Stateside

Just a quick update...I've been traveling the last few days. In Baltimore now. A full day's blogging to follow.

A combustible mix of politics, economics, history...and liberty!

Just a quick update...I've been traveling the last few days. In Baltimore now. A full day's blogging to follow.

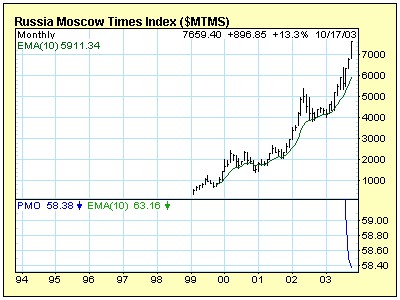

Why is it that everyone seems to think if U.S. interest rates rise, so will rates on emerging market debt? Perhaps it's because that's what's happened in the past. To have a convergence between U.S. rates and emerging market rates, you'd have to have a serious upgrade in the credit-worthiness of emerging markets and a downgrade or change in the perception of U.S. credit risk. But in the dollar-standard era, as the U.S. went, so went the rest of the world. If U.S. bond prices fell, it was because U.S. economic growth was strong. And if U.S. economic growth was strong, the appetite for dollar-denominated assets increased---while the appetite for emerging market debt decreased. Strong eco growth in the U.S. has, at least in recent history, meant falling foreign bond prices (as well as falling Treasury prices.) Will the relationship hold this time? It IS possible you could see some profit taking from emerging market bond holders. Holders of sovereign Brazilian date are sitting on total returns of 54% this year-to-date. Russia's Moscow Times Index has screamed into the stratosphere. Take a look at the chart below.

In fact, I had lunch yesterday from an old college friend who now helps negotiate bond offerings my Russian public companies. She says transparency is improving. And she says the recent Moody's upgrading means even more new companies can raise money through bonds at lower rates...and that there's no shortage of foreign capital in Russia. For now.

My take? I think in the near-term, the perception of a robust U.S. recovery and the huge summer Russia has had mean a quick correction in emerging market debt, perhaps a correction in bonds too, with moderately higher rates.

But the great correlation that's held sway under the dollar standard isn't going to win the day any longer. Rising U.S. yields won't automatically mean rising emerging market yields. The U.S. is going to have to compete with more and more borrowers on the open market. And saddled with a growing debt...it's going to get harder to compete without raising rates.

It's odd that the main reason you hear for rising rates is as bullish one: that the economy is recovering and as the demand for credit and money increases, so does the cost of money.

Seems to me the exact opposite is true in the long term. The U.S. governmen willl have to pay more to borrow because it ALREADY has so much debt outstanding and its consumers--the engine of its consumption based economy--are tapped out as well.

But then again, I could be wrong. It happens more than I would care to admit. And I'm sure it will happen again, sometime soon.

In the meantime, I'd look to buy puts on bond funds that have significant exposure to Russia--to play a short correction in the bubble that's formed in emerging markets.

In fact, I had lunch yesterday from an old college friend who now helps negotiate bond offerings my Russian public companies. She says transparency is improving. And she says the recent Moody's upgrading means even more new companies can raise money through bonds at lower rates...and that there's no shortage of foreign capital in Russia. For now.

My take? I think in the near-term, the perception of a robust U.S. recovery and the huge summer Russia has had mean a quick correction in emerging market debt, perhaps a correction in bonds too, with moderately higher rates.

But the great correlation that's held sway under the dollar standard isn't going to win the day any longer. Rising U.S. yields won't automatically mean rising emerging market yields. The U.S. is going to have to compete with more and more borrowers on the open market. And saddled with a growing debt...it's going to get harder to compete without raising rates.

It's odd that the main reason you hear for rising rates is as bullish one: that the economy is recovering and as the demand for credit and money increases, so does the cost of money.

Seems to me the exact opposite is true in the long term. The U.S. governmen willl have to pay more to borrow because it ALREADY has so much debt outstanding and its consumers--the engine of its consumption based economy--are tapped out as well.

But then again, I could be wrong. It happens more than I would care to admit. And I'm sure it will happen again, sometime soon.

In the meantime, I'd look to buy puts on bond funds that have significant exposure to Russia--to play a short correction in the bubble that's formed in emerging markets.