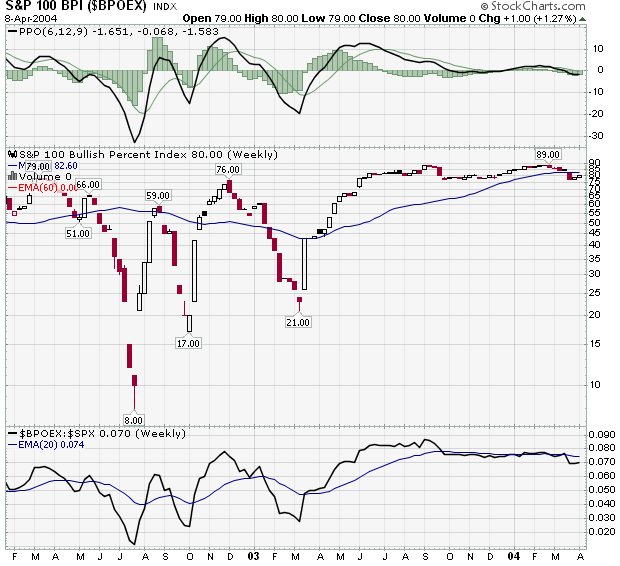

Bullish Percentage Chart, Weekly Basis, Still Time to Bail

A combustible mix of politics, economics, history...and liberty!

Last week (and in the April issue) I mentioned that one of the odd side effects of so much money sloshing around in the financial economy is the creation of "flash bubbles." These are bubbles created when the market spots something that's relatively undervalued. The problem is, there's very little in the world that's ABSOLUTELY undervalued. And so when a trickle turns into a torrent, it can take an asset you might be mildly bullish on, and turn it into a bubble. An example? Copper. The chart below shows it all. And it explains why I'm holding puts on major copper producer Freeport McMoran.

Big Media is again dropping the ball on Iraq. The Christian Science Monitor, though, has a great piece here on the origins of the current events. Here's the money paragraph: For now, US attempts to work with Sadr are over, and he’ll probably be arrested soon. But his arrest could stir up more anti-American anger among Iraq’s Shiites. As I talk to more people here on the streets, I get the feeling that the US will have to be careful in the way that it handles Sadr, but that widespread fighting for him isn’t likely. There will undoubtedly be more bloody incidents, but he so far hasn’t managed to spark the broader uprising he was hoping for.

Last week Lord Rees Mogg and I sat down to talk Constitutions. Europe has drafted one. It’s now deciding how to go about ratifying it, which has turned out to be no easy task. Lord Rees Mogg Explains why below. But indulge for a moment and allow me to offer three additional reasons. 1) English Liberalism versus French Liberalism. The English liberal tradition is based on just that…tradition. It’s based on common law…the organic growth of law through centuries of actual experience. French liberalism came from the Revolution, which was based on the conceit that men were smart enough to make the world perfect through reason. It had a profound disrespect for tradition, as evidenced by its abolition of all things traditional (the aristocracy, the Church, even the Calendar.) Today’s Europe is democratic in the French tradition not the English, and so is founded on the belief that the State can solve all problems through democratically elected legislators. 2) The Definition of Democracy. We all use the word, but do we mean the same thing by it? For some, it means the right to vote. For others, it’s a process. And for others, it’s an ideal. For all of us, the word has become dangerously ill defined. Where does political authority come from? The consent of the governed? The fact that those who govern are elected? One man one vote? The barrel of a gun I suspect the answer to where authority comes from is answered very differently all over the world—even if we’re all using the word democracy. 3) Institutional Authority. In Lord Rees Mogg’s piece, he makes reference to the institutions of the EU. What’s notable to me is that neither religion nor the family is among them. Webster’s defines and "institution" as an established custom or practice…something that exists, in my definition, because it’s successful at passing down rules and ethics that help people survive and thrive over time…broad rules which have proven effective and durable in a wide context. Today, nearly all problems in the West are thought of as political problems, requiring political institutions to solve. The Nanny State, Big Mother, Big Brother…take your pick…the idea that strong, small groups of likeminded people can govern themselves effectively is not only dismissed, it’s considered dangerous. Perhaps I’m putting too much thought into it, though. When I asked Bill Bonner what he thought, he said simply, “All countries have to find a way to ruin themselves eventually. That’s nature’s way.” Perhaps. Still, there is something remarkable about the American experiment. It’s institutionalized revolution. And I’d get into THAT even more, but it’s near the end of the day and I have to see what the price of gold is doing. Strategic Insider – William Rees-Mogg – 2 April 2004 To most Americans, the draft European Constitution is a remote and complicated scheme which is Europe’s business rather than America’s. A few foreign policy wonks find it interesting, and some lawyers with constitutional interests, but it is probable that 99 out of 100 American citizens do not even know of its existence, or that the members states of the European Union plan to reach final agreement in June. This compares unfavourably with the intense historic interest in Europe in the constitutional development of the United States. All politically concerned Europeans in 1787 were following the proceedings at Philadelphia, even though they took six weeks or more to cross the Atlantic. It is no coincidence that the signing of the U.S. Constitution was immediately followed by the French Revolution. When the French Revolution started, the French were trying to give themselves a new constitution, on American and British models. Thomas Jefferson was wholly on the side of the French Revolution, as was Tom Paine. Americans only began to feel concern at what was happening in France during the period of Robespierre’s terror, and Jefferson remained supportive even then. It must be important for the United States to see a continental power, in many ways modelled on the United States, emerging in Europe. The scheme may succeed or fail – failure is a distinct possibility – but either way major allies of the United States, and the world’s largest economy will be dramatically changed. It is also important because the European Constitution, as it has been proposed, offers a very different political and economic model from the American. Europe is not America; we have already seen how “old Europe”, particularly France and Germany, have quarrelled with American foreign policy in Iraq. There are cultural differences, and political and economic differences. The American Constitution is based on the principle of democracy. Sovereignty belongs to the people and is given by them to the government. In European thinking, despite some rhetoric about democracy, the state is the authority and the people are its subjects. This is reflected in the bureaucratic nature of the European Constitution, which is widely questioned by those European peoples that feel closest to America, the British, the Irish, the Scandinavians. Power in the European system will rest with three institutions, the Commission, the Council of Ministers and the European Court and one Alliance, the Franco-German Alliance. Two of the Institutions are appointed, and the third is indirectly elected. It is not possible, therefore, to change the European Government. In November the American people can re-elect or remove their President. Under this Constitution, the European people can never remove their government, though individual governments can change the Council of Ministers, and the European Parliament can force the resignation of the Commission, without having any power to create the new Commission. The economic difference is particularly significant. Continental Europe sees a clear distinction between the Anglo-Saxon model and the Franco-German model. The Anglo-Saxon model comes from Adam Smith and relies on markets and individual enterprise; the Franco-German model rejects Adam Smith and relies on state regulation and welfare. One is individualist and the other is collectivist. Currently the Franco-German model is working badly. Both countries are in political trouble with weak governments which are being battered in mid-term elections. President Chirac of France recently won only a single regional election, out of 22. In Germany, real GDP growth has been below one per cent for the last three years, and expectations for the current year are falling. Tony Blair, the British Prime Minister, is Anglo-Saxon in his own economic principles, but he is taking Britain into the new Constitution against the will of the British people. When the people of American do pay attention to the European Constitution, they may well sympathise with the British people.

A lot of readers have written in asking me what I think about Iraq. I'll do you one better. Go to http://doc.weblogs.com/2004/04/04#rollingIraq and you can find out from Iraqis themselves what's going on. Some of it's good. Some of it's bad. All of it looks honest to me. I guarantee you'll find it better than CBS, the Washington Post, or CNN and the New York Times. I try to avoid having strong opinions about things I know very little about. And I know very little about what's going on in Iraq right now. I might be able to tell you what a textbook Marine Corps urban combat exercise would look like. But I can't tell you what's actually going on in Falluja. But there are bloggers in Iraq, and they can tell you what's going on. Bloggers aren't journalists in the pure sense. They're eyewitnesses...and if you know anything from watching the American legal system, an eye witness can provide both the most compelling and the most untrustworthy kind of evidence. What I prefer about bloggers to straight up journalists is the lack of pretense. Most bloggers don't try and pretend to objectivity. It's their ideas and opinion you're getting, not news analysis...or a reporter with a political agenda hiding behind the "credibility" of his newspaper or his supposed objectivity. That doesn't make bloggers superior. But it does mean that bloggers are better newsgatherers. There are other reasons to read blogs with a grain of salt. But they get back to what writing and persuasion is all about, you and me exchanging ideas in plain, simple language. And because these blogs come from Iraqis making sense of Iraq and not Americans making sense of Iraq...they deserve to be read carefully by any Americans who want to understand what's going on there.

Fair enough, dear reader. You can't keep saying it's a jobless recovery if the jobs show up, right? Right. That said, nothing in Friday's employment report casts doubt on several of our investment arguments. Namely, average hourly earnings are still disinflating, high-income manufacturing jobs (when they ARE being replaced) are being replaced by lower income service jobs, and consumer wage growth is too anemic to help reduce that most heinous of moral and economic burdens: debt. I did go through the employment report myself to spot the key statistics. But since my friend Greg Weldon does it so well, I thought I'd quote you a fair piece from him. Before I do, though, let me take on one other idea...that the positive jobs report will lead to a Fed tightening. No way. Bond prices are getting whacked on just such an expectation. But as Greg shows below and as I've said before, the consumer, especially the homeowner, is making his tenuous living at the margin as it is. Rising rates threaten to tip him over into chaos (what with incomes growing so poorly to begin with.) The only scenario under which the Fed raises rates is massive inflation in commodity prices, brought about by shortages in raw materials. More on this later. For now, I'd look to buy bond calls in a day or two, on a quick turnaround play...once the market realizes the fundamentals of the consumer economy simply can't handle a rise in rates. On to Greg...on why a rate hike does NOT follow naturally from the jobs report. Emphasis added is mine. "BUT,we have a problem with all that. DEBT, a lack of consumer income, over-leveraged housing, and no savings. Okay, so we have FOUR problems with thoughts of upward spiraling short term interest rates. To us, they are all symptomatic of the same bottomline dynamic as relates to debt. We have a problem with all that, when we note the EMPLOYMENT Report, and focus on the following factoids extracted from such: * Number of People Working Part-Time for Economic Reasons, up +296,000 *Number of People Who Could ONLY Find Part-Time Work, up +80,000 *Part-Time Workers, up +294,000 (implying Full-Time Jobs FELL) * Household Survey, Unemployment, up +182,000 *Job Losers, up +284,000 * Percent Unemployed Longer than 27 Weeks, 23.9%, up from 22.9%, with 1.988 million in this category during March, up +117,000 from February. *Persons Currently Want a Job, Cannot Find a Job, 4.843 million, a NEW HIGH, and up +97,000 from last month * Number Not in Labor Force, 75.9 million, a NEW HIGH, and up almost +900,000 from November. *Employment-to-Population Ratio, 62.1, DOWN from February's 62.2, and DOWN from the January rate of 62.4 In other words, DEPITE all the self-gratuitous knee-slapping in the pop-media as relates to 1Q job creation, LESS of the US Population has a job now, than three months ago, AND more people are working part-time just to make ends meet. Fed tightening ??? Further: * Aggregate Weekly Payrolls grew only +0.1% for the month, LESS than the +0.2% rise in February, and FAR LESS than the +1.0% rise in January. * Aggregate Weekly Payrolls, Retail, down for the second month in a row. *Aggregate Weekly Payrolls, down in Transportation, down in Warehousing, down in Information, down in Business Services, down in Durable Goods, down in Non-Durable Goods. Moreover, against the Seasonally Adjusted rise in Service Payrolls (+230,000,) we note that Aggregate Weekly Payroll figure for Service Providing Industries was UNCHANGED, after rising each of the last two months. This measure clearly indicates that a surge in weekly hiring, has ENDED already. And how about hours, and income ??? NEITHER dynamic supports thoughts of higher interest rates. Note: * Weekly Average Earnings FELL to $523.70 from February's $524.58. *Weekly Average Hourly Earnings posted their third sub-2% yr-yr rate in the last four months, with outright declines posted in several industries, including Construction and Retail, the two surprise-stars in terms of headline job growth. *Total Aggregate Hours, DOWN (-) 0.1% for the month, leaving it down over the last two months combined, and unchanged over the last four months on a cumulative basis. *A VAST and BROAD-BASED MAJORITY of industries reported LESS Hours being worked, including -Wood Products -Primary Metals -Machinery -Computers - Electronic Products - Appliances - Transportation Equipment - Food - Beverages - Textiles - Apparel - Printing and Paper - Petroleum and Coal - Chemicals - Plastics and Rubber - Transportation - Warehousing - Information - Professional and Business Services - Private Service Producing ALL THOSE industries are working LESS Hours. Sorry, we just do NOT see labor-market strength within this data series.

"The current deterioration in the U.S. fiscal position and the acute decline in the net national savings rate represent risks to the financial system and the economy as a whole," Fed Governor Timothy Geithner.

Will the bullish jobs report be seen as the END of the bull market rally and the resumption of the bear market? The chart bellow says "yes." It's a five-year chart of the Wilshire 5000 Total Market Index (TMWX). From its high of 14,751 to its low of 7,342, the index lost 50% and 7,409 points. Since making that low in October of 2002, it's recovered half its bear market loss (in terms of points.) In fact, at Friday's close of 11,202, it's trading slightly above the 50% recovery of 11,046. Technically, this doesn't mean TMWX has to correct. But when the broadest measure of stock market wealth has tacked on 52%...we're either in a new bull market...or this rally has about run its course. Obviously, you know where I stand on that issue, which is why I've sold a good number of our positions to lock in profits. It could be that the frothiness of the market means another 5-10% rise in the market. But I'd rather make my exit now than try to time in perfectly. TWMX Sends a Sell Signal tmwxfiveyearweekly.bmp P.S. A full 60% retracement of the bear-market decline would take TMWX up to 11,747--a level it last reached, but could not hold in June 2001.