japanese yen 13.6% UK pound 11.9% Canadian dollar 9.1% Swedish krona 4.2% Swiss franc 3.6% Why these countries and these currencies? These countries constitute most of America’s international trade (excepting Mexico and China), and have relatively well-developed foreign exchange markets. Most importantly, the value of these currencies are, with the exception of central bank intervention, freely determined by market forces and market participants (central banks are market participants too.) Because the exchange rate of each of the currencies that the dollar is measured against is determined by the market, the index should, at least in theory, tell you what the market thinks of the strength of America’s economy as represented by the dollar. Strong economy, strong dollar. Weak economy with chronic debt, structural employment problems, and a pathological consumption addiction…weaker dollar. Incidentally, the USDX was invented in 1973. That was two years after Nixon closed the gold window. And it was the year the gold standard was completely abandoned and the 25-year reign of the Bretton Woods regime of fixed exchange rates was ditched once and for all. Such is the fate of all currency regimes…sooner or later. The USDX uses a base of 100, which was established in March 1973 by an agreement reached at the Smithsonian in Washington, D.C. And so the current level of the dollar index reflects the average value of the dollar in the era of free-floating exchange rates. The chart below shows that dollar went as high as 170 in the mid-1980s. It was on September 22, 1985 that the ministers of what was then the G-5 (the U.S., Germany, France, the U.K. and Japan) made the following statement in point 18 of the now-famous Plaza Accord: “18. The Ministers and Governors agreed that exchange rates should play a role in adjusting external imbalances. In order to do this, exchange rates should better reflect fundamental economic conditions than has been the case. They believe that agreed policy actions must be implemented and reinforced to improve the fundamentals further, and that in view of the present and prospective changes in fundamentals, some further orderly appreciation of the main non-dollar currencies against the dollar is desirable. They stand ready to cooperate more closely to encourage this when to do so would be helpful.” An Orderly Fall in the Dollar, Part One

The Plaza Accord did succeed in bringing the dollar down. However, it’s worth pointing out that it did NOT succeed in readjusting the main imbalance of the U.S. economy. In fact, that imbalance is still with us today….too much global reliance on U.S. consumption. And so now, the G7 meets last week to again ask for an orderly decline in the dollar as the Plaza Accords stated, to “better reflect fundamental economic conditions.”

How far the dollar index declines this time depends on just how bad “fundamental economic conditions in the U.S. are.” I believe they’re much worse than they were in 1985. And so the dollar index could plunge to new historic lows. Buying options on dollar index futures would be one way to profit.

The only caveat is that a big influence on the value of the dollar right now is not measured by the dollar index, namely the Chinese currency. Since the Chinese do not allow the yuan to trade freely, its essentially acting as a giant sword of Damocles in currency markets. The day the yuan floats is the day dollar depreciation goes into fifth gear.

It’s also the day that the Chinese bad loan problems explode into a Chinese banking crisis. And I don’t believe the Chinese are ready to try and deal with bad loans in a strengthening currency. The worst scenario for a debtor is to have to pay off loans in a currency that’s gaining in purchasing power. You borrowed in a weak currency but must pay off in strong one. Not a good scenario. But even without the de-pegging of the yuan…the dollar index will be under heavy pressure.

A Falling Dollar Means Rising Interest Rates, Right?

The second and third ways to profit from a falling dollar depend on a proxy relationship. That is, other than the forex markets, there is no one to one way for you to directly invest in a falling dollar. There are other relationships, though, that are what I call dollar proxies. Specifically, there are interest rates and bond prices.

When a currency falls, in theory anyway, interest rates usually rise. A government whose currency is falling apart tries to make it more attractive by raising the yield it pays on government debt. It attempts to make assets denominated in that currency more attractive by making them pay more to potential investors. And if the government doesn’t raise rates, the market will do it by selling off bonds and driving yields up.

And so, in theory, you would normally expect to see a falling U.S. dollar accompanied by rising U.S. interest rates. That’s the theory anyway. The fact is, the Fed and the Bush administration are doing everything they can to engineer a weaker dollar WITHOUT causing a rise in long-term rates.

The problem, from the Bush/Greenspan perspective is that rising long-term rates pose two enormous problems. First, rising long-term rates make it more expensive to service existing outstanding U.S. debt. The federal government has paid out $161 billion in interest this year on the spectrum of debt (3,7,10, 30-year) issued by the Treasury.

However, according to the White House’s own report on the 2004 budget, just a one percent rise in interest rates would nearly double that figure by 2008. The White House projects that a 1% rise in interest rates would add $8.7 billion in interest expense for the rest of calendar year 2003, $21 billion in 2004, $30.5 billion in 2005, $36.4 billion in 2006, $41.8 billion in 2007, and $47.2 billion in 2008…for a grand total of $154.9 billion in the next 5 years. And to meet this added interest expense, the government would, of course, have to float even more bonds…also at the higher interest rate.

Sounds like a nightmare doesn’t it? Having to issue more debt at higher interest rates to pay off your existing debt, all because your currency is falling and rates are rising. In fact, it’s not just the Federal government that’s vulnerable to rising rates. It’s the whole low-rate leveraged U.S. economy, mostly because of the huge debt over-hang I’ve been haranguing about ad nauseam.

Let me give Bill Gross of PIMCO a turn at the podium, “Up to now, with yields declining and home mortgages, car loans, and all sorts of debt being discounted to near 0% yields, the debt levels have not mattered….If you don’t pay any interest on it [the debt], there’s no limit to the amount businesses and consumers can borrow and spend. My point exactly: if and when rates do go up, we will all care--the leverage will work in reverse, the economy will founder.”

The group that cares the most right now is the Bush administration and the Fed. Rising rates will be bad for businesses and consumers who have too much debt. But they will be disastrous for the Federal government and its currency, the dollar.

How can the Fed and Bush talk down the dollar but prevent long-term rates from rising? Well…they can do what they Japanese did and buy tons and tons and more tons of U.S. bonds. But my guess is that no amount of intervention by the Fed--even unorthodox and unconventional means--can prevent long-term rates from rising.

The U.S. government is a credit risk. Its bonds are no longer a safe haven. The yield must rise. Bondholders must get paid for the risk of owning the assets of a country whose currency is weaker.

Which brings us back to profiting from dollar. If bond yields must go up, bond prices will go down (bond prices and yields move in opposite directions.) This leaves you with two specific ways to profit. First by betting on rising yields. Second by betting on falling prices.

The falling prices scenario is easy to invest in and I’ve already recommended several ways to do it. Below is a chart of the 30-year Lehman bond fund (TLT), as well as the 10-year fund (IEF). If yields rise, bond prices will fall. And as these two investments reflect bond prices, they’ll fall, just as they did this summer when yields rose.

The solution for falling bond prices? Buy puts on TLT and IEF.

The Plaza Accord did succeed in bringing the dollar down. However, it’s worth pointing out that it did NOT succeed in readjusting the main imbalance of the U.S. economy. In fact, that imbalance is still with us today….too much global reliance on U.S. consumption. And so now, the G7 meets last week to again ask for an orderly decline in the dollar as the Plaza Accords stated, to “better reflect fundamental economic conditions.”

How far the dollar index declines this time depends on just how bad “fundamental economic conditions in the U.S. are.” I believe they’re much worse than they were in 1985. And so the dollar index could plunge to new historic lows. Buying options on dollar index futures would be one way to profit.

The only caveat is that a big influence on the value of the dollar right now is not measured by the dollar index, namely the Chinese currency. Since the Chinese do not allow the yuan to trade freely, its essentially acting as a giant sword of Damocles in currency markets. The day the yuan floats is the day dollar depreciation goes into fifth gear.

It’s also the day that the Chinese bad loan problems explode into a Chinese banking crisis. And I don’t believe the Chinese are ready to try and deal with bad loans in a strengthening currency. The worst scenario for a debtor is to have to pay off loans in a currency that’s gaining in purchasing power. You borrowed in a weak currency but must pay off in strong one. Not a good scenario. But even without the de-pegging of the yuan…the dollar index will be under heavy pressure.

A Falling Dollar Means Rising Interest Rates, Right?

The second and third ways to profit from a falling dollar depend on a proxy relationship. That is, other than the forex markets, there is no one to one way for you to directly invest in a falling dollar. There are other relationships, though, that are what I call dollar proxies. Specifically, there are interest rates and bond prices.

When a currency falls, in theory anyway, interest rates usually rise. A government whose currency is falling apart tries to make it more attractive by raising the yield it pays on government debt. It attempts to make assets denominated in that currency more attractive by making them pay more to potential investors. And if the government doesn’t raise rates, the market will do it by selling off bonds and driving yields up.

And so, in theory, you would normally expect to see a falling U.S. dollar accompanied by rising U.S. interest rates. That’s the theory anyway. The fact is, the Fed and the Bush administration are doing everything they can to engineer a weaker dollar WITHOUT causing a rise in long-term rates.

The problem, from the Bush/Greenspan perspective is that rising long-term rates pose two enormous problems. First, rising long-term rates make it more expensive to service existing outstanding U.S. debt. The federal government has paid out $161 billion in interest this year on the spectrum of debt (3,7,10, 30-year) issued by the Treasury.

However, according to the White House’s own report on the 2004 budget, just a one percent rise in interest rates would nearly double that figure by 2008. The White House projects that a 1% rise in interest rates would add $8.7 billion in interest expense for the rest of calendar year 2003, $21 billion in 2004, $30.5 billion in 2005, $36.4 billion in 2006, $41.8 billion in 2007, and $47.2 billion in 2008…for a grand total of $154.9 billion in the next 5 years. And to meet this added interest expense, the government would, of course, have to float even more bonds…also at the higher interest rate.

Sounds like a nightmare doesn’t it? Having to issue more debt at higher interest rates to pay off your existing debt, all because your currency is falling and rates are rising. In fact, it’s not just the Federal government that’s vulnerable to rising rates. It’s the whole low-rate leveraged U.S. economy, mostly because of the huge debt over-hang I’ve been haranguing about ad nauseam.

Let me give Bill Gross of PIMCO a turn at the podium, “Up to now, with yields declining and home mortgages, car loans, and all sorts of debt being discounted to near 0% yields, the debt levels have not mattered….If you don’t pay any interest on it [the debt], there’s no limit to the amount businesses and consumers can borrow and spend. My point exactly: if and when rates do go up, we will all care--the leverage will work in reverse, the economy will founder.”

The group that cares the most right now is the Bush administration and the Fed. Rising rates will be bad for businesses and consumers who have too much debt. But they will be disastrous for the Federal government and its currency, the dollar.

How can the Fed and Bush talk down the dollar but prevent long-term rates from rising? Well…they can do what they Japanese did and buy tons and tons and more tons of U.S. bonds. But my guess is that no amount of intervention by the Fed--even unorthodox and unconventional means--can prevent long-term rates from rising.

The U.S. government is a credit risk. Its bonds are no longer a safe haven. The yield must rise. Bondholders must get paid for the risk of owning the assets of a country whose currency is weaker.

Which brings us back to profiting from dollar. If bond yields must go up, bond prices will go down (bond prices and yields move in opposite directions.) This leaves you with two specific ways to profit. First by betting on rising yields. Second by betting on falling prices.

The falling prices scenario is easy to invest in and I’ve already recommended several ways to do it. Below is a chart of the 30-year Lehman bond fund (TLT), as well as the 10-year fund (IEF). If yields rise, bond prices will fall. And as these two investments reflect bond prices, they’ll fall, just as they did this summer when yields rose.

The solution for falling bond prices? Buy puts on TLT and IEF.

But what about rising yields? You can also buy a CBOE listed interest rate option on the 10-year bond. The ticker symbol is TNX. TNX moves up when yields go up, in other words its performance is positively correlated to rising yields (while IEF and TLT are positively correlated to rising bond prices).

So, if you bought the theory that interest rates must rise, and therefore bond yields, you’d be a call buyer on TNX. A yield-based call option buyer profits if as, CBOE’s site explains, “the underlying interest rate rises above the strike price plus the premium paid for the call.”

To Bet on Rising Rates, Buy TNX Calls

But what about rising yields? You can also buy a CBOE listed interest rate option on the 10-year bond. The ticker symbol is TNX. TNX moves up when yields go up, in other words its performance is positively correlated to rising yields (while IEF and TLT are positively correlated to rising bond prices).

So, if you bought the theory that interest rates must rise, and therefore bond yields, you’d be a call buyer on TNX. A yield-based call option buyer profits if as, CBOE’s site explains, “the underlying interest rate rises above the strike price plus the premium paid for the call.”

To Bet on Rising Rates, Buy TNX Calls

The price on TNX is calculated by multiplying the price of the most recently auctioned bond by 10. The index currently trades at 41.02, implying a yield of 4.10 on the most recently auctioned 10-year note.

Yesterday’s ten-year notes closed at a yield of 4.09%. Multiply that times ten and you get 40.90, implying that TNX trades a slight premium to the actual ten year note, which is perhaps why TNX fell eight tenths of one percent yesterday.

Still, as an options trader, this would be a fairly straightforward proposition. If you’re betting that a falling dollar leads to rising rates, you’d buy calls on TNX. For example if rates rise by 1%, TNX would trade over 50, or almost 25% above its current price. Leverage that with an in-the-money-call, and voila. you’ve got a simple way to benefit from a rising rates and a falling dollar.

As you can see, the easiest way to hedge against a falling dollar is to buy gold. But if you want to get more exotic, buy put options on dollar index futures. If you’re interested in doing that, call the folks at Fox Investments. They can execute the trades for you. From overseas, call 312-528-3000. From the U.S. call 1-800-621-0265.

Beyond that, for falling bond prices, buy put options on TLT and IEF. And for rising yields, calls on TNX. It’s a trade I’ll be making in Strategic Options Alert.

The price on TNX is calculated by multiplying the price of the most recently auctioned bond by 10. The index currently trades at 41.02, implying a yield of 4.10 on the most recently auctioned 10-year note.

Yesterday’s ten-year notes closed at a yield of 4.09%. Multiply that times ten and you get 40.90, implying that TNX trades a slight premium to the actual ten year note, which is perhaps why TNX fell eight tenths of one percent yesterday.

Still, as an options trader, this would be a fairly straightforward proposition. If you’re betting that a falling dollar leads to rising rates, you’d buy calls on TNX. For example if rates rise by 1%, TNX would trade over 50, or almost 25% above its current price. Leverage that with an in-the-money-call, and voila. you’ve got a simple way to benefit from a rising rates and a falling dollar.

As you can see, the easiest way to hedge against a falling dollar is to buy gold. But if you want to get more exotic, buy put options on dollar index futures. If you’re interested in doing that, call the folks at Fox Investments. They can execute the trades for you. From overseas, call 312-528-3000. From the U.S. call 1-800-621-0265.

Beyond that, for falling bond prices, buy put options on TLT and IEF. And for rising yields, calls on TNX. It’s a trade I’ll be making in Strategic Options Alert.

0 Comments:

Post a Comment

<< Home