The New Fund Industry: Exchange Traded, Not Mutual

Headed over to London on Thursday to meet with some brokers at Man Financial about buying London’s gold ETF for U.S. investors. A bullion backed, London-listed ETF looks like it will arrive on the scene in England before it hits the States. You can already buy Australia’s gold backed bullion fund. Gold Bullion Limited has sold almost 130,000 ounces or about 4 tonnes of gold since listing the ETF on the Australian Stock Exchange at the end of March. It trades on the ASX under the symbol GOLD. You can see by the chart below that a basket of unhedged gold stocks in the U.S., as measured by the HUI, has roundly clubbed the new bullion-based ETF. True. But this is more a question of liquidity, which should not be a problem for a U.S. listing. What’s more, the ETFs will be backed by real gold, rather than the stocks of gold companies. Demand for Gold Liquidity a Good Omen

Later this week I’m going to show you an easy way to own physical gold. But for most investors, the easiest way to own gold will be through an exchange traded fund backed by bullion. ETFs, ishares, and HOLDERS, all of which I call precision guided investments, are simple ways to own a liquidly traded basket of stocks in a specific sector, country, or asset class.

Index funds, which are not actively managed, have much lower expense ratios than mutual funds. And you can trade them during the day. Imagine that…not only do you not have to pay some hot shot’s big salary…you don’t have to risk him letting his banker buddies trade your mutual fund after the close at prices you don’t get.

It’s a much better deal for the average investor. And it’s one reason I think this IS the new investment strategy for a high-risk, low-return market. You lower your costs, take more intelligent risks, and if you wish, leverage it with options.

Wall Street knows the public never tires of new investment products, especially ones that actually make investors money. That’s why I wasn’t too surprised to see an article in today’s Wall Street Journal over a brewing debate between the exchanges about how to list index options. A few exchanges want options listed on multiple paces. Others want to maintain the status quo.

Right now, each individual exchange bids for the right list options on a particular index. For example, the Philadelphia Stock Exchange recently beat out the Pacific Exchange over the right to trade options on the Nasdaq Composite.

When you consider that the Qs, the tracking stock for the Nasdaq 100, did over 69 million shares in volume yesterday and had the third highest trading volume of all U.S. listed securities…you can see why getting the rights to trade options on a popular index makes a difference to even a large exchange. Heavy trading volume generates huge revenues for an exchange.

If index options get listed on multiple exchanges, you’ll see more volume, more liquidity, and probably tighter spreads. This is all good news. The Philly stock exchange says it’s less likely to list index options if they’re listed in multiple places. And of course it would say that. After all, less profit if you have to share trading and spreads get tighter.

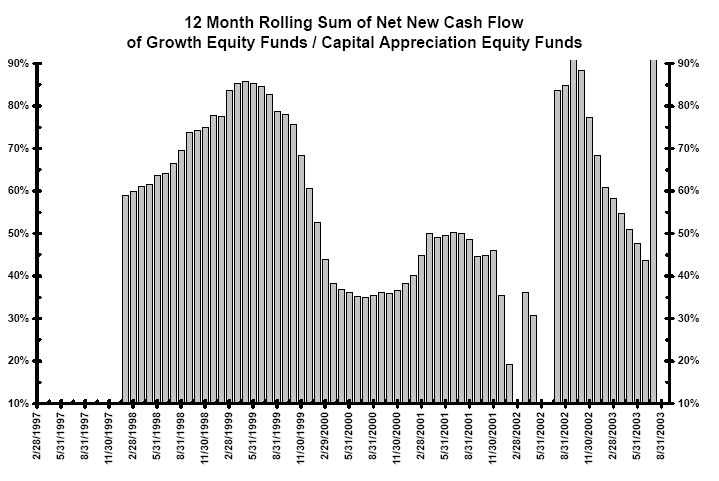

The mutual fund industry is already in trouble with its high management fees and poor performance. And with this new scandal coming out about illegal trading--it could deal a deathblow to investor confidence in the fund industry. In fact, look at the chart below courtesy of the top-shelf guys at Bianco. It shows you just what can happen when the retail investors loses confidence in an idea. His cash does the talking. (also note the disturbing recent spike of cash back into growth and capital appreciation equity funds...a sure sign that the hyper-bull mentality is back, at least for a few months)

When Panic Attacks: Cash Can Leave Funds as Quickly as it Flows to Them

Later this week I’m going to show you an easy way to own physical gold. But for most investors, the easiest way to own gold will be through an exchange traded fund backed by bullion. ETFs, ishares, and HOLDERS, all of which I call precision guided investments, are simple ways to own a liquidly traded basket of stocks in a specific sector, country, or asset class.

Index funds, which are not actively managed, have much lower expense ratios than mutual funds. And you can trade them during the day. Imagine that…not only do you not have to pay some hot shot’s big salary…you don’t have to risk him letting his banker buddies trade your mutual fund after the close at prices you don’t get.

It’s a much better deal for the average investor. And it’s one reason I think this IS the new investment strategy for a high-risk, low-return market. You lower your costs, take more intelligent risks, and if you wish, leverage it with options.

Wall Street knows the public never tires of new investment products, especially ones that actually make investors money. That’s why I wasn’t too surprised to see an article in today’s Wall Street Journal over a brewing debate between the exchanges about how to list index options. A few exchanges want options listed on multiple paces. Others want to maintain the status quo.

Right now, each individual exchange bids for the right list options on a particular index. For example, the Philadelphia Stock Exchange recently beat out the Pacific Exchange over the right to trade options on the Nasdaq Composite.

When you consider that the Qs, the tracking stock for the Nasdaq 100, did over 69 million shares in volume yesterday and had the third highest trading volume of all U.S. listed securities…you can see why getting the rights to trade options on a popular index makes a difference to even a large exchange. Heavy trading volume generates huge revenues for an exchange.

If index options get listed on multiple exchanges, you’ll see more volume, more liquidity, and probably tighter spreads. This is all good news. The Philly stock exchange says it’s less likely to list index options if they’re listed in multiple places. And of course it would say that. After all, less profit if you have to share trading and spreads get tighter.

The mutual fund industry is already in trouble with its high management fees and poor performance. And with this new scandal coming out about illegal trading--it could deal a deathblow to investor confidence in the fund industry. In fact, look at the chart below courtesy of the top-shelf guys at Bianco. It shows you just what can happen when the retail investors loses confidence in an idea. His cash does the talking. (also note the disturbing recent spike of cash back into growth and capital appreciation equity funds...a sure sign that the hyper-bull mentality is back, at least for a few months)

When Panic Attacks: Cash Can Leave Funds as Quickly as it Flows to Them

What better product to fill the void than index ETFs? If the ETF can start getting more assets under management, it could replace the mutual fund industry entirely. There will be issues to be worked out, like making it possible for 401(k) investors to get in and out of ETFs and trade options.

But the investment demand is already there. It’s a matter of when, not if.

What better product to fill the void than index ETFs? If the ETF can start getting more assets under management, it could replace the mutual fund industry entirely. There will be issues to be worked out, like making it possible for 401(k) investors to get in and out of ETFs and trade options.

But the investment demand is already there. It’s a matter of when, not if.

0 Comments:

Post a Comment

<< Home