The Perpetual Debt Machine

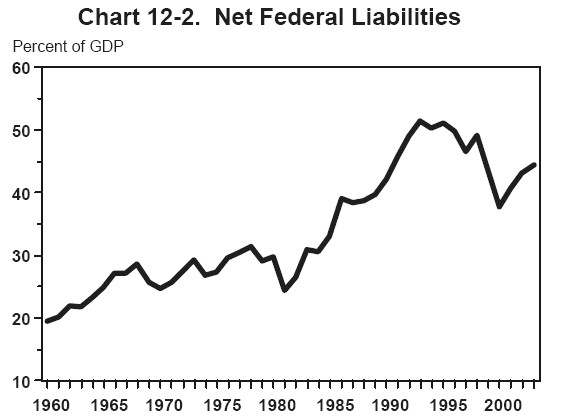

Wanna know just how bad is? Do you? Really? You sure? Okay. Then don't pay attention to the fiscal year deficit as a percentage of GDP. It doesn't tell you anything useful--which is exactly why the government uses it. It minimizes what a scheme they're running. Below is a chart showing current government liabilities as a percentage of GDP. And below THAT is the text from the White House's "Analytical Perspectives" on the FY 2005 Budget. If you're a masochist, you can find the whole thing at http://www.whitehouse.gov/omb/budget/fy2005/pdf/spec.pdf. The figures below do NOT include social security. And please note the text I've bolded in the explanation from the Feds. Then tell me if you're comforted. And if you want to understand how government deficits and the making of war are inextricably linked throughout history, I recommend you take a look at Scott Trask's article at http://www.mises.org/fullarticle.asp?control=1419&id=65 . It's great. Money quote: "Since Prime Minister Robert Walpole's introduction of the funding system in England during the 1720s, the secret was out that government debt need never be repaid. Just create a regular and dependable source of revenue and use it to pay the annual interest and the principal of maturing bonds. Then for every retired bond, sell a new one. In this way, a national debt could be made perpetual."

The government explanation for what a "liability" is.

Table 12-1 includes Federal liabilities that would also be listed on a business balance sheet. All the various forms of publicly held Federal debt are counted, as are Federal pension and health insurance obligations to civilian and military retirees and the disability compensation that is owed the Nation's veterans. The estimated liabilities stemming from Federal insurance programs and loan guarantees are also shown. The benefits that are due and payable under various Federal programs are also included, but these are short-term obligations not long-term responsibilities. Other obligations, including future benefit payments that are likely to be made through Social Security and other Federal income transfer programs, are not shown in this table. These are not Federal liabilities in a legal or accounting sense. They are Federal responsibilities, and it is important to gauge their size, but they are not binding in the same way that a liability is.

The government explanation for what a "liability" is.

Table 12-1 includes Federal liabilities that would also be listed on a business balance sheet. All the various forms of publicly held Federal debt are counted, as are Federal pension and health insurance obligations to civilian and military retirees and the disability compensation that is owed the Nation's veterans. The estimated liabilities stemming from Federal insurance programs and loan guarantees are also shown. The benefits that are due and payable under various Federal programs are also included, but these are short-term obligations not long-term responsibilities. Other obligations, including future benefit payments that are likely to be made through Social Security and other Federal income transfer programs, are not shown in this table. These are not Federal liabilities in a legal or accounting sense. They are Federal responsibilities, and it is important to gauge their size, but they are not binding in the same way that a liability is.

0 Comments:

Post a Comment

<< Home