Mobilus

One of the aspects of the lighter-than-air airships I didn't cover in yesterday's Whiskey and Gunpowder was the use of huge airships for shipping and transportation. The program is called Mobilus. You can find out more here, where the Office of Force Transformation invites you to imagine a world where....

- A new form of airlift dramatically increases the overall capacity of the transportation network from origin to destination (strategic and operational distances) and within theaters of operation

- Humanitarian relief – massive amounts of food, modular hospitals, water purification equipment – can be delivered directly to the point where it is needed

- This maneuver capability can overcome area denial and anti-access measures by flying directly to the destination area and offloading in austere areas

- New trade patterns can open land-locked countries to better commerce Heavy construction materials can be delivered into dense urban centers with minimum disruption

- High volume/heavy loads can be taken off our highways and moved another way The US air transportation system becomes a more robust and agile network capable of absorbing disruptions due to weather or attack

- Military capabilities can rapidly maneuver to critical points across the earth at least three times faster than by ship and be ready to operate immediately – and do so at lower cost than existing airlift

- Mineral resources and oil can be obtained with far less environmental impact and at lower monetary cost

- Business logistics are streamlined because many physical transportation limits no longer apply

- The US Aerospace Industry again takes a dominant place in the world and offers new challenges to entrepreneurs and engineers

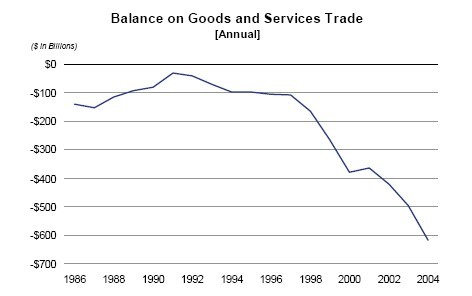

source: Bureau of Economic Analysis, Department of Commerce

source: Bureau of Economic Analysis, Department of Commerce

Is it time to buy gold calls?

Is it time to buy gold calls?

Bottom of the channel? Or moving down to the next channel?

Bottom of the channel? Or moving down to the next channel?