Income Reflation vs. Wealth Reflation

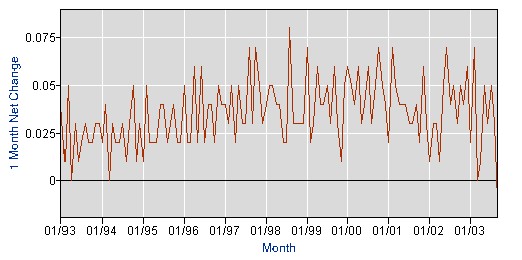

I talked on the phone with my friend Greg Weldon earlier today. On Monday, Greg authored a great piece which I think goes a long way toward explaining the asset inflation you're seeing in housing/banking/financial stocks--even as income growth is non-existent. It's a case of income growth versus asset growth. Rather than parsing his article, I asked him if I could republish a piece of it. Greg agreed. He agrees with me that it's astounding that you could see such a large rise in paper wealth and future economic expectations against such bleak income numbers. Even if job growth is modest...the American consumer is simply tapped out and stretched to the max. Without income growth...asset inflation is going to run out of steam, and sooner rather than later. If you like Greg's take-no-prisoners writing style, feel free to send him an email at weldonfinancial@comcast.net or contact his managing director, Bill O'herron at 203-858-1579. Emphasis added below is all mine. ____________________________________________ According to Doctor Market the prognosis calls for …… INTENSE job CREATION …… strong enough to support an INCOME REFLATION …… which, in turn, would allow for ‘positive’ profit-margin-expanding pricing-power for corporate America …… and thus, sparking inflation virulent enough to cause the Fed to TRIPLE the Fed Funds rate over the next eighteen months, starting with a rate HIKE by the end of THIS year. Certainly, the rampant rise in interest rates posted last Thursday-Friday is NOT to be viewed as the function of a dollar disinvestment, since the greenback participated in the upside US equity-currency surge. There is little doubt that THE CATALYST for last week’s upside all-along-the curve, rate-spike, is the belief that job CREATION has arrived, and thus the busted rungs(s) in the ladder of reflation, can be ‘repaired’. The mid-week ISM readings, came accompanied by a rise in the Mortgage Bankers indexes, to feed into Friday’s HEADLINE posting of job growth, to foster belief that both income and wealth are again, on the rise. Here is our point of macro-attack today … income, and wealth reflation. As for Income growth …in a word … fuh-get-ahhh-BOUT-itttt. There is NO income growth in the US. Let’s rewind for a second. We have long noted the existence of virtually unprecedented yr-yr rates of decline posted in ‘Real Earnings’ data, along with a second bout of DEFLATION in the yr-yr, and monthly posting in Average Weekly Earnings …and we have highlighted … barely-equal-to-inflation, disinflating, and near-secular lows, in the yr-yr rate of Average Hourly Earnings. Indeed, in the past we have spotlighted our thought-process that suggests working LESS hours, and earning the inflation rate via income growth, means an overall DEFLATION in ACTUAL income. NOW, there is INDISPUTABLE evidence, as per a nearly unheard-of monthly DECLINE in Average Hourly Earnings, posted within Friday’s Payroll data, and COMPLETELY MASKED by the headlines centered on miniscule job growth. Observe the FACT that September’s DECLINE in Average Hourly Earnings is a deflationary-influence NOT SEEN ONCE, in the lasts DECADE, as detailed in the chart below, coming directly from the US Labor Department’s web-site. First, September’s deflation is obvious, and clearly UNUSUAL. Secondly, there have been ONLY THREE instances of no-growth (unchanged) in Average Hourly Earnings on a month-month basis, once in 1993, once in 1994, and the other time coming JUST THIS YEAR … meaning … that the income deflation of 2003 is something NOT SEEN in at least a DECADE. Income Deflation Takes the Stage

Changes in Avearage Hourly Earnings Growth, month-over-month

BUT, the wealth factor is NOT negative, not at all, not right now. This is KEY, as it explains the MASSIVE ‘dual-draw-down’ in US Savings Deposits, AND, US Money Market Funds … totaling more than $100 billion in just the last month alone. Consumers feel supported by income-tax-relief-belief, AND, a strong-dose of wealth reflation … and despite bouts of confidence-shaken-confidence readings related to JOB ANXIETY … consumers are STRUTTING right now.

…The resilience of the stock market itself, feeds into the current ‘environment’, especially in light of strong rallies in cyclicals, banks, brokers, tech-stocks … and, particularly, real-estate stocks. But, at the END OF THE DAY, consumers are experiencing INCOME DEFLATION, despite appearances of, or even in the face-of, job creation headlines … and … are CLEARLY ‘drawing’ on ‘wealth’ and ‘savings’, to

maintain consumption.

Thus, from the macro-perspective, going forward … the factors influencing WEALTH become of paramount importance. At the bottom-line then, as goes HOUSING, so goes US Wealth.

-------------------

The wealth effect used to be driven by cofidence in the stock market. Now it's driven by confidence in housing prices and stocks leveraged to low interest rates. Houses being an asset closer to home than stocks, when the wealth effect here reverse and asset prices give ground...the damage will be severe.

Changes in Avearage Hourly Earnings Growth, month-over-month

BUT, the wealth factor is NOT negative, not at all, not right now. This is KEY, as it explains the MASSIVE ‘dual-draw-down’ in US Savings Deposits, AND, US Money Market Funds … totaling more than $100 billion in just the last month alone. Consumers feel supported by income-tax-relief-belief, AND, a strong-dose of wealth reflation … and despite bouts of confidence-shaken-confidence readings related to JOB ANXIETY … consumers are STRUTTING right now.

…The resilience of the stock market itself, feeds into the current ‘environment’, especially in light of strong rallies in cyclicals, banks, brokers, tech-stocks … and, particularly, real-estate stocks. But, at the END OF THE DAY, consumers are experiencing INCOME DEFLATION, despite appearances of, or even in the face-of, job creation headlines … and … are CLEARLY ‘drawing’ on ‘wealth’ and ‘savings’, to

maintain consumption.

Thus, from the macro-perspective, going forward … the factors influencing WEALTH become of paramount importance. At the bottom-line then, as goes HOUSING, so goes US Wealth.

-------------------

The wealth effect used to be driven by cofidence in the stock market. Now it's driven by confidence in housing prices and stocks leveraged to low interest rates. Houses being an asset closer to home than stocks, when the wealth effect here reverse and asset prices give ground...the damage will be severe.

0 Comments:

Post a Comment

<< Home