Isabelle

A combustible mix of politics, economics, history...and liberty!

Here is something I could only ever publish on a blog...where space is not a premium. I'm linking to it because of something I saw in San Francisco and passed on to the conference goers there in August. I was standing in line at a fish stand at Oakland's Stadium. I was there for an A's-Red Sox game (the Red Son won in extra innnings after Manny Ramirez homered to tie the game in the 9th). While the kids behind the counter made my fish sandwich, a guy walked up on my right. All the kids behind the counter got excited and one of them fished out a Rubik's cube and set it on the counter. I was intrigued. The guy then began solving the cube while the kids behind the counter traded cash. I couldn't resist and asked him what he was doing. It had only been about 20 seconds, but he'd already solved one complete side. He said he'd told the kids he could solve the cube in less than three minutes and that they didn't believe him. He was going to prove it to them. He looked me in the eyes the whole time, but his hands kept working the cube. I asked him, "When did you start doing this?" "When I was about 10." "What's your secret?" "There's no secret really. I just realized there are about 10 or 15 patterns. You just have to figure out what they are and then work them in the right order. After that, it's easy." I asked him a few more questions. He kept working the cube, but looking at me. And sure enough, two minutes later, the thing was solved. He put it on the counter and waved goodbye to the teenagers working the fish stand (who were jumping up and down and smiling). So the key to solving the cube is pattern recognition. There's no real artistry in it, where you have an amazing insight or breakthrough. You have to work it the right way or you won't solve it. Of course, you COULD do it accidentally. But then it would be awfully hard to repeat. You wouldn't know what it was you did right. The parallels are obvious for investors. There's nothing new under the sun on Wall Street. But the world changes every day. Interest rates. Rhodes Scholar former generals running for President. Hurricanes smacking the East Coast and the price of plywood. And all these events affect investment values. You may not be able to determine with scientific exactitude how much any one given event is affecting the broad market. But you can look for relationships...patterns...and trends. Is there a pattern or explanation that takes into account all of the variables and tells you what you should do? In other words, can this kind of "strategic intelligence gathering" be predictive? Maybe. Maybe not. But you'll only know if you're looking...if you accept that the best investment decision comes from getting as big a picture as possible (financial data, economic numbers, political events) and then hunting for the probabilities. Far too many investors are content with riding a trend (rising stock prices) without questioning what the premise of that trend is, and if that premise is false. All of which is to say...the rally in stocks is real...but based on a false trend...that trend being that stock values can be supported indefinitely by easy money...until the economy grows out of its enormous debt. Wicked, tricksey, false, as Gollum might say. The big consequence of the Fed-generated rally is that it creates an even larger divergence between Wall Street's financial economy and America's real economy. And with each dollar of debt added...it hollows out the American currency...and hastens the day when the American financial economy falls apart. Not a cheery note, of course. But it is one you can prepare for. For one, we've seen it in the past before (pattern recognition). And we know that the world doesn't end when financial economies collapse (Argentina, Russia, John Law France). But it DOES change, especially if most of your wealth is tied up in the currency of the financial economy that happens to be collapsing. Which reminds me...I need to get back to the October issue of Strategic....

Major oversight for me to not include a link the comments from New York Times reporter John Burns about the media's performance leading up to the war in Iraq. I'll leave the subject alone and get back to the markets. But Burns tackles the issue head on. You can read the whole thing here or go to http://209.11.49.220/editorandpublisher/headlines/article_display.jsp?vnu_content_id=1979014 Here's the money quote: "There is corruption in our business. We need to get back to basics. This war should be studied and talked about. In the run up to this war, to my mind, there was a gross abdication of responsibility. You have to be ready to listen to whispers." While I'm at it, let me pass on a link from a translation of an article that appeared in the French daily Le Figaro. I can't vouch for the whole translation, sinch my French is poor. But it's suprising, nonetheless, coming from a Frenchman, even though Le Figaro has a reputation for being "right wing" unlike Le Monde. You can fine the whole thing here or by going here...http://cinderellabloggerfeller.blogspot.com/2003_09_14_cinderellabloggerfeller_archive.html . The piece in question is from Monday, the 15th, titled "The Birth of the First American Empire," by Guy Sorman. Here's the quote... In sum, the great adventure of the burgeoning century is not the clash of civilizations, which was never anything but a Hollywood-style metaphor with no real basis in fact; it will be the demonstration of the failure or the universality of the three great principles embodied by the first American empire: democracy, individualism and consumption. Facing it, there no longer exists either a Soviet model, or a Chinese or an Islamist one, nor a European alternative, not even a utopia. There only really remains the question posed by the American empire: to be Americanized or not to be? The century, it is true, is only three years old.

Working on the issue, but I did see an interesting link I figured is worth passing on. Doesn't really matter where your stance on the war. The point that's emerging (and has been for some time now) is that the media are systematically...well...lying about the state of affairs in Iraq. Granted, I'm not there. But these are eyewitness accounts, and not by soldiers (although there are plenty of those that put the lie to the relentless "quagmire" reporting.")) Of course the media isn't doing anything in Iraq that it hasn't been doing for years...mis-representing, under reporting, being selective with the facts. The difference today is that investors can see for themselves what's going on...fraud, huge salaries, fines by the government while business as usual goes on. If you're an investor, at least you have the choice between believing the hype and losing your money...or taking a totally different path. In Iraq, though, the media's campaign to create an image that's at odds with reality WILL have consequences...and not good ones if you ask me. Fair enough to oppose the war and the strategy. Quite another thing to send reports back from Baghdad designed to influence public opinion at the expense of the truth. It's not really "quite another thing." It's what Al Franken would call a big fat lie. Take a look at this headline from today's International Herald Tribune....

...And then compare it to these two excerpts, both via Instapundit.

First, Eric Olsen at Blogcritics.org posts this note from a friend....

One of the State folks was telling me about that big story early in the war when the Iraqis claimed that the US had blown up a busload of Syrians trying to leave Iraq and get back into Syria. Turns out it was a busload of Syrian fighters trying to get INTO Iraq to fight. She said that she used to walk home at night at 10pm and see them all chanting away, lining up to get on the buses to go to Iraq (the Iraqi embassy is right next to the US one in Damascus). Assad was overjoyed to get rid of these fundamentalists, and Saddam was happy to get them, and throw them all on the front lines. Apparently they are the only ones who did any real fighting and they got totally wiped out. That explains why the Syrians never made much noise about a busload of their "civilians" being killed--

but all the Western media ran the story and never ran the retraction.

Another thing that she said is that ALL the Iraqis are done with the idea of Arab Unity. They hate all the other states except for Syria. They believe Saddam gave so much money to these other states, and none of them offered any support. They are particularly hateful now to the Palestinians; ordinary Iraqis were sometimes moved out of their own homes to house them, and they got jobs and pensions-- and she said that the new Arabic graffiti on the walls of Baghdad University is "Palestinians go home. The free ride is over."

In any case, this tour was a lovefest compared to the last one, so god only knows what the reporters are all going on about. Another thing I heard is that 90% of all the attacks have happened in the Sunni Triangle, which if you look on a map represents all of about 1/8 of Iraq maybe (Ramadi, Fallujah, Baghdad-- I don't have a good map to do the math with), so you have a country 7/8 calm. This guy's Iraqi mom (from Mosul) also said that the power is now on regularly in Baghdad but no one is reporting that.

If CNN hasn't gotten it, it appears that Assad in Syria has. The cabinet change was a big thing even though many hoped/expected that Assad would choose a non-Baathist over Otri. Still, they think a few of the new guys will be non-Baathists which would have been unthinkable before.

They sure need it-- the country is a beautiful basket case full of intelligent, kind people who could do something good if given a chance. On a more superficial, but probably important level as well, the kids military uniforms we saw last year are all gone, and a lot of the militarization you used to see in posters and monuments, etc. seems to have been toned down. The Lebanese paper, The Star, attributes this directly albeit grudgingly to the US being right next door.

The music went over even better, and it now looks like we will be going back next month, and then on to Beirut. Obviously, we have to be careful. But we also have to be careful about what we are being told about this war and its aftermath. It's frightening to me how unrepresentative it is of public opinion in the most hardline of all Arab states!

And then there's this from Judge Don Walters, also via Instapundit. You can find the whole thing here or by going to

http://www.instapundit.com/archives/011552.php

The Judge, by the way, did NOT support the war initially. He was asked by the Justice Department to travel to Iraq with a team of other jurists to evaluate the legal system and make recommendations. He's highly critical about the Coalition Provisional Authority and the communication between the civilian and military efforts of the U.S. operation. But he's even more critical of the media's coverage of the entire post-war situation. Here's an excerpt of a speech he recently gave on the subject. Please note these are his speaking notes and aren't a verbatim transcript from the speech itself

WE ARE NOT GETTING THE WHOLE TRUTH FROM THE NEWS MEDIA. And not always the truth: tell about the riot, tiger stadium!

THE NEWS YOU WATCH, LISTEN TO AND READ IS HIGHLY SELECTIVE. GOOD NEWS DOESN'T SELL,

THIS IS THE KIND OF YOU DON'T HEAR ABOUT.

90% OF THE DAMAGE YOU SEE ON TV WAS CAUSED BY IRAQI'S, NOT BY US. ALL OF THE DAMAGE YOU SEE TO SCHOOLS, HOSPITALS, POWER GENERATION FACILITIES, REFINERIES, PIPELINES, AND WATER SUPPLIES, AS WELL AS SHOPS, MUSEUMS, AND SEMI-PUBLIC BUILDINGS (LIKE HOTELS) WAS CAUSED EITHER BY THE IRAQI ARMY IN ITS DEATH THROES OR IRAQI CIVILIANS LOOTING AND RIOTING.

THE DAY AFTER THE WAR WAS OVER, THERE WAS NEARLY 0 POWER BEING GENERATED IN IRAQ. 45 DAYS LATER, 1/3 OF THE TOTAL NATIONAL POTENTIAL OF 8000 MW IS UP AND RUNNING. DOWNED POWER LINES ARE BEING REPAIRED AND ARE ABOUT 70% COMPLETE.

THERE IS WATER PURIFICATION WHERE LITTLE OR NONE EXISTED BEFORE. WATER IS BEING PURIFIED BY US, NOT ALWAYS SUCCESSFULLY, BUT AS BEST WE CAN, AND AT LEAST IT'S RUNNING AGAIN AND THIS TIME TO EVERYONE.

OIL IS 95% OF THE IRAQI GNP. FOR IRAQ TO SURVIVE, IT MUST SELL OIL. THERE WAS DAMAGE TO THE OIL FIELDS, THE PIPELINES, THE REFINERIES.

ALL DONE BY THE IRAQI ARMY OR LOOTERS. THE 14 STORY OFFICE BUILDING OF THE SOUTHERN IRAQ OIL COMPANY IN BASRA WAS TORCHED BY BATHIST, DESTROYING ALL OF THE BOOKS, RECORDS AND COMPUTERS OF THE COMPANY. TODAY, THE REFINERY AT BAYJI IS AT 75% OF CAPACITY PRODUCING GASOLINE. THE CRUDE PIPELINE BETWEEN KIRKUK AND BAYJI HAS BEEN REPAIRED, THOUGH THE BATHIST KEEP TRYING TO DISRUPT IT. LIQUID PETROLEUM GAS, WHICH ALL IRAQIS USE TO COOK AND HEAT, IS AT 103% OF NORMAL PRODUCTION.

UNTIL EXPORTS START, EVERY DROP OF GASOLINE PRODUCED GOES TO THE IRAQI PEOPLE,

CRUDE OIL IS BEING STORED, WHEN IT CANNOT BE REFINED, IN PREPARATION FOR EXPORT.

IF WE ARE DOING ALL THIS FOR THE PEOPLE, WHY ARE THEY SHOOTING US?

THE GENERAL POPULATION ISN'T. BELIEVE ME, BY MY SAMPLE, 90% ARE GLAD WE CAME AND THE MAJORITY DON'T WANT US TO LEAVE FOR SOME TIME TO COME, BUT, THERE ARE STILL PLENTY OF BAD GUYS, THE BATHISTS WHO LIVED WELL UNDER SADDAM. THE THUGS OF THE OLD REGIME STILL HOPE TO RETURN TO POWER, AND THERE ARE PLENTY OF THEM, MOSTLY LOCATED IN SUNI AREAS. THEN TOO, SADDAM, IN THE RAMADAN AMNESTY, LET EVERY MURDERER, BUTCHER, RAPIST AND VIOLENT CRIMINAL LOOSE ON HIS OWN PEOPLE. THERE ARE INTERESTS, INCLUDING ORGANIZED CRIME, WITH A DESIRE FOR ANARCHY AND PROFIT.

WE MUST RESTORE ORDER, AND WE WILL. MEANWHILE, OUR TROOPS AND IRAQI CIVILIANS WORKING FOR THE COALITION WILL BE ATTACKED EVERYDAY BY SMALL ARMS. SO FAR THE THUGS HAVE KILLED MORE IRAQIS THAN AMERICANS BUT WE ARE LOSING OUR SOLDIERS AT A RATE ALMOST EQUAL TO THE MORTALITY OF THE WAR. I BELIEVE THAT THE FIGURE TODAY IS ON THE ORDER OF 33. AND THIS IS TRAGIC, FOR US, FOR THE FAMILIES OF THE DEAD AND WOUNDED, AND FOR THE IRAQI PEOPLE. THE SIMPLE TRUTH IS, IF THE THUGS WOULD JUST LET US ALONE WE COULD HAVE THAT COUNTRY UP AND RUNNING IN 6 MONTHS. BUT IT TAKES SECONDS TO BLOW UP A PIPE OR POWER LINE AND DAYS TO REPAIR.

...And then compare it to these two excerpts, both via Instapundit.

First, Eric Olsen at Blogcritics.org posts this note from a friend....

One of the State folks was telling me about that big story early in the war when the Iraqis claimed that the US had blown up a busload of Syrians trying to leave Iraq and get back into Syria. Turns out it was a busload of Syrian fighters trying to get INTO Iraq to fight. She said that she used to walk home at night at 10pm and see them all chanting away, lining up to get on the buses to go to Iraq (the Iraqi embassy is right next to the US one in Damascus). Assad was overjoyed to get rid of these fundamentalists, and Saddam was happy to get them, and throw them all on the front lines. Apparently they are the only ones who did any real fighting and they got totally wiped out. That explains why the Syrians never made much noise about a busload of their "civilians" being killed--

but all the Western media ran the story and never ran the retraction.

Another thing that she said is that ALL the Iraqis are done with the idea of Arab Unity. They hate all the other states except for Syria. They believe Saddam gave so much money to these other states, and none of them offered any support. They are particularly hateful now to the Palestinians; ordinary Iraqis were sometimes moved out of their own homes to house them, and they got jobs and pensions-- and she said that the new Arabic graffiti on the walls of Baghdad University is "Palestinians go home. The free ride is over."

In any case, this tour was a lovefest compared to the last one, so god only knows what the reporters are all going on about. Another thing I heard is that 90% of all the attacks have happened in the Sunni Triangle, which if you look on a map represents all of about 1/8 of Iraq maybe (Ramadi, Fallujah, Baghdad-- I don't have a good map to do the math with), so you have a country 7/8 calm. This guy's Iraqi mom (from Mosul) also said that the power is now on regularly in Baghdad but no one is reporting that.

If CNN hasn't gotten it, it appears that Assad in Syria has. The cabinet change was a big thing even though many hoped/expected that Assad would choose a non-Baathist over Otri. Still, they think a few of the new guys will be non-Baathists which would have been unthinkable before.

They sure need it-- the country is a beautiful basket case full of intelligent, kind people who could do something good if given a chance. On a more superficial, but probably important level as well, the kids military uniforms we saw last year are all gone, and a lot of the militarization you used to see in posters and monuments, etc. seems to have been toned down. The Lebanese paper, The Star, attributes this directly albeit grudgingly to the US being right next door.

The music went over even better, and it now looks like we will be going back next month, and then on to Beirut. Obviously, we have to be careful. But we also have to be careful about what we are being told about this war and its aftermath. It's frightening to me how unrepresentative it is of public opinion in the most hardline of all Arab states!

And then there's this from Judge Don Walters, also via Instapundit. You can find the whole thing here or by going to

http://www.instapundit.com/archives/011552.php

The Judge, by the way, did NOT support the war initially. He was asked by the Justice Department to travel to Iraq with a team of other jurists to evaluate the legal system and make recommendations. He's highly critical about the Coalition Provisional Authority and the communication between the civilian and military efforts of the U.S. operation. But he's even more critical of the media's coverage of the entire post-war situation. Here's an excerpt of a speech he recently gave on the subject. Please note these are his speaking notes and aren't a verbatim transcript from the speech itself

WE ARE NOT GETTING THE WHOLE TRUTH FROM THE NEWS MEDIA. And not always the truth: tell about the riot, tiger stadium!

THE NEWS YOU WATCH, LISTEN TO AND READ IS HIGHLY SELECTIVE. GOOD NEWS DOESN'T SELL,

THIS IS THE KIND OF YOU DON'T HEAR ABOUT.

90% OF THE DAMAGE YOU SEE ON TV WAS CAUSED BY IRAQI'S, NOT BY US. ALL OF THE DAMAGE YOU SEE TO SCHOOLS, HOSPITALS, POWER GENERATION FACILITIES, REFINERIES, PIPELINES, AND WATER SUPPLIES, AS WELL AS SHOPS, MUSEUMS, AND SEMI-PUBLIC BUILDINGS (LIKE HOTELS) WAS CAUSED EITHER BY THE IRAQI ARMY IN ITS DEATH THROES OR IRAQI CIVILIANS LOOTING AND RIOTING.

THE DAY AFTER THE WAR WAS OVER, THERE WAS NEARLY 0 POWER BEING GENERATED IN IRAQ. 45 DAYS LATER, 1/3 OF THE TOTAL NATIONAL POTENTIAL OF 8000 MW IS UP AND RUNNING. DOWNED POWER LINES ARE BEING REPAIRED AND ARE ABOUT 70% COMPLETE.

THERE IS WATER PURIFICATION WHERE LITTLE OR NONE EXISTED BEFORE. WATER IS BEING PURIFIED BY US, NOT ALWAYS SUCCESSFULLY, BUT AS BEST WE CAN, AND AT LEAST IT'S RUNNING AGAIN AND THIS TIME TO EVERYONE.

OIL IS 95% OF THE IRAQI GNP. FOR IRAQ TO SURVIVE, IT MUST SELL OIL. THERE WAS DAMAGE TO THE OIL FIELDS, THE PIPELINES, THE REFINERIES.

ALL DONE BY THE IRAQI ARMY OR LOOTERS. THE 14 STORY OFFICE BUILDING OF THE SOUTHERN IRAQ OIL COMPANY IN BASRA WAS TORCHED BY BATHIST, DESTROYING ALL OF THE BOOKS, RECORDS AND COMPUTERS OF THE COMPANY. TODAY, THE REFINERY AT BAYJI IS AT 75% OF CAPACITY PRODUCING GASOLINE. THE CRUDE PIPELINE BETWEEN KIRKUK AND BAYJI HAS BEEN REPAIRED, THOUGH THE BATHIST KEEP TRYING TO DISRUPT IT. LIQUID PETROLEUM GAS, WHICH ALL IRAQIS USE TO COOK AND HEAT, IS AT 103% OF NORMAL PRODUCTION.

UNTIL EXPORTS START, EVERY DROP OF GASOLINE PRODUCED GOES TO THE IRAQI PEOPLE,

CRUDE OIL IS BEING STORED, WHEN IT CANNOT BE REFINED, IN PREPARATION FOR EXPORT.

IF WE ARE DOING ALL THIS FOR THE PEOPLE, WHY ARE THEY SHOOTING US?

THE GENERAL POPULATION ISN'T. BELIEVE ME, BY MY SAMPLE, 90% ARE GLAD WE CAME AND THE MAJORITY DON'T WANT US TO LEAVE FOR SOME TIME TO COME, BUT, THERE ARE STILL PLENTY OF BAD GUYS, THE BATHISTS WHO LIVED WELL UNDER SADDAM. THE THUGS OF THE OLD REGIME STILL HOPE TO RETURN TO POWER, AND THERE ARE PLENTY OF THEM, MOSTLY LOCATED IN SUNI AREAS. THEN TOO, SADDAM, IN THE RAMADAN AMNESTY, LET EVERY MURDERER, BUTCHER, RAPIST AND VIOLENT CRIMINAL LOOSE ON HIS OWN PEOPLE. THERE ARE INTERESTS, INCLUDING ORGANIZED CRIME, WITH A DESIRE FOR ANARCHY AND PROFIT.

WE MUST RESTORE ORDER, AND WE WILL. MEANWHILE, OUR TROOPS AND IRAQI CIVILIANS WORKING FOR THE COALITION WILL BE ATTACKED EVERYDAY BY SMALL ARMS. SO FAR THE THUGS HAVE KILLED MORE IRAQIS THAN AMERICANS BUT WE ARE LOSING OUR SOLDIERS AT A RATE ALMOST EQUAL TO THE MORTALITY OF THE WAR. I BELIEVE THAT THE FIGURE TODAY IS ON THE ORDER OF 33. AND THIS IS TRAGIC, FOR US, FOR THE FAMILIES OF THE DEAD AND WOUNDED, AND FOR THE IRAQI PEOPLE. THE SIMPLE TRUTH IS, IF THE THUGS WOULD JUST LET US ALONE WE COULD HAVE THAT COUNTRY UP AND RUNNING IN 6 MONTHS. BUT IT TAKES SECONDS TO BLOW UP A PIPE OR POWER LINE AND DAYS TO REPAIR.

Today I really mean it. Lite blogging while I finish up my work for the October issue of Strategic Investment. I will keep one eye on the markets though, and check in if necessary. Dan

I'm going to give away one of my favorite sources for cutting satire and straight shooting. His name is Tim Blair. You can read his blog at www.spleenville.com. It doesn't have anything to do with investing. But he does comment about geopolitics from an Australian perspective. I'm sure his isn't THE definitive Australian perspective. But all the Aussies I've met here in Paris are...similar. And I quite like it. In fact, I'll confess I'm kind of fascinated by the Aussies. It's a young Anglo culture. It's geographically isolated...but is going to occupy an intriguing position in what I'm dubbing (rather unimaginatively I admit) "the Asian Century." In fact, had things gone my way, I'd be getting set to move to Sydney early in 2004. But I've been baffled by the Australian immigration process. It's incredibly complicated...almost as if they don't want folks coming in. Maybe the government is concerned about its proximity to terrorist cells in South east Asia. Or maybe the Aussies are worried that all that cheap labor will ruin living standards...or maybe it's just a racial thing since most of the immigrants would have brown skin and not white skin (and NO, I'm not accusing anyone of racism I'm just pointing out that this is often an element in immigration discussions in America that is politely ignored). Truth is, I have no idea why the strict immigration laws. I remember talking to Jim Rogers on the phone a few months ago about his trip around the world (Adventure Capitalist). He pointed out to an Australian MP that a foreigner couldn't buy land in Australia. The man insisted it wasn't true, and was a little embarrassed to find out later that it was true. Maybe the government gives generous benefits to immigrants or asylum seekers and is therefore leery of opening the door too wide. Like I said, I have no idea. I'm still interested in moving there. But until I figure out the best way to do it...it will have to wait. If you're reading this and you're in Australia and you have a suggestion, send me an e-mail at StrategicInsider@aol.com Now...on to Tim Blair. Again, you can find the whole thing at http://63.247.131.180/~lilith33/timblair/ . This SBS interview with a young Australian Muslim is the best thing you'll read all day, guaranteed. It's especially worthwhile for the interviewer's concerned responses: REPORTER: Afroz's son Andez, who lives mostly elsewhere with his mother, has a passion for television and video games. This is giving him a very different view of the world. ANDEZ ALI: There's actually one game I really like. It's called 'Not Against Allah 2'. It's an anti-terrorism game. REPORTER: Anti-terrorism? What does that mean? ANDEZ ALI: It's like, um, like taking out all the terrorists and kind of like that. I've been watching the news every single night. REPORTER: When did you start doing that? ANDEZ ALI: Right when September 11 happened. The planes crashing into the twin towers, that's why I started, just in case anything else happened. REPORTER: And you wanted to be able to watch out for it? ANDEZ ALI: Yeah. REPORTER: Do you know what you want to be when you grow up? ANDEZ ALI: I want to be in the army. Yes. REPORTER: In the Australian Army? ANDEZ ALI: Yes. REPORTER: Why do you want to be in the army? ANDEZ ALI: I want to serve Australia and make sure everyone is safe. Oh no! An Australian citizen wants to join the army! As the interviewer remarks, "All of this comes as a surprise to his father Afroz;" AFROZ ALI: This is interesting and in fact quite shocking that he has that, which means that he is watching the very thing that I would like him not to watch, and that's television. It is certainly giving an exceptionally warped and wrong information to, here we go, my child. And that, to me, is really beyond belief. Too late, Afroz! Your boy is OURS! Incredibly, the interviewer describes the kid's pro-Australian, anti-terrorist mindset as a "problem";. And it gets worse: REPORTER: The problem is even more complex than it appears. Since Andez has been spending only weekends with his father, he has started to call himself a Christian. AFROZ ALI: I personally think that the episode of September 11 has had a negative impact upon him, a negative image of Islam on him. I believe that he has not fully made his mind up about it, and that's where the confusion arises. On the contrary. Sounds like this youngster isn't confused at all. Makes you sit up and think, doesn't it? I recall getting in a conversation about immigration with someone a year or so ago. I remarked that immigrants are typically the cream of the crop. Not always, of course. I'm sure there are free loaders who come just for the great government peanutbutter and cheese and the chance to clean toilets and do dishes for minimum wage. But my experience is that immigrants (legal or otherwise) work hard and have taken huge risks. They've left everything they know behind to start all over with nothing somewhere else. Sure, what they're leaving may be a nightmare compared to where they're heading. But how many Americans would pack up and leave for another country and leave the language and everything familar behind if there were no economic opportunities in the States? Maybe that's a question we'll find out the answer to in twenty years. There is one other interesting aspect to American immigration. I'm not sure if it's true in other countries. But with the exception of the Chicano Student Movement of Aztlan, which aims to reclaim the Southwestern United States for the bronze people from whom it was "stolen", you don't find many separtist immigrant groups in America. In fact, most immigrant groups seem to be eager to call themselves just "American," not some hyphenated version. I imagine that first generation Americans who grew up in a different country are anxious to preserve some idea of where they've come from to their children and grandchildren. But should it be all that suprising when a second or third generation American is more interested in the only country he's known as home rather than the one his parents came from? For example...consider the solider below. You remember that picture right? It outraged CNN. It was put up there by a Marine named Edward Chin. Corporal Chin and his family are ethnic Chinese, originally from Burma. His family moved moved to America when Chin was one week old. They live in Brooklyn.

In television interviews is father said, "I thought, 'Oh, my son, you are making history, you are part of the Iraqis' liberation"'

His sister said, "I'm very proud of him. Here's a 23-year-old doing all these amazing things and representing America and representing it well, I think."

You can talk about the imperial intentions of a global hyper-power and Arab sensibilities etc. There's a place for that. Here on the blog even. But maybe the more interesting question is what is it about the idea of America (whether its true right now or not) that makes American immigrants so eager to give back to their country?

In fact, what Americans think about when they think "America" is a lot different than say, what the English think when you say "England" or what the French think when you say "France." Different, I said. Not neccessarrily better, or worse.

It does remind of a great quote from an old F. Scott Fitzgerald story called "The Swimmers" The narrator, an Amercian expat living in France, says, "France was a land, England was a people, but America, having about it still that quality of the idea, was harder to utter--it was the graves at Shiloh and the tired, drawn, nervous faces of its great men, and the country boys dying in the Argonne for a phrase that was empty before their bodies withered. It was a willingness of the heart."

By the way, the whole somewhat less romantic crew at the Daily Reckoning have put together their own version of "The Idea of America." You can find out more about it here or at http://www.agora-inc.com/reports/901SIOAB/IdeaofAmer/

In television interviews is father said, "I thought, 'Oh, my son, you are making history, you are part of the Iraqis' liberation"'

His sister said, "I'm very proud of him. Here's a 23-year-old doing all these amazing things and representing America and representing it well, I think."

You can talk about the imperial intentions of a global hyper-power and Arab sensibilities etc. There's a place for that. Here on the blog even. But maybe the more interesting question is what is it about the idea of America (whether its true right now or not) that makes American immigrants so eager to give back to their country?

In fact, what Americans think about when they think "America" is a lot different than say, what the English think when you say "England" or what the French think when you say "France." Different, I said. Not neccessarrily better, or worse.

It does remind of a great quote from an old F. Scott Fitzgerald story called "The Swimmers" The narrator, an Amercian expat living in France, says, "France was a land, England was a people, but America, having about it still that quality of the idea, was harder to utter--it was the graves at Shiloh and the tired, drawn, nervous faces of its great men, and the country boys dying in the Argonne for a phrase that was empty before their bodies withered. It was a willingness of the heart."

By the way, the whole somewhat less romantic crew at the Daily Reckoning have put together their own version of "The Idea of America." You can find out more about it here or at http://www.agora-inc.com/reports/901SIOAB/IdeaofAmer/

Reader mail below. By the way, Krugman's solution to the deficit problem is predictable: higher taxes. My prediction: one of the ten Democratic candidates is going to embrace "Krugenomics" and call for the Bush tax cuts to be repealed and for a retroactive tax increase on the nation's top 1% in the tax bracket. You don't hear Democrats criticizing bush for spending too much. They criticize him for taxing too little. That's what's caused the deficit. If we just raised taxes we could have everything we want and get the Bank of Japan to pay for it... Hi Dan, The daily articles are great. The commentary regarding taxes at 26% of GDP versus 38% of GDP for Canada ignores a major issue - Canada's tax revenue provides coverage (perhaps inferior) for all Canadians. I understand that Health Care is 14% of United States GDP. Health care coverage in the US is increasing well above the rate of inflation. The upcoming changes for drug coverage in the US congress does nothing to rein in the rising cost of drugs. Drug companies have convinced republicans to accept the new bill, as they were concerned about the recent court rulings in the State of Maine. The new bill will ensure list price is paid for drugs despite the fact there is only one bill payer. Congress and media owners were open to changing the laws to allow drug companies to spend billions on advertising, and now advertising is 14% of drug industry sales - I believe this is more than they spend on R&D. Americans typically accept that all industries should be super efficient or die, somehow this does not apply to health care. The number of drug suppliers is consolidating while their pricing power increases. Insurers, HMOs, individual bill payers remain part of a large fragmented market with minimal bargaining power. One should also consider the added burden of an out-of-control tort system that provides minimal value-added to the US economy. Canadian and European corporations avoid such costs. Fortunately, the US economy is much more productive than Canada's economy. Regarding China, even if China were to raise its labor rates by 50%, the US would still have to contend with much higher legal and medical costs. Adjusting the Yuan by 50% will not stop the flow of manufacturing jobs to China, as corporations are not simply chasing a country with low-cost wages, they are targeting a market that also has huge potential demand over the next decade. I believe in free and open markets; however, North American workers/consumers are in for a major drop in their standard of living. The train is coming and we should not be arguing about its speed, we need to get off the train tracks and figure out a way combat China from an economic perspective. Brendan Korneski My only other comment on Brendan's letter is that you can't really "combat China from an economic perspective" and win. If you "win," say by raising tariffs, prices rise dramatically for U.S. consumers. And if you "win" by getting the Chinese to revalue the Yuan, the dollar collapses. Either way, Brendan is right, standards of living are going to fall. It won't be the end of civilized society. But it may be the end of living above your means by refinancing your house....and incidentally... Today's housing numbers revealed that starts on single-family homes were down 4% and the average housing starts were down by 1.82 million. The upside is that building permits were up 4.8%. It's almost frightening how bubbly the housing numbers are being spun. According to the "spin," a decline in single family home sales is not cause for concern because mortgage rates remain historically low-- even though rates are rising and the odds of rates going historically lower are not good. And one of the hallmarks of a bubble is that supply continues to flood the market well in excess of the sustainable rate of demand. Now, it COULD be that even if housing PRICES fall, the net demand for housing will keep growing. In fact, I suppose you could say that if housing prices fell, or ceased growing as fast, it could conceivably make new homes more affordable (re the size of the monthly mortgage payment) than they currently are now. However, none of this takes into consideration that prospective new home buyers make a complicated calculation of risk when buying a new home. First, they assume they'll have a job which provides the income to make a mortgage payment. Even if unemployment numbers don't get much larger, and I think they actually will, if the marginal new home buyer decides not to buy a new home because he's uncertain about his job, this takes the steam out of new home sales...at the same time new supply is coming on stream. Falling demand, increased supply. Not a good scenario for prices. Even lower prices and historically low mortgage rates may not be enough to get a worker who fears for his job to take the risk of buying a new home. And this all based on the unexamined notion that mortgage rates will stay historically low. The Fed can choose to keep short-term interest rates low. And the 30-year mortgage rate can be kept somewhat lower because of the Fed. But the Fed has no control over long term rates. And when those start to rise as bond investors sell and the government must raise yields to find takers for its debt, the era of historically low mortgage rates ends. Maybe you want to buy homebuilders when they're making new highs. But the picture below shows me a trend whose premise is false...the only question is whether now is the time to ride the false trend, or bet against it. Strong Trend, False Premise, Place Your Bets

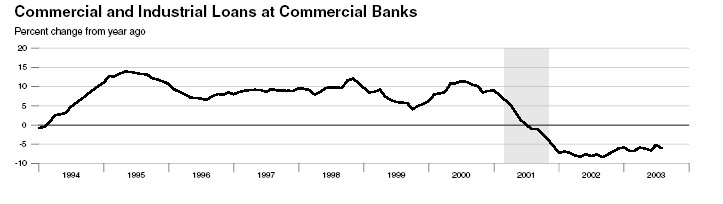

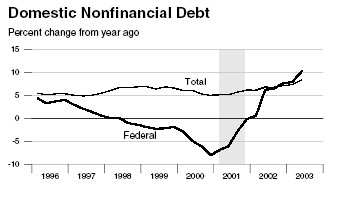

Blogging will be light today as I'm working on the October issue of Strategic Investment. But I did want to post some charts I pulled from the St. Louis Fed's report on Monetary trends released yesterday. You can see from the charts that monetary looseness has not led to more borrowing and has eviscerated money market savers. The Fed has punished saving without at least getting a kick in bank lending for its efforts. And on the fiscal policy front...that's an awful lot of stimulus (deficit spending) for very modest GDP growth. Low Short Term Rates Have Not Led to More Lending...

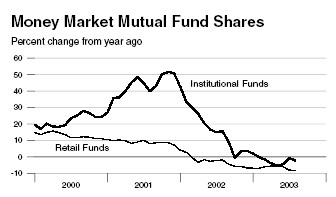

...But They Have Destroyed the Income of Savers

...But They Have Destroyed the Income of Savers

As for fiscal policy (government spending), the jobs report tomorrow will tell us whether the Bush tax cuts are leading to a turn around in the employment numbers. I wouldn't count on it. The CPI numbers from the Labor Department yesterday show that prices are rising at their slowest annual rate in 37 years.

The Fed simply hasn't succeeded in getting consumers to spend faster than they already are, nor in creating the inflationary numbers that come with an expansion. Kind of makes you wonder just how durable and genuine the expansion is.

And even if you took the defense spending fattened 2nd quarter GDP numbers as a sign that the economy is turning around, how long can the government afford to rack up deficits in order to achieve such modest growth? When will business spending pick up?

Hey Keynes, It's Still Not Working

As for fiscal policy (government spending), the jobs report tomorrow will tell us whether the Bush tax cuts are leading to a turn around in the employment numbers. I wouldn't count on it. The CPI numbers from the Labor Department yesterday show that prices are rising at their slowest annual rate in 37 years.

The Fed simply hasn't succeeded in getting consumers to spend faster than they already are, nor in creating the inflationary numbers that come with an expansion. Kind of makes you wonder just how durable and genuine the expansion is.

And even if you took the defense spending fattened 2nd quarter GDP numbers as a sign that the economy is turning around, how long can the government afford to rack up deficits in order to achieve such modest growth? When will business spending pick up?

Hey Keynes, It's Still Not Working

And as for the deficits themselves, what if bond investors prefer corporate bonds to Treasuries? And what if bond investors, foreign and domestic, demand higher interest rates to compensate for the increased risk that Uncle Sam is racking up a tab a) he can't afford to pay, or b) plans to pay off in wildly inflated dollars? Will there still be takers for U.S. bonds?

My answer? Puts on the bond market. 10-year notes did NOT fall immediately on the Fed's decision to stand pat. And if the bond market thought the Fed was wrong before about deflation being a greater risk than inflation, it's not going to like they key paragraph from yesterday's statement. Yields should rise and prices should fall, if the past really is prologue.

The Committee perceives that the upside and downside risks to the attainment of sustainable growth for the next few quarters are roughly equal. In contrast, the probability, though minor, of an unwelcome fall in inflation exceeds that of a rise in inflation from its already low level. The Committee judges that, on balance, the risk of inflation becoming undesirably low remains the predominant concern for the foreseeable future. In these circumstances, the Committee believes that policy accommodation can be maintained for a considerable period.

And as for the deficits themselves, what if bond investors prefer corporate bonds to Treasuries? And what if bond investors, foreign and domestic, demand higher interest rates to compensate for the increased risk that Uncle Sam is racking up a tab a) he can't afford to pay, or b) plans to pay off in wildly inflated dollars? Will there still be takers for U.S. bonds?

My answer? Puts on the bond market. 10-year notes did NOT fall immediately on the Fed's decision to stand pat. And if the bond market thought the Fed was wrong before about deflation being a greater risk than inflation, it's not going to like they key paragraph from yesterday's statement. Yields should rise and prices should fall, if the past really is prologue.

The Committee perceives that the upside and downside risks to the attainment of sustainable growth for the next few quarters are roughly equal. In contrast, the probability, though minor, of an unwelcome fall in inflation exceeds that of a rise in inflation from its already low level. The Committee judges that, on balance, the risk of inflation becoming undesirably low remains the predominant concern for the foreseeable future. In these circumstances, the Committee believes that policy accommodation can be maintained for a considerable period.

Interesting transcript of an interview with Paul Krugman you can find here. I'm reluctant to say in public that I agree with Krugman. He's gone of the deep end with his "everything Bush says is a lie." Bush, like all polticians, does lie. But not about everything, at least I don't think so. Still, if he's just talking the economics of deficits, he sounds more sane. Here's the money section from the interview. And by the way, I disagree with Krugman that the Chinese might not someday attempt to use owernship of U.S. assets as a way to influence U.S. foreign policy. Emphasis added is mine. Krugman: Train wreck is a way overused metaphor, but we're headed for some kind of collision, and there are three things that can happen. Just by the arithmetic, you can either have big tax increases, roll back the whole Bush program plus some; or you can sharply cut Medicare and Social Security, because that's where the money is; or the U.S. just tootles along until we actually have a financial crisis where the marginal buyer of U.S. treasury bills, which is actually the Reserve Bank of China, says, we don't trust these guys anymore — and we turn into Argentina. All three of those are clearly impossible, and yet one of them has to happen, so, your choice. Which one? Kevin Drum (http://www.calpundit.com): How does all this feed in to the current account deficit? Will China keep financing that forever? Krugman: They're financing both the current account deficit, and, as it turns out, directly financing the government deficit. We were running a big current account deficit that accelerated through the late 90s, but there you could say that it was due to the strength of the U.S. economy, it was all this investment demand, technological revolution, and after all, the government was in surplus. Now, we're back in twin deficits territory, and there are two related issues, the solvency of the federal government and the solvency of the United States per se, and both of them are now somewhat in question. Maybe I'm a captive of my own model, but I think that what happens when the world loses faith in the U.S. as a place to invest is that the dollar plunges, but that in itself is not so bad because the lucky thing is our foreign debts are in dollars, so we don't do an Indonesia or an Argentina. But the federal government's solvency is a much more critical thing because it needs to keep on borrowing more and more just to pay its bills Drum: What happens if these foreign countries do stop buying U.S. bonds? Is this a real concern, or a tinfoil hat kind of thing? Krugman: Oh, I don't think China is going to do it to pressure us. You can just barely conceive of a situation where they're mad at us because we're keeping them from invading Taiwan or something, but more likely they just start to wonder if this is really a good place to be putting their money. So what happens is a plunge in the dollar when they decide to stop buying and start cashing in, and a spike in U.S. interest rates. But you might also get in a situation where the interest rates the government has to pay to roll over its debt become so high that you get an accelerating problem, which is what happened in Argentina. What happened was that suddenly no one would buy Argentine debt unless they paid a twenty something percent interest rate, and everybody says, but if they have to roll over their debt at a twenty percent interest rate, there's no way they can pay that back. So the whole thing grinds to a halt and the cash flow just dries up. Drum: And do you think that's a serious possibility for the United States? Yeah, just take the numbers as they now look, and that's where it heads. And you might say, OK, we can easily handle it. U.S. taxes are 26 percent of GDP in the U.S., in Canada they're 38 percent of GDP. If you raise U.S. taxes to Canadian levels there's plenty of money to cope with all of this. But politically we've got a deadlock, and it's hard to imagine that happening. So you say, but this can't happen, this is America, and I guess my answer is, is it? Is this the same country that we had in 1970? I think we have a much more polarized political system, a much more polarized social climate. We certainly aren't the country of Franklin Roosevelt, and we're probably not the country of Richard Nixon either, so I think we have to take seriously the possibility that things won't work out this time.

One of the big conclusions Jim Bianco made last week is that when the Fed speaks and the bond market doesn't like what it hears (dovish monentary policy, greater risk being for deflation), bonds tank. We'll we see if that happens again today. Bianco and the team at Arbor Research offer this comment: "Since the FOMC adopted the "Bernanke view" on May 6 (pursuing inflationary policies to prevent deflation), every time the FOMC/Greenspan speaks, the bond market has collapsed. It's a record that would make G. William Miller jealous. Witness: "On June 25, the FOMC cut the targeted federal fund rates 25 basis points to 1.00%. Bonds fell over three points – their worst reaction to an ease in the history of the Greenspan Fed (Since Greenspan became chairman, the Fed has moved the funds rate 77 times - 45 eases and 32 hikes). "On July 15, Greenspan spoke about the economy. In his testimony, twice he said: "The FOMC stands prepared to maintain a highly accommodative stance of policy for as long as needed to promote satisfactory economic performance. "That day bonds fell over two points, their worst reaction to any of Greenspan’s 171 testimonies since becoming Fed chairman in August 1987. "On August 12 the FOMC re-iterated its dovish talk of June 25. The next day bonds collapsed over 2 ½ points. "On August 29, Greenspan spoke at "Fed camp" (Jackson Hole WY gathering). Over the next two trading days, bonds slumped almost 3 points. "Will this FOMC meeting be the next in a line of bond market sell-offs in reaction to dovish statements? " If the Bianco crew is right, you could do worse than buy puts on TLT or IEF, the Lehman bond funds that trade like stocks. The chart below shows what Jim pointed out...bonds selling off on Fed dovishness.

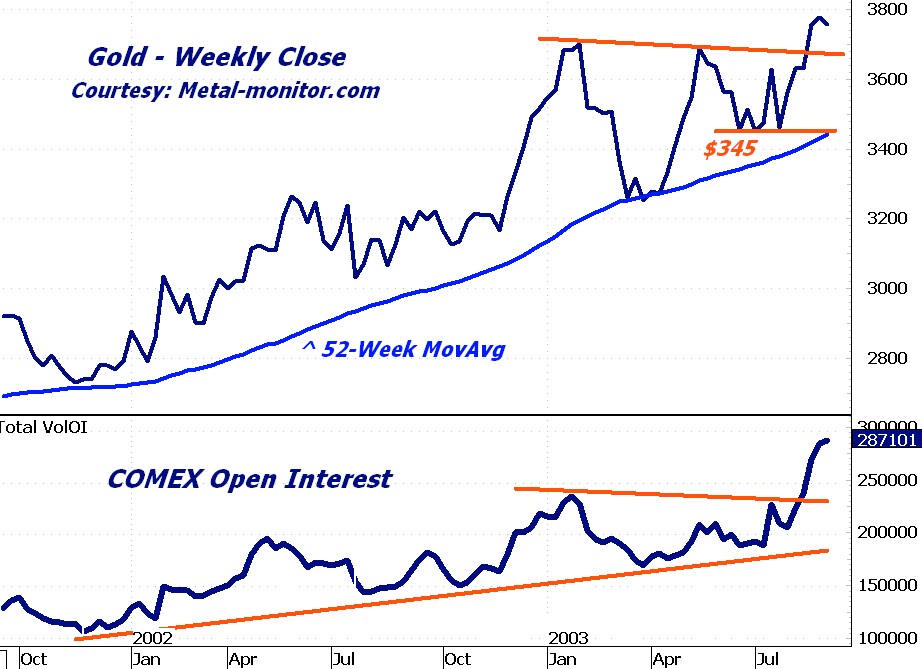

The story in the gold market is unfolding in the futures maket, and the stakes are enormously high for those of you who have positions in gold stocks. I'll give you my conclusions up front, and the analysis for you to peruse. Concusion: gold is overbought short-term, and there are some powerful forces lining up that could lead to a gold-sell off and a rally in the broader indexes. Conservative investors should be braced for a gold sell-off with stop-losses, and look to buy back in at lower prices. This could be a bump in the road on the way to a quadruple digit spot gold price. But it may be an uncomfortably large bump. The large speculators and commercial traders and hedgers have been waging an epic battle in the gold futures market. The commercials/hedgers have a huge net short position in gold. They’ve been selling. The latest Commitment of Traders report shows that commercials are net short 157,940 contracts . On the other hand, large speculators still have a massively long position, long net 115,092 contracts according to the latest COT report. Presumably the hedgers and commercial traders “know” something about gold that the speculators don’t. The commercials mine and process gold and are closer to supply/demand dynamics than the market. But is their large net short position bearish for gold? Or are the speculators ahead of the gold industry in getting long bullion when all paper currencies are racing to devalue relative to the dollar? In short, who’s right here, and is gold at a major turning point? My conclusion is that it’s a very dangerous time to be long gold stocks or gold futures without…if you’ll pardon the pun, hedging your risk. Gold open interest has exploded in the last three months. The shorts are putting out more and more supply. As the longs eat it up, prices rise. But by creating supply, the commercials put pressure on the speculators to buy futures faster than the shorts can put them out. Check out the chart from my metals go-to guy Greg Weldon. You can find more about Greg's private research products in the metals sector by going to http://www.metal-monitor.com/. Greg's charts show the huge increase in open interest that's putting near-term pressure on the gold longs and the technical pressure spot gold might encounter. Open Interest Explodes

Once the buying dries up, poof, buying power disappears amid growing supply and the prices fall. The shorts will cover at some point. But the question is, how far could the gold price fall if the turning point comes?

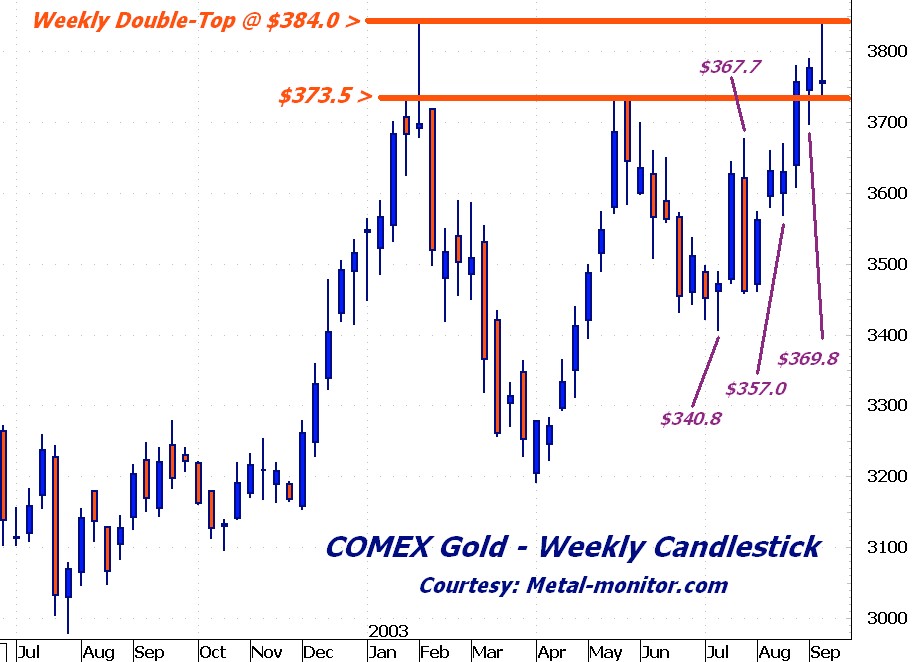

Gold, Technically Speaking

Once the buying dries up, poof, buying power disappears amid growing supply and the prices fall. The shorts will cover at some point. But the question is, how far could the gold price fall if the turning point comes?

Gold, Technically Speaking

Spot gold will test support at $375 and should it crash through that, July 14th’s $340 level is next…and should it break that, April’s $325 level. The big danger is that the large specs are so massively long and commercials are so massively short that the resolution of the battle could send spot gold below $300 and then some--while equity markets soar.

Most vulnerable is the XAU. It could decline to 75 easily if spot gold falls to July's level. Puts would be in order.

Spot gold will test support at $375 and should it crash through that, July 14th’s $340 level is next…and should it break that, April’s $325 level. The big danger is that the large specs are so massively long and commercials are so massively short that the resolution of the battle could send spot gold below $300 and then some--while equity markets soar.

Most vulnerable is the XAU. It could decline to 75 easily if spot gold falls to July's level. Puts would be in order.

Rueters reported the following today: "Of the 16,000 U.S. employers surveyed by Manpower in July, 22 percent said they intend to increase their work force in the fourth quarter. That is up from the third quarter, when the forecast predicted only 20 percent of employers would add to payrolls in the survey's weakest job outlook in 12 years. "But the widely watched quarterly survey by staffing company Manpower Inc. MAN.N also found the number of companies expecting to cut payroll is up as well, and fourth-quarter hiring this year will not keep pace with the prior year." Conventional wisdom says the unemployment number is a lagging indicator...that business investment (which leads to increased hiring) comes before the recovery...and by the time the actual hiring happens, the recovery is well under way. But I'd say employment is now THE leading indicator for the economy, simply because its the concern that's closest to home for the average consumer. A consumer worried about losing his job is not going to spend a lot of money, leading to higher business profits, leading to more hiring. Two thirds of the U.S. economy is driven by consumer spending. A few years ago, consumers got confidence from high stock prices. Consumer confidence fueled higher stock prices, which returned the favor and led to higher confidence. In the last few years, housing has been consumer-supportive. With mortgage rates low and home prices rising, consumers felt more secure, more confident. Their chief asset was appreciating in value. They were so confident of perpetually rising house prices, they refinanced the house at 125% of its price, cashed out the difference, and spent it on a new couch. So what if your mortgaged 125% of the value of your home? It would be worth 25% more in a few years, five tops. But one by one...the main crutches of consumer confience have been kicked out. The stock market bubble burst and the wealth effect broke down. And now, mortgage rates are rising. It will be interesting to see tomorrow's housing starts and building permits reports for August. Starts of single family homes reached a 25-year high in in July. Rates are historically low. When rates reach an all time low and starts reach an all time high...where can they go? Rates COULD go lower. But they're not. And starts COULD go higher in a rising-rate environment, although it's not likely. And so housing begins to recede as a source of comfort and confidence for the consumer. Take away the security of your 401(k) and your house and what's left, economically speaking? Your job, of course. As long as you're gainfully employed you can downsize your lifestyle and ride out a bear market in stocks and falling housing prices. But when the average American begins to fear (or realize) that unemployment is reaching a European-like level of permanent high single digits...watch out. As I've said for over a year now, the American labor market is becoming two-tiered. On the top, you have high-paying service industry jobs. And below, you have low paying service jobs. What's being sucked out are the middle income goods-producing jobs...just the jobs that have moved to Mexico and China in recent years. It's unemployment that is going spook the American consumer to the point where he stops buying stocks at 30 times earnings and sells the ones he owns. And it's unemployment that will make it awfully hard for a lot of new homeowners to make their mortgage payments. The job market holds the key. And the job market is getting structurally worse, not better. Incidentally, it's also unemployment that causes consumers to spend less. As if on cue, this also from Reuters, "Sales at U.S. chain stores reversed course and slipped, breaking a three-week run, a report showed on Tuesday. Sales fell 0.3 percent in the week ended Sept. 13, the Bank of Tokyo-Mitsubishi and UBS said in a joint report, after rising 0.5 percent in the prior week." Stalking Weak Retailers If you're thinking of going after the retailers because you agree with my assessment of the job market (or you have your own very good reasons) the vehicle I've used is the Amex-listed retail holder (RTH). RTH is a basket of 20 retail stocks. Its two largest holdings are Wal-Mart (WMT) and Home Depot (HD). As you can see from the chart, RTH is sitting smack on a rising trend-line. Short the Retail Sector With a Single Stock

You might hold out hope that a strong holiday season will deliver booming Q4 numbers for Wal-Mart and be RTH supportive. But there are enough other retail stocks in RTH to counter Wal-Mart strength (WMT tends to outperform the sector, see chart, also note that even though its outperformed other RTH components like The Gap (GAP), TJ Max (TJX), and Walgreen's (WAG), it's not exactly the picture of technical strength, sitting, as it is, on its 50-day moving average.)

Even a Comparatively Stong WMT May Not Save RTH

You might hold out hope that a strong holiday season will deliver booming Q4 numbers for Wal-Mart and be RTH supportive. But there are enough other retail stocks in RTH to counter Wal-Mart strength (WMT tends to outperform the sector, see chart, also note that even though its outperformed other RTH components like The Gap (GAP), TJ Max (TJX), and Walgreen's (WAG), it's not exactly the picture of technical strength, sitting, as it is, on its 50-day moving average.)

Even a Comparatively Stong WMT May Not Save RTH

And there's Home Depot (HD). You might not think of HD as an interest rate-sensitive stock. But it's strong upward move from March, along with its 50-day moving average, began to go sideways exactly about the same time the yield on the ten-year bond rose at a record pace in a record short amount of time.

HD, Sensitive to Rising Rates AND Falling Consumer Spending

And there's Home Depot (HD). You might not think of HD as an interest rate-sensitive stock. But it's strong upward move from March, along with its 50-day moving average, began to go sideways exactly about the same time the yield on the ten-year bond rose at a record pace in a record short amount of time.

HD, Sensitive to Rising Rates AND Falling Consumer Spending

Gee...did HD suddenly realize that higher mortgage rates meant fewer refinancings, fewer cash outs, and fewer Sunday trips for caulk guns and grout? And is it now waiting/relying on continued strength in the retail sector to make up for lack of support from housing?

RTH the simplest way to be bearish the entire sector. And if you want to make it even simpler, buy puts. You play the unemployment figures and the retail figures at precisely the place where they converge...the cash register.

Gee...did HD suddenly realize that higher mortgage rates meant fewer refinancings, fewer cash outs, and fewer Sunday trips for caulk guns and grout? And is it now waiting/relying on continued strength in the retail sector to make up for lack of support from housing?

RTH the simplest way to be bearish the entire sector. And if you want to make it even simpler, buy puts. You play the unemployment figures and the retail figures at precisely the place where they converge...the cash register.

The mob is now running the 21st century. The World Trade Organization is designed to eliminate trade barriers and tariffs among its 146 members. But it's been corrupted by the same political cancer that makes the U.N. (and the U.S. Congress) so useless: majoritarian politics, otherwise known as Democracy. It looks as though the EU and the U.S. were finally ready to make some concessions on their respective (and ridiculous) farm subsidies. But the deal got killed by developing nations who wanted to make a point that they can...well...that they can make a point if they want to. So no deal got done. And now, global trade will probably proceed in the framework of bi-lateral agreements. This is not a problem for the EU and the U.S., who can do some serious arm-twisting when negotiating agreements one at a time. But it will be a problem for developing nations who have zero leverage in bi-lateral talks. Forbes reports that, "Poor countries emerge as the political winners from the wreckage of world trade talks in Cancun, but they also risk being the economic losers. By dealing a grievous blow to the multilateral trading system, the collapse of World Trade Organization talks Sunday will probably lead to a new rash of country-to-country and regional market-opening deals." When voluntary trade talks collapse, it obviously hurts poor nations a lot more than rich ones, although every one loses. The mistake opponents of trade have made by attacking the WTO and scuttling the talks is that they can exert any political pressure on the developed world to act differently. They can't. The WTO isn't the U.N., not yet anyway. It probably won't be long before somone proposes that trade agreements should be voted on democratically and that the majority decision should carry the day. If you can use the U.S. Congress to "redisribute" wealth (confiscate money through the threat of force), why not the WTO, or the U.N.? It's the logical fulfillment of the idea of wealth redistribution. In fact, I'm suprised we haven't seen it yet. I jest, partly. The reason the IRS gets away with extortion is that it can throw you in jail if you don't pay up. There's no real way for the rest of the world to actually make the U.S. or Europe give in on farm subsidies. And so the demands of a "democratic" WTO would be unforceable. But that doesn't mean it won't happen anyway...the U.N. says plenty of things it doesn't mean and means plenty of things it can't do anything about. And yet people take it seriously too...

"Anything that ain't poetry, fiction, or drama is rhetoric," so my classical rhetoric mentor used to say. Soup can labels, greeting cards, and photos in the newspaper. There's no such thing as communication for the sake of conveying a fact, unless you count the Weather Channel, and the Weather Channel is never right, therefore not factual. Take a look at the photos below, courtesty of AP, and one via Instapundit. Now ask yourself how much of what you see on T.V. or in the paper isn't staged or heavily influenced by the editorial opinions of so-called "objective" journalists...the same ones bringing you the quagmire in Iraq and the bull market on Wall Street. Is it Real...or is it...Not Real?

"Quick, there's a camera. Let's burn a flag..."

"Quick, there's a camera. Let's burn a flag..."

Everything printed is an effort to cause some change, in action, thought, or belief. It doesn't mean there isn't a version of events out there that more accurately reflects reality (the one I'm trying to put forward in the investment world.) But it does mean you should always be on your guard about being led around by the nose by the government AND the media.

Everything printed is an effort to cause some change, in action, thought, or belief. It doesn't mean there isn't a version of events out there that more accurately reflects reality (the one I'm trying to put forward in the investment world.) But it does mean you should always be on your guard about being led around by the nose by the government AND the media.

The Financial Times has published some pretty idiotic columns recently...and by this I mean publishing articles that don't reveal the prejudices of their author. The good thing about op-ed pieces is that you KNOW they're subjective. And the one below gets to what I think the heart of what the anti-war critique is really about, and what it's consequences are for those people who find themselves living under tyrants. The article is by Ian Buruma. You can find the whole thing here. First, there's this quote. Emphasis is mine: Anti-Americanism may indeed have grown fiercer than it was during the cold war. It is a common phenomenon that when the angels fail to deliver, the demons become more fearsome. The socialist debacle, then, contributed to the resentment of American triumphs. But something else happened at the same time. In a curious way left and right began to change places. The expansion of global capitalism, which is not without negative consequences, to be sure, turned leftists into champions of cultural and political nationalism. When Marxism was still a potent ideology, the left sought universal solutions for the ills of the world. Now globalisation has become another word for what Heidegger meant by Americanism: an assault on native culture and identity. So the old left has turned conservative. One man's free markets are now, on the far left and the far right, nothing more than modern-day economic imperialism. Buruma covers that too, though. Quoting Jose Ramos-Horta, he writes about the root of the argument against Western interventions: "...the problems of faraway peoples are for them to solve alone, and that we have no business intervening on their behalf against tyrants, and that any attempt to do so has to be, by definition, racist, or colonialist, or venal. "This belief may indeed be more pragmatic, even realistic. But those who hold it should at least have the honesty to call themselves conservatives, of the Henry Kissinger school, and stop pretending they speak for the liberal-left."

Which is it going to be, a recovery or a rout? Dick Cheney was on T.V. this weekend talking up third quarter economic growth. And we’re supposed to be encouraged by Friday’s news that retail and restaurant sales rose 0.6% in August. But take a closer look my friends. And as you look at the numbers, remember that binging consumers going berserk with credit cards is what got us into this debt mess to continue with. Consumer spending will not grow the economy out of debt. Neither will government spending. In fact, no one spends his way to prosperity. But even if you could do that, the Commerce Department’s numbers do NOT show evidence of a growing economy with reflationary pressures. Quite the opposite. Friday’s report showed that retail sales at Electronics Stores were up +1.4% in August. Greg Weldon reports that this takes the unadjusted year-year gain to +9.4%, nearly triple June’s 3.8%. “But,� Greg ads, “this comes at the expense of Building Materials and Clothing, both of which posted outright sales contractions during August: ·Sales of Building Materials … down (-) 0.2%, its first decline in many moons, and driving the yr-yr growth down to +4.6% from+9.5% in July, and +9.3% in June. · Sales of Clothing … down (-) 1.4% month, following three consecutive monthly increases, resulting in a LOWLY yr-yr growth rate of +1.5%, down HUGE from July’s +7.5%, and lower than June’s lowly +2.1% growth. In fact, the latest numbers show that the year over year rate for retail sales growth has fallen in half since July. Sales were growing at annual pace of 6% in July. By the end of August, they were growing at 3%. And even where sales were strong, pricing power is fell. When the Producer Prices Index report came out on Friday, it reported that prices for Home Electronics Equipment actually DEFLATED by 3% on a year-over-year basis by a DEEP (-) 3.0% year-year. Again, courtesy of the macro-data-master Weldon, we learn that consumer electronic prices have not had a single month of price increases in the last four months. By the way, don’t you think this sounds like exactly what happens when the world shifts its industrial production to Asia and counts on the U.S. consumer to be the engine of growth? Wouldn’t you get falling prices for consumer electronics even on higher sales? So let’s get the “recovery theory� straight: modest sales growth in consumer electronics, where prices are actually falling, is supposed to lift the $9 trillion U.S. economy out of the doldrums and into 6-7% economic growth for the third quarter. Is that about right? Forget the jobless nature of the so-called recovery. Forget the soaring government debt. Forget that we’re entering political season and Congress is rattling its trade-war saber. And forget the $32 trillion in aggregate debt that the U.S. economy is already laboring to pay the interest on, even as it hopes to spend its way out of weak growth. In fact, you’re using the eco news as an excuse to go long stocks, you’d BETTER forget all the immense obstacles that stand between a rosy economic scenario and what the rest of us call reality. Only an opportune case of amnesia would allow you forget that stocks are already valued for a strong economic recovery that has yet to materialize, and probably won’t.

I was in London last week meeting with investors. One of them was Jim Bianco of Bianco Research. I've heard Jim speak several times now, and he's one of the most effective and blunt critics of Fed policy you'll ever meet. He didn't disappoint. His main theme on Thursday was this: The Fed and the bond market have completely divergent expectations for the economy. The net result will be more bond selling. Jim points out that the Fed has signaled its intention to keep the Funds rate low for a "considerable" period of time. The Fed fears deflation and would rather risk inflation. Ironically, I think the Fed is right to fear deflation, but wrong to keep interest rates low. The bond market partly agrees with me, and wholly disagrees with the Fed. The bond market fears inflation. That's why it drove up longer-term rates in July and August. The bond market understood the Fed's message. But it told the Fed, "We think you're wrong." Who's right? I think the Fed is right, for now. The greatest risk the world faces right now is that instead of addressing the global imbalance in production/consumption, the rest of the world will try to keep its currency low relative to the dollar and export goods to the American market for profit. In this scenario, the dollar remains strong because everyone else chooses to stay comparatively weak. Does the rest of the world overestimate the strength economyU.S. ecomomy? Or does it underestimate its need to move toward an economic model that's based on a healthier balance between consumption and production? Who knows? The world likes what it gets out of the dollar-centric system for now. The dollar-centric world economy is simple to understand: U.S. consumers leverage their houses to consume above their means on goods produced overseas by cheaper labor. The dollars spent by U.S. consumers go to foreign savers or central banks, who return them to the U.S. market through foreign purchases of Treasuries. As long as the dollars coming in match the dollars going out, the currency itself retains its purchasing power and the whole system remains stable. Despite mammoth twin federal and current account deficits, foreigners continue to plow their export-acquired dollars right back into the bond market. The latest Fed flow of funds report shows that private foreign citizens bought an unprecedented $129 billion in United States government and agency securities. "Official accounts, mostly central banks, added $43 billion more," according to Floyd Norris in the New York Times. Norris ads that "foreigners bought almost 80 percent of the net increase in Treasury and agency debt during the quarter. They now own 38 percent of outstanding Treasuries, more than double the figure of a decade ago." What's shocking in Norris' numbers is the level of private Treasury buying. Either the U.S. bond market is still seen as the world's safest asset haven in dangerous times, or an awful lot of folks were late to the bond bubble before the big sell off. The latter explanation makes more sense to me. The rest of the world crowded into bonds rather than confronting the abyss of a world without a strong dollar...world where U.S. consumption was not the engine of global growth...a world in which Asia and Europe could not rely on exports to the U.S. to cloak the structural problems that they face. The Fed is destroying this world by accelerating the supply of dollars. Its policy is designed to be inflationary. But it's only inflating U.S. asset prices, not prices for goods and services produced overseas. My belief is that ultimately, creating all those new dollars and issuing billions more in debt will make the U.S. government a credit risk (particularly since the Feds implicitly guarantee the bonds issued by mortgage lenders Fannie Mae and Freddie Mac--a market that's even larger than the government bond market.) Either way, whether it's the perception that the government is a credit risk and is creating too many dollars and issuing too many bonds, or that the bond market is right and inflation is a big threat, bond yields may rise even more. Jim Bianco thinks that they could rise to at least 6% before it's all over. And of course, as yields rise, the prices will fall apart.