Whiskey and Gunpowder

A combustible mix of politics, economics, history...and liberty!

October 11, 2003

October 10, 2003

Income Reflation vs. Wealth Reflation

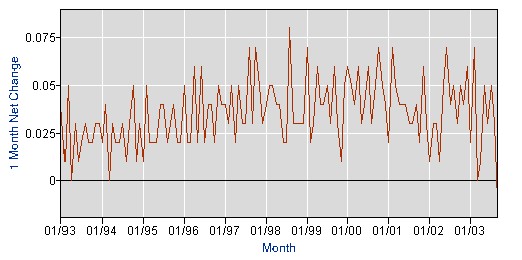

I talked on the phone with my friend Greg Weldon earlier today. On Monday, Greg authored a great piece which I think goes a long way toward explaining the asset inflation you're seeing in housing/banking/financial stocks--even as income growth is non-existent. It's a case of income growth versus asset growth. Rather than parsing his article, I asked him if I could republish a piece of it. Greg agreed. He agrees with me that it's astounding that you could see such a large rise in paper wealth and future economic expectations against such bleak income numbers. Even if job growth is modest...the American consumer is simply tapped out and stretched to the max. Without income growth...asset inflation is going to run out of steam, and sooner rather than later. If you like Greg's take-no-prisoners writing style, feel free to send him an email at weldonfinancial@comcast.net or contact his managing director, Bill O'herron at 203-858-1579. Emphasis added below is all mine. ____________________________________________ According to Doctor Market the prognosis calls for …… INTENSE job CREATION …… strong enough to support an INCOME REFLATION …… which, in turn, would allow for ‘positive’ profit-margin-expanding pricing-power for corporate America …… and thus, sparking inflation virulent enough to cause the Fed to TRIPLE the Fed Funds rate over the next eighteen months, starting with a rate HIKE by the end of THIS year. Certainly, the rampant rise in interest rates posted last Thursday-Friday is NOT to be viewed as the function of a dollar disinvestment, since the greenback participated in the upside US equity-currency surge. There is little doubt that THE CATALYST for last week’s upside all-along-the curve, rate-spike, is the belief that job CREATION has arrived, and thus the busted rungs(s) in the ladder of reflation, can be ‘repaired’. The mid-week ISM readings, came accompanied by a rise in the Mortgage Bankers indexes, to feed into Friday’s HEADLINE posting of job growth, to foster belief that both income and wealth are again, on the rise. Here is our point of macro-attack today … income, and wealth reflation. As for Income growth …in a word … fuh-get-ahhh-BOUT-itttt. There is NO income growth in the US. Let’s rewind for a second. We have long noted the existence of virtually unprecedented yr-yr rates of decline posted in ‘Real Earnings’ data, along with a second bout of DEFLATION in the yr-yr, and monthly posting in Average Weekly Earnings …and we have highlighted … barely-equal-to-inflation, disinflating, and near-secular lows, in the yr-yr rate of Average Hourly Earnings. Indeed, in the past we have spotlighted our thought-process that suggests working LESS hours, and earning the inflation rate via income growth, means an overall DEFLATION in ACTUAL income. NOW, there is INDISPUTABLE evidence, as per a nearly unheard-of monthly DECLINE in Average Hourly Earnings, posted within Friday’s Payroll data, and COMPLETELY MASKED by the headlines centered on miniscule job growth. Observe the FACT that September’s DECLINE in Average Hourly Earnings is a deflationary-influence NOT SEEN ONCE, in the lasts DECADE, as detailed in the chart below, coming directly from the US Labor Department’s web-site. First, September’s deflation is obvious, and clearly UNUSUAL. Secondly, there have been ONLY THREE instances of no-growth (unchanged) in Average Hourly Earnings on a month-month basis, once in 1993, once in 1994, and the other time coming JUST THIS YEAR … meaning … that the income deflation of 2003 is something NOT SEEN in at least a DECADE. Income Deflation Takes the Stage

Changes in Avearage Hourly Earnings Growth, month-over-month

BUT, the wealth factor is NOT negative, not at all, not right now. This is KEY, as it explains the MASSIVE ‘dual-draw-down’ in US Savings Deposits, AND, US Money Market Funds … totaling more than $100 billion in just the last month alone. Consumers feel supported by income-tax-relief-belief, AND, a strong-dose of wealth reflation … and despite bouts of confidence-shaken-confidence readings related to JOB ANXIETY … consumers are STRUTTING right now.

…The resilience of the stock market itself, feeds into the current ‘environment’, especially in light of strong rallies in cyclicals, banks, brokers, tech-stocks … and, particularly, real-estate stocks. But, at the END OF THE DAY, consumers are experiencing INCOME DEFLATION, despite appearances of, or even in the face-of, job creation headlines … and … are CLEARLY ‘drawing’ on ‘wealth’ and ‘savings’, to

maintain consumption.

Thus, from the macro-perspective, going forward … the factors influencing WEALTH become of paramount importance. At the bottom-line then, as goes HOUSING, so goes US Wealth.

-------------------

The wealth effect used to be driven by cofidence in the stock market. Now it's driven by confidence in housing prices and stocks leveraged to low interest rates. Houses being an asset closer to home than stocks, when the wealth effect here reverse and asset prices give ground...the damage will be severe.

Changes in Avearage Hourly Earnings Growth, month-over-month

BUT, the wealth factor is NOT negative, not at all, not right now. This is KEY, as it explains the MASSIVE ‘dual-draw-down’ in US Savings Deposits, AND, US Money Market Funds … totaling more than $100 billion in just the last month alone. Consumers feel supported by income-tax-relief-belief, AND, a strong-dose of wealth reflation … and despite bouts of confidence-shaken-confidence readings related to JOB ANXIETY … consumers are STRUTTING right now.

…The resilience of the stock market itself, feeds into the current ‘environment’, especially in light of strong rallies in cyclicals, banks, brokers, tech-stocks … and, particularly, real-estate stocks. But, at the END OF THE DAY, consumers are experiencing INCOME DEFLATION, despite appearances of, or even in the face-of, job creation headlines … and … are CLEARLY ‘drawing’ on ‘wealth’ and ‘savings’, to

maintain consumption.

Thus, from the macro-perspective, going forward … the factors influencing WEALTH become of paramount importance. At the bottom-line then, as goes HOUSING, so goes US Wealth.

-------------------

The wealth effect used to be driven by cofidence in the stock market. Now it's driven by confidence in housing prices and stocks leveraged to low interest rates. Houses being an asset closer to home than stocks, when the wealth effect here reverse and asset prices give ground...the damage will be severe.

Klartext and Vulgar Culture

Now we know why the European political establishment is making it a point to ridicule Schwarzenegger's election. Check out some of this quotation from a Reuter's article: "Ronny Zibinski, a 19-year-old Berlin technician, said he liked the idea of a Schwarzenegger-type chancellor for Germany. 'We need someone like that to clean up the mess and blow away the lousy politicians,' he said." It's hard to imagine a similar political revolt in Europe (this century). It would probably be made illegal. But then again, I wonder how strong the bloodlines of democratic rebellion are anywhere in the Western world. Can anyone really withdraw his or her consent to be governed anymore? The U.S. Constitution says governments derive their just powers from the consent of the governed. It doesn't say anything about government's unjust powers, of which there are many. And Lincoln proved that no one is really free to alter or abolish the government, even if it’s demonstrably true that it’s become destructive to the ends for which it was instituted by men in the first place. It's an intriguing question...really just one of idle speculation on a Friday afternoon. Once political power, and a monopoly on violence, becomes concentrated...does it ever get dispersed again? Consider the French. They traded a Church for a King, a King for a mob, and a mob for an Emperor. True the nobility surrendered its privileges. But that was only under imminent threat. Will Durant described how the revolutionaries “assembled, exchanged complaints and vows, armed themselves, attacked the chateaux, burned the homes of unyielding seigneurs and destroyed the manorial rolls which were quoted as sanctioning the feudal dues. It was that direct action, threatening a nationwide destruction of seigneurial property, that frightened the nobles into surrendering their feudal privileges (August 4, 1789) and so bringing a legal end to the Old Regime.” Incidentally, my desk mate Françoise tells me that the chief privileges which the nobility surrendered were: the right to wear a sword, the right to levy taxes, the privilege of owning land, the right not to pay any taxes at all, and preferential punishment when convicted of a crime. By the way, I’m sure the specific privileges with respect to land and taxes are more complicated than I’ve made them here. But the general point suffices. And isn’t it odd how the privileges of the nobility then sound so much like the privileges of the government today, at least in Europe: the sole right to carry arms, the sole right to levy taxes (and print money), and preferential treatment in the justice system (see Elf trial here in France, Eurostats scandal). Certainly the European political class isn’t going to surrender its privileges in a gesture of solidarity or even self-preservation. Britain, the source of American common law, is considering not even HAVING a referendum on the EU constitution. Can you guess why? The people would trounce it. And that really would be too much democracy, wouldn’t it? But it may be very hard for the bureaucrats in Brussels, Paris, or Berlin to pull this one over on the European populace. We’ll see. But even French PM Raffarin seems to know this. He spoke out today in favor of a French referendum, even though he knows it would lose in France today, and that his boss (Chirac) is not entirely comfortable with it. Still, straight talking might be vogue again, thanks to the Governator. The German word for straight talking, as far as I can tell, is Klartext. There are two sides to blunt political speech. One is that it defeats attempts to make subjects seem more complicated than they are. Tom McClintock scored points for speaking with intellectual clarity about conservatism. He didn't win. But people understood what he stood for. They knew what he believed because he said it clearly. He came off as a man who knew what he believed, and that’s essential for any kind of effective persuasion. On the other hand, it was obvious Gray Davis didn't know what he believed, or that he had public policy positions rather than personal beliefs. It was also painfully clear that he arrived at those positions by triangulating between special interests and polls (the political equivalent of a floating exchange rate mechanism). It's Clintonian talent, and something Bush seems to be practicing when it comes to trade. A little Klartext by the Terminator put all that to rout. And it left Davis politically naked, with no one to blame and nothing to say for himself. It’s one thing to be blunt, using Klartext. It’s another thing to use words like a blunt instrument, perfect for mugging a serious discussion before it can get started. Or for far, far more destructive ends. Europe knows the danger of blunt political speech. Which brings me to one final thought…I mentioned in my October print letter that if there is potential for a rising fascist threat in American politics, it’s a lot more likely to come from the Wesley Clark/Hillary Clinton left than the Josh Ashcroft/George Bush right. Why? Ideological politicians are on a short categorical leash. A liberal can get away with crushing freedom of religion (and murdering kids at Waco), because liberals are known for their defense of free speech. Liberals get a pass when it comes to crushing of dissent. And conservatives get a pass when it comes to running up big deficits. Think Al Gore would be allowed to rack up the kind of deficits GW has? Forget about it. For some reasons, Republicans can talk the fiscal conservative talk, but they don’t have to actually walk the walk. But the candidate/demagogue who wants to start laying the groundwork for a new kind of American national socialism is going to have to come up with a persuasive rhetoric that can flourish in the age of the 24-hour media cycle. I was thinking about this as I rode the train from Paris to London last week. My old rhetoric teacher in college used to tell me that the fist step in characterization is appellation. You start to define things simply by naming them. (One of Adam’s most important tasks in Genesis is to name things.) The calculating political mind is careful about naming things. In modern politics, for better or worse, naming is defining. And definitions are crucial to controlling public debate and its eventual outcome. For example, does anyone really have any idea what compassionate conservatism means? I don’t. But it sounds like something I’d like to call myself. And it forces the listener to associate conservatism with “compassion,” rather than with “tightfistedness,” “prudishness,” “meanspiritedness,” or any other word which some other calculating political mind has managed to associate the word conservatism in the past. It’s actually a fun exercise. Go ahead and try it. Take a word that has one accepted meaning….a meaning that has a whole set of beliefs associated with. And then try and choose a word that completely alters that meaning, or changes it altogether. Here are a few examples off the top of my head. These would be political labels, of course, something a future candidate for public office might call him or herself to nullify an old label or change it’s meaning. You could have “Responsible Liberalism” to counter “Compassionate Conservatism". To counter a “unilateral” foreign policy, without totally selling out the U.N., your foreign policy could be based on a framework of “Multi-Lateral Autonomy.” A future candidate could run as a “Reagan Homosexual" or a “A God Fearing Bill Clinton.” The names don’t have to make any logical sense. They just have to SEEM to make sense. They have to marry your greatest strength with your greatest perceived weakness. And they have to make it easy for people to say what they think you believe in. What you’re looking for is something Hollywood would call “high concept,” something that takes two distinct ideas, marries them together, and creates a brand new third identity which is instantly identifiable and appealing. Picture yourself in a boardroom, being pitched movie ideas. “It’s ‘Chariots of Fire’ meets ‘Animal House.’” “It’s ‘Titanic’ meets ‘Lost in Space.” “It’s ‘A Wonderful Life’ meets ‘Armageddon.’” It’s harder than you think, you see. And that’s why we may have a little time before some Huey Long comes along with perfect political pitch and sings just the right tune to get the folks marching off. If you have some submissions of your own, by all means send them in. I’ll publish the best ones next week. Send them to strategicinsider@aol.com And finally, now that I’ve nearly got my desk cleared off the sundry items that don’t belong anywhere else, the etymology of the world vulgar. I choose vulgar because that’s the word I’ve heard most often from European colleagues over the Governator’s election. Vulgar, of course, means boorish. And to the extent the Arnold is a groper of women and a bully, I suppose the name fits. But the root of the word is vulgus, Latin for “the common people.” The Vulgate bible translated by Saint Jerome at the end of the fourth century brought the scriptures to the common people in a powerful new way. And when the bible was translated into individual vernacular tongues, it was suddenly even more accessible to everyone. Vulgate and vernacular are synonyms. And maybe that’s why it’s so fitting that Californians have elected someone from outside the political class as governor, chucking out a lifetime political hack. American culture IS vulgar. It IS of the common people. And when you apply that to the political process, it’s distinctly anti-institutional. In a vulgar politics, the political class is stripped of the trappings of professional respectability. Politics is revealed for what it really is: shameless pandering, entertainment, and as Rick Rule says often, “an advance auction of stolen goods.” To the extent the Arnold has dealt a blow to the idea of professional politicians, his election is a great thing. Viva la revolucion!

Mortgage rates rise above 6 percent

Man, blogging must be getting pedestrian. There's now a blog on...get this...mortgage rates. Useful though, for folks like me and you. You can find the blog here or by going tohttp://www.bankrate.com/brm/news/mortgages/mortgage_update.asp The fixed 30-year rate is now back above 6%, after four weeks of falling. Does this signal the end of historically low mortgage rates? I've said that before and been wrong. But it is in keeping with the idea that the big-run in financial, housing, and real estate stocks is a blow-off top--asset inflation of the first order rather than the market's prediction of future earnigns growth in those industries. Don't take my word for it though. Look at the charts.

The chart above is a 3-year weekly-close chart for the streettracks Willshire REIT exchange traded fund (RWR). The fund's ten largest holdings are:

1. Equity Office Pptys Tr 7.38%

2. Simon Ppty Group Inc New 4.99%

3. Equity Residential 4.79%

4. Prologis 3.31%

5. Vornado Rlty Tr 3.30%

6. Archstone Smith Tr 2.96%

7. Public Storage Inc 2.87%

8. Boston Pptys Inc 2.86%

9. Kimco Rlty Corp 2.70%

10. General Growth Pptys Inc 2.66%

The yellow line is the 20-week moving average. I wanted to extend both the chart and the MA out in time to give you an idea of how pronounced the increase has been since the March lows this year.The slope is steep. And it looks to me like the employment news last week and this--although misunderstood--is triggering a new wave of asset inflation that could send the REITs into parabolic mode. Thus the blowofff top.

You see the same pattern forming in the Philly Broker/Dealer Index...

The chart above is a 3-year weekly-close chart for the streettracks Willshire REIT exchange traded fund (RWR). The fund's ten largest holdings are:

1. Equity Office Pptys Tr 7.38%

2. Simon Ppty Group Inc New 4.99%

3. Equity Residential 4.79%

4. Prologis 3.31%

5. Vornado Rlty Tr 3.30%

6. Archstone Smith Tr 2.96%

7. Public Storage Inc 2.87%

8. Boston Pptys Inc 2.86%

9. Kimco Rlty Corp 2.70%

10. General Growth Pptys Inc 2.66%

The yellow line is the 20-week moving average. I wanted to extend both the chart and the MA out in time to give you an idea of how pronounced the increase has been since the March lows this year.The slope is steep. And it looks to me like the employment news last week and this--although misunderstood--is triggering a new wave of asset inflation that could send the REITs into parabolic mode. Thus the blowofff top.

You see the same pattern forming in the Philly Broker/Dealer Index...

And in small cap stocks as measured by the Russell 2000...

And in small cap stocks as measured by the Russell 2000...

And speaking of small caps, notice any resemblance between the chart above, and the same chart of the Russell 2000 between January of 1999 and May 2000--in other words the last manic phase of the tech bubble?

And speaking of small caps, notice any resemblance between the chart above, and the same chart of the Russell 2000 between January of 1999 and May 2000--in other words the last manic phase of the tech bubble?

The Yuan Gets Buoyant?

Hat-tip to 6’10 power-forward and macro-maven Greg Weldon for spotting a suspicious phrase in a statement from China’s Premier Wen Jiabo on the currency. Wen said: “The current unitary and managed floating exchange rate regime based on market demand and supply is in line with China’s reality. It shows China has a high sense of responsibility toward the international community.” Say what? What exactly is a “managed floating exchange rate regime.” I was under the impression China had pegged its currency to the dollar. A peg doesn’t float, it follows rigidly. So is China sending out signals that it’s willing to change its currency policy? Is China caving to the Bush administration? Hardly. Both Bush and China want an “orderly” decline in the dollar (and a stronger yuan), but for different reasons. China wants the revaluation of the yuan to be gradual. If there’s a run on the dollar, Chinese holdings of U.S. bonds get whacked. And the Chinese own a lot of U.S. bonds. How to engineer a lower dollar without causing a run on dollar-denominated assets? This is THE key question for U.S. monetary and fiscal policy makers. John Snow and George Bush want a weaker dollar so they can show a turnaround in U.S. trade numbers for the first and second quarter of next year--just in time to win the election. But the dollar can’t go too low too fast. The difference between an orderly retreat and full-scale rout could cost Bush the Presidency. One possible solution to a lower dollar that DOESN’T cause bonds to sell off (and yields to rise), is to direct Chinese and Japanese into buying agency securities (Fannie and Freddie bonds.) This keeps the flow of capital into dollar-denominated assets, which prevents the trade deficit from exploding even more…and gives a weaker dollar time to work it’s export-boosting magic (remember, this is the theory…in point of fact, the weaker dollar of the last twelve months has caused a whopping 1% of growth in export prices, while import prices have grown at 0.8%). Persuading foreign central banks to buy agency securities instead of Treasuries doesn’t exactly solve the U.S. federal government’s funding problems. But it might at least placate the market that there IS a market for Fannie and Freddie mortgage backed bonds--even as the ground beneath Fannie and Freddie starts to crumble. And instead of having the Japanese and Chinese buy bonds directly on the open market, the Fed can do what it did last week and buy U.S. bonds on behalf of foreign central banks. The bond market gets supported, the dollar weakens, and everyone is happy. Is this the secret plan to de-peg the yuan gradually without blowing up the dollar? We’ll see. For now, foreign investors, both central banks and private investors, are still scooping up U.S. bonds. Yesterday, the Fed reported that foreign holdings of Treasuries rose $16.94 billion last week to an all-time high of $798.67 billion. Foreigners added $1.30 billion in agency debt for a total of $193.10 billion. But after today’s trade numbers--and with the simmering trouble at Fannie and Freddie--don’t be surprised if the pace of machination picks up soon. And keep in mind, the list of governments that have engineered orderly transitions for an over- or undervalued currency….is so short…that it doesn’t exist.

Scrap as a Cash Crop

Ohh, it’s good to be back behind the blog-wheel. Lots of ground to cover in the Insider today. Let’s hope all those rumors about increasing productivity are true. But before I get into the heavy stuff, I’m going to start with some belly laughs. I laughed, at least. I hope you do too. I’m subscribed to about 15 different reports from the Bureau of Labor Statistics. This means instead of waiting to read the Bloomberg version of a report, the data comes to my mailbox unfiltered. Later today, I'll break down the trade balance numbers. But yesterday, I got a report that didn’t seem to make any headlines, but should have. The BLS reported that prices for imported goods fell half a percent in September. And on the other hand, export prices were up .4%. How can this be? Isn’t a weaker dollar supposed to make imports more expensive and exports cheaper? Shouldn’t import prices be rising and export prices be falling? And falling right now!! Granted, the big culprit in falling import prices was petroleum. BLS reports that the price index for imported petroleum fell 5.2% in September. That fall offset the 1.4% rise in non--petroleum industrial supplies and materials. Meat and coffee prices were up. And in the last year, prices for imported foods, feeds, and beverages are up 2.3%.

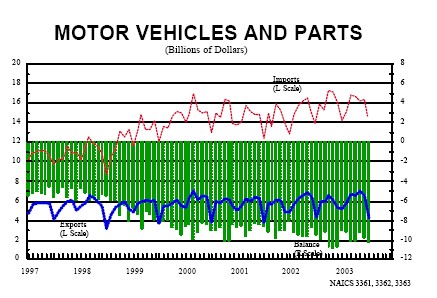

The trade deficit in motor vehicle parts is consistent and large. Immediately destroying imports and exporting the parts back to Japan would reverse some of 2003’s $41.9 billion deficit.

Here’s an interesting note, the price indexes for imported capital goods and cars both FELL in September. Cars are getting cheaper while raw materials are getting more expensive. This leads me to a new business idea and a new economic law: the law of destructive destruction.

The business idea is simple: pay zero down and buy imported cars at low interest rates. Immediately scrap the cars sell the raw materials back to Japan for a profit. If we can’t produce it more efficiently, why no destroy it for a profit?

After all, America is the world’s leading consumer of stuff. Why not turn all that crap in your garage or in your storage unit into profit? Talk about a wasting asset. This is an enormous profit opportunity. You’re making a mistake if you have a garage sale. What you ought to be doing is rendering all that old furniture from Ikea into lumber and selling it back to Canada at a fat profit.

And just think about the vast expanses of tract housing that will sit unoccupied when the housing boom goes bust. Buy up the defaulted mortgages for pennies on the dollar, pay a few bucks to a work crew, and reduce the place to scrap, the parts obviously being worth more than the whole. (Think of all the new jobs….it could be a real turn around in employment.)

I jest, sort of. I recall doing some research a few months ago which showed that one of the industries the U.S. consistently showed a trade surplus in is scrap metal. And in fact, export prices for textile fibers (and their waste) are up 17% in the last year. Export prices for meatlliferrous ores and metal scrap are up nearly 30%.

So you see…perhaps there’s a business after all in buying cheap imports on credit, destroying them into their component parts, and exporting them back overseas at a profit. We could convert America’s junk surplus into honest to goodness cash. One nation’s trash is that same nation’s treasure, if we’d only get to destroying.

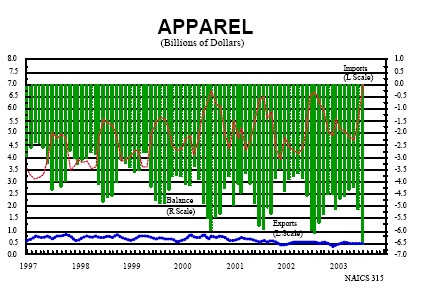

America’s projected apparel deficit for 2003 is $59.4 billion--a 15% increase over last year. The solution: rip up last year’s fall collection and export it for a profit.

The trade deficit in motor vehicle parts is consistent and large. Immediately destroying imports and exporting the parts back to Japan would reverse some of 2003’s $41.9 billion deficit.

Here’s an interesting note, the price indexes for imported capital goods and cars both FELL in September. Cars are getting cheaper while raw materials are getting more expensive. This leads me to a new business idea and a new economic law: the law of destructive destruction.

The business idea is simple: pay zero down and buy imported cars at low interest rates. Immediately scrap the cars sell the raw materials back to Japan for a profit. If we can’t produce it more efficiently, why no destroy it for a profit?

After all, America is the world’s leading consumer of stuff. Why not turn all that crap in your garage or in your storage unit into profit? Talk about a wasting asset. This is an enormous profit opportunity. You’re making a mistake if you have a garage sale. What you ought to be doing is rendering all that old furniture from Ikea into lumber and selling it back to Canada at a fat profit.

And just think about the vast expanses of tract housing that will sit unoccupied when the housing boom goes bust. Buy up the defaulted mortgages for pennies on the dollar, pay a few bucks to a work crew, and reduce the place to scrap, the parts obviously being worth more than the whole. (Think of all the new jobs….it could be a real turn around in employment.)

I jest, sort of. I recall doing some research a few months ago which showed that one of the industries the U.S. consistently showed a trade surplus in is scrap metal. And in fact, export prices for textile fibers (and their waste) are up 17% in the last year. Export prices for meatlliferrous ores and metal scrap are up nearly 30%.

So you see…perhaps there’s a business after all in buying cheap imports on credit, destroying them into their component parts, and exporting them back overseas at a profit. We could convert America’s junk surplus into honest to goodness cash. One nation’s trash is that same nation’s treasure, if we’d only get to destroying.

America’s projected apparel deficit for 2003 is $59.4 billion--a 15% increase over last year. The solution: rip up last year’s fall collection and export it for a profit.

In fact, that’s what we’ll call this new law, the law of destructive destruction. Value is added by subtraction. True, there is some labor involved in destroying things. And there would be technical problems in measuring output per hour for those in the destroying business. But presumably, the more you destroy, the more productive you are. This is something American's definitely have a competitive advantage in. Even Greenspan is going to love this.

In fact, that’s what we’ll call this new law, the law of destructive destruction. Value is added by subtraction. True, there is some labor involved in destroying things. And there would be technical problems in measuring output per hour for those in the destroying business. But presumably, the more you destroy, the more productive you are. This is something American's definitely have a competitive advantage in. Even Greenspan is going to love this.

October 08, 2003

In From the Clouds at Menaggio

Incidentally, I haven't extended my vacation. It turns out that while I was staying at Menaggio, north of Milan, I came down with a bit of a cold that's knocked me out of commission for a few days. I'm back in the saddle today, but more of a canter rather than a gallop. I DO have a pile of articles on my desk with notes I made while gone. And I hope to post some of those in the next few days, and fill you in on my trip to London last week. By the way, I'll post some pictures from Menaggio when I get them. But from the one below, you can actually see the hotel I was in on the lower right. I'm not sure if it was the first frost of the year, but there was fresh snow on the mountains Sunday morning. Being the mountain man I am (born and raised in Colorado), I'd left the window open but the shutters closed on Saturday night. That may have something to do with my cold. But it was worth it. It's refreshing to get off the grid and breathe some clean air. Good to be back though. And back to normal schedule. Dan

The Order of the Dragon

Here is more evidence that develops the case I laid out in the October issue of SI...namely that China and Asia already constitute a larger economic zone than Europe or North America. The article says that, "But freer trade might not be Beijing's most important goal -- after all, China can manufacture, export and grow with or without a trade agreement with Southeast Asia. As China works to emerge as a world power, experts say it is using its trading prowess to extend its political clout, in part by promoting itself as a good neighbor that can shepherd the entire region to greater prosperity." It's a simple formula really. One used by the French, the Spanish, the British, the Americans...and now the Chinese. Economic power leads to military and political power. In fact, seldom can a nation state become and remain a military power if it doesn't have the economic power to fund its war machine. China, for its part, is buildinging an economic war machine. And while the U.S. frets about the dollar and competitive exports...a whole new economic order is taking shape in Asia.

October 07, 2003

Correction

Okay...so it wasn't Hillary that filed. The NRO reports that the entry on the FEC site was an ID created when a draft Hillary committee registered. Still...all the pieces are now in place...

Here Comes Hillary

Back from my retreat to the Alps and Lake Como. Details to follow later. But for now, courtesy of Glenn Reynolds...check out the below...and keep in mind that on Friday, Hillary filed to run for President. The race is about to get really interesting.... KTIV: News (News): "Hillary Coming to Des Moines New York Senator Hillary Rodham Clinton will be the keynote speaker for the Iowa Democratic Party's biggest annual fundraiser. Clinton's staff made the announcement yesterday. She'll speak at the annual Jefferson-Jackson Day fundraiser on November 15th in Des Moines. The former first lady is serving her first term in the senate but has ruled out running for the party's presidential nomination. The 10 Democrats seeking the presidential nomination have been invited."