Monetary Trends

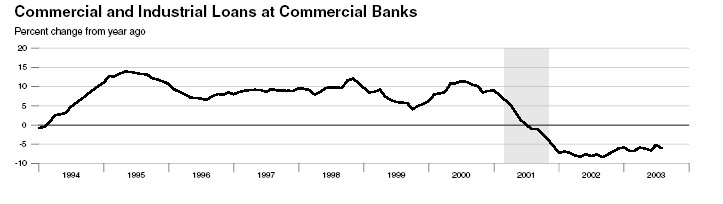

Blogging will be light today as I'm working on the October issue of Strategic Investment. But I did want to post some charts I pulled from the St. Louis Fed's report on Monetary trends released yesterday. You can see from the charts that monetary looseness has not led to more borrowing and has eviscerated money market savers. The Fed has punished saving without at least getting a kick in bank lending for its efforts. And on the fiscal policy front...that's an awful lot of stimulus (deficit spending) for very modest GDP growth. Low Short Term Rates Have Not Led to More Lending...

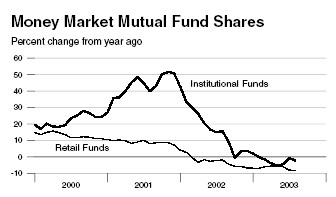

...But They Have Destroyed the Income of Savers

...But They Have Destroyed the Income of Savers

As for fiscal policy (government spending), the jobs report tomorrow will tell us whether the Bush tax cuts are leading to a turn around in the employment numbers. I wouldn't count on it. The CPI numbers from the Labor Department yesterday show that prices are rising at their slowest annual rate in 37 years.

The Fed simply hasn't succeeded in getting consumers to spend faster than they already are, nor in creating the inflationary numbers that come with an expansion. Kind of makes you wonder just how durable and genuine the expansion is.

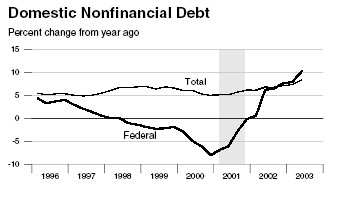

And even if you took the defense spending fattened 2nd quarter GDP numbers as a sign that the economy is turning around, how long can the government afford to rack up deficits in order to achieve such modest growth? When will business spending pick up?

Hey Keynes, It's Still Not Working

As for fiscal policy (government spending), the jobs report tomorrow will tell us whether the Bush tax cuts are leading to a turn around in the employment numbers. I wouldn't count on it. The CPI numbers from the Labor Department yesterday show that prices are rising at their slowest annual rate in 37 years.

The Fed simply hasn't succeeded in getting consumers to spend faster than they already are, nor in creating the inflationary numbers that come with an expansion. Kind of makes you wonder just how durable and genuine the expansion is.

And even if you took the defense spending fattened 2nd quarter GDP numbers as a sign that the economy is turning around, how long can the government afford to rack up deficits in order to achieve such modest growth? When will business spending pick up?

Hey Keynes, It's Still Not Working

And as for the deficits themselves, what if bond investors prefer corporate bonds to Treasuries? And what if bond investors, foreign and domestic, demand higher interest rates to compensate for the increased risk that Uncle Sam is racking up a tab a) he can't afford to pay, or b) plans to pay off in wildly inflated dollars? Will there still be takers for U.S. bonds?

My answer? Puts on the bond market. 10-year notes did NOT fall immediately on the Fed's decision to stand pat. And if the bond market thought the Fed was wrong before about deflation being a greater risk than inflation, it's not going to like they key paragraph from yesterday's statement. Yields should rise and prices should fall, if the past really is prologue.

The Committee perceives that the upside and downside risks to the attainment of sustainable growth for the next few quarters are roughly equal. In contrast, the probability, though minor, of an unwelcome fall in inflation exceeds that of a rise in inflation from its already low level. The Committee judges that, on balance, the risk of inflation becoming undesirably low remains the predominant concern for the foreseeable future. In these circumstances, the Committee believes that policy accommodation can be maintained for a considerable period.

And as for the deficits themselves, what if bond investors prefer corporate bonds to Treasuries? And what if bond investors, foreign and domestic, demand higher interest rates to compensate for the increased risk that Uncle Sam is racking up a tab a) he can't afford to pay, or b) plans to pay off in wildly inflated dollars? Will there still be takers for U.S. bonds?

My answer? Puts on the bond market. 10-year notes did NOT fall immediately on the Fed's decision to stand pat. And if the bond market thought the Fed was wrong before about deflation being a greater risk than inflation, it's not going to like they key paragraph from yesterday's statement. Yields should rise and prices should fall, if the past really is prologue.

The Committee perceives that the upside and downside risks to the attainment of sustainable growth for the next few quarters are roughly equal. In contrast, the probability, though minor, of an unwelcome fall in inflation exceeds that of a rise in inflation from its already low level. The Committee judges that, on balance, the risk of inflation becoming undesirably low remains the predominant concern for the foreseeable future. In these circumstances, the Committee believes that policy accommodation can be maintained for a considerable period.

0 Comments:

Post a Comment

<< Home