The REAL Case Against Gold

A sharp reader writes in on why governments have always feared gold: Military powers have a legitimate case against gold; it is impossible to wage aggressive war and maintain a gold standard concurrently, let alone Bread and Circuses. The government has convinced the masses of the disutility of gold so successfully, that if you suggest reinstituting a gold-backed currency to any 'peace-loving' Democrat - there are a lot of those here in Portland, OR -, they are more likely to mention WJB than listen to any reasoned statements about gold's inherent ability to restrain military spending. Incidentally the WJB referred to is William Jenning's Bryan, who opposed the gold standard at the Democratic Convention in 1896. I wrote up a brief analysis of the speech which I published earlier this month to paid-up subscribers of Strategic Investment (where I do my weekly stock picking and follow up on our portfolio, as well as editing the 16 page monthly paper letter, with articles from Dr. Kurt Richebacher, Dr. Marc Faber, and the Daily Reckoning's own Bill Bonner). Here's the excerpt from my SI article from June 13 of this year: "Gold as been at war with paper money forever, and in the United States since the Federal Reserve was created in 1913. 1913 was arguably the worst year in American history for liberty. It saw the creation of the Fed, the creation of the income tax via the 16th Amendment to the Constitution, and the 17th Amendment -- popular election of Senators. Believe it or not, after the United States passed the Gold Standard Act of 1900 under William McKinley, the country enjoyed what is now known as the era of the classical gold standard. During that brief era, gold was fixed at $20.67 and every dollar was redeemable for gold. The U.S. Treasury was required to maintain a minimum of $150 million in gold reserves. And in language that would embarrass a modern central banker with a big printing press, the act brashly asserted that the gold-backed dollar "shall be the standard unit of value, and all forms of money issued or coined by the United States shall be maintained at a parity of value with this standard, and it shall be the duty of the Secretary of the Treasury to maintain such parity." Imagine that, a stable currency backed by a real asset. The classical era fell apart when the world went to war in 1914. During wars, governments are fatally constricted by a gold standard. They can't print money to pay for the war. Under the gold standard, the money must be backed by an asset redeemable for paper. And seeing the wartime deficits, a skeptical populace would cash out its paper for gold -- thereby stripping the government of its ability to pay for war. That's why gold gets confiscated in wars. That's why Franklin Roosevelt made it illegal in 1933. That's why Nixon took us completely off the gold standard in 1971 and created the dollar standard. And that's why today, the government continues its war against gold. You have to wonder though, in a world increasingly at war and warlike, how long will the public keep paying for the government's wars? And not just the American public. The dollar is the world's reserve currency. If the U.S. government must borrow much more than it takes in to pay for wars that are not popular elsewhere, who will pay for them with dollars? Or will the rest of the world vote with its pocketbook... switching its dollars for gold, and bringing an end to the late, great U.S. dollar? P.P.S. For you hardcore historians, the heart and soul of the modern Democratic party has its roots in the debate over "the money issue." When William Jennings Bryan ran for President in 1896, he made the gold standard his enemy. Bryan took the floor in Chicago and gave birth to modern populism with his "Cross of Gold" speech in which he pitted Eastern business interests versus the backbone of the American Mid West. Bryan's money quote, from a populist perspective, his below. He's challenging the Democratic backers of the gold standard. He says: "They can find where the holders of the fixed investments have declared for a gold standard, but not where the masses have. Mr. Carlisle said in 1878 that this was a struggle between "the idle holders of capital" and "the struggling masses who produce the wealth and pay the taxes of the country;" and, my friends the question we are to decide is: Upon which side with the Democratic party fight; upon the side of "the idle holders of capital" or upon the side of "the struggling masses?" That is the question which the party must answer first, and then it must be answered by each individual hereafter. "The sympathies of the Democratic party, as show by the platform, are on the side of the struggling masses who have ever been the foundation of the Democratic party. There are two ideas of government. There are those who believe that, if you only legislate to make the well-to-do prosperous, their prosperity will leak through on those below. The Democratic idea, however, has been that if you legislate to make the masses prosperous, their prosperity will find its way up through every class which rests up on them." You can hear the whole thing at http://historymatters.gmu.edu/d/5354/ . And as they say here in France, "plus ca change, plus c'est la meme chose."

Bears shouldn't underestimate the staying power of the Fed. Ultimately, I don't think the Fed is going to be any more effective at rescuing the economy with low short-term interest rates that it would be at say, learning to speak Chinese by eating spinach. But if it keeps the money spigots open at the current pace, it can inflate stock values even higher than their currently absurd levels. As long as money keeps finding its way into the market, stock prices will go up.

But there's a lot going against the Fed. There's the federal deficit, which I referred to yesterday. It's already beginning to scare away foreign bond investors. And there's the current account balance, the other deficit that threatens to destroy the confidence foreign lenders have in the credit-worthiness of U.S. borrowers.

I'm assuming you share at least part of my concern with the unwinding of this debt obligation. Can the Fed engineer a muddle through? Will the economy muddle through anyway, despite the Fed's actions? And if it really is as bad as I say it is, what in the world can you do as an investor?

First, be prepared for more rallies. It defies sense and reality and history, but the market can go higher from here. Don't get caught in too many speculative bearish positions, or in too many shorts. If you are short or own puts, hedge them with calls.

This is something I ought to have done better this summer. Yet there are non-financial reasons the market could keep rising as well. One is the Presidential election. The Fed will stay loose during the election cycle, and who knows, maybe, just maybe, there IS such a thing as the Plunge Protection Team intervening in the markets to limit the losses on the big indexes.

But even without it, the market could still go up as long as money from the Fed and BS from Wall Street keep flowing. In fact, in a speculative market like this, you could do worse than buy calls on the most speculative sectors.

In the past I've recommended a small-cap index fund IWO and Biotech holders. As you can see below, they've both done quite well, as have the semiconductor holders. As toppy as they look to me, in a continued rally, they'll go up even more.

THREE LEADING SPECULATIONS

Bears shouldn't underestimate the staying power of the Fed. Ultimately, I don't think the Fed is going to be any more effective at rescuing the economy with low short-term interest rates that it would be at say, learning to speak Chinese by eating spinach. But if it keeps the money spigots open at the current pace, it can inflate stock values even higher than their currently absurd levels. As long as money keeps finding its way into the market, stock prices will go up.

But there's a lot going against the Fed. There's the federal deficit, which I referred to yesterday. It's already beginning to scare away foreign bond investors. And there's the current account balance, the other deficit that threatens to destroy the confidence foreign lenders have in the credit-worthiness of U.S. borrowers.

I'm assuming you share at least part of my concern with the unwinding of this debt obligation. Can the Fed engineer a muddle through? Will the economy muddle through anyway, despite the Fed's actions? And if it really is as bad as I say it is, what in the world can you do as an investor?

First, be prepared for more rallies. It defies sense and reality and history, but the market can go higher from here. Don't get caught in too many speculative bearish positions, or in too many shorts. If you are short or own puts, hedge them with calls.

This is something I ought to have done better this summer. Yet there are non-financial reasons the market could keep rising as well. One is the Presidential election. The Fed will stay loose during the election cycle, and who knows, maybe, just maybe, there IS such a thing as the Plunge Protection Team intervening in the markets to limit the losses on the big indexes.

But even without it, the market could still go up as long as money from the Fed and BS from Wall Street keep flowing. In fact, in a speculative market like this, you could do worse than buy calls on the most speculative sectors.

In the past I've recommended a small-cap index fund IWO and Biotech holders. As you can see below, they've both done quite well, as have the semiconductor holders. As toppy as they look to me, in a continued rally, they'll go up even more.

THREE LEADING SPECULATIONS

Be advised, playing the upside in those sectors is a "greater fool" exercise. You can do it. And you can even do it profitably. But you'd better have good timing.

What if you don't want to take the risk of being in the market but want to do something about the risk in the dollar? Should you buy bullion? Should you sell everything and move to Thailand (I mention this because two of my subscribers, a husband and wife, did just that. The husband up and quit is job in Silicon Valley and cashed out everything, and the wife did the same. They now run a business from there.)

First, I believe you can make money on gold stocks even with the risk to overall equities in the event of a massive stock market correction. Gold stocks are the most liquid way for most investors to profit from rising spot gold. You can't trade your stock certificates for lunch at the Wendy's down the street. But you ought to be able to profit from a rise in the stocks of gold companies as they come the lifeboats of choice on the S.S. Bull Market Rally.

The key will be knowing when to sell, and then what to do with your dollar denominated proceeds. Keep in mind, I'm not predicting the end of the American Way of Life and the Collapse of Western Civilization. I don't believe a major stock market collapse and economic recession/depression will lead to the complete loss of civil order.

But standards of living will fall. And the dollar will get inflated to the moon. Your paper assets will be worth less than your hard assets. And in that case, you ought to own some gold coins. Next week, I'm going to give you a list of just who to contact and what kind to buy. But for now, keep in mind that even if you turned just 2% of your cash into gold coins, it would be better than none at all.

Most of you probably won't do this. You'll worry about looking foolish. Or owning a bunch of gold coins which don't throw off the 1-2% interest you can get in a more socially respectable money market fund. But if and when you need them, it will be awfully nice to have those coins in your pocket. More next week.

As for the today...stock markets will not be helped by the news that August payrolls fell by 93,000. It was the 7th consecutive month of declines in non-farm payrolls. The press seems fascinated by the synchronous decline in payrolls and rise in productivity.

I was a liberal arts major back in my college days (history and literature). But even I have figured out how statistics work. When the number of workers fired goes up, but the quantity of work that gets done remains the same, productivity (output) per worker rises. Yet even then, U.S. workers are NOT the world's most productive workers, at least on an hourly basis.

A study released last week shows that the average Norwegian, Belgian, and yes, Frenchmen beat the U.S. when it comes to output per our. But because the average U.S. worker works an additional three hours per week, the U.S. comes out on top in terms of total productivity per worker. U.S. output per U.S. worker last year was $60,728, according to the report, while Belgium ranked tops in Europe with an output of $54,333 per worker.

When it comes to productivity per hour, the report says,""Norwegians lead the world with an output of $38 per hour worked last year. French workers were in second place, averaging $35 an hour,. Belgians were third at $34, followed by Americans at $32."

Americans stubbornly believe that pervasive use of information technology gives the American worker a decisive advantage in productivity over his foreign counterparts. I admit, IT makes me enormously productive (perhaps too productive, judging my some of your comments, counter productive even). But my job, all kidding aside, is fairly unique.

The fact is, the productivity miracle is a myth, and has been for the duration of the bull market. It's a convenient shibboleth for the CNBC crowd which has been repeated so often its taken for gospel--even though there's no evidence its true.

One by one the myths of the old bull are destroyed. The market can float on a sea of liquidity for awhile. But sooner later, it's going to begin to sink under the weight of America's collossal debt.

Be advised, playing the upside in those sectors is a "greater fool" exercise. You can do it. And you can even do it profitably. But you'd better have good timing.

What if you don't want to take the risk of being in the market but want to do something about the risk in the dollar? Should you buy bullion? Should you sell everything and move to Thailand (I mention this because two of my subscribers, a husband and wife, did just that. The husband up and quit is job in Silicon Valley and cashed out everything, and the wife did the same. They now run a business from there.)

First, I believe you can make money on gold stocks even with the risk to overall equities in the event of a massive stock market correction. Gold stocks are the most liquid way for most investors to profit from rising spot gold. You can't trade your stock certificates for lunch at the Wendy's down the street. But you ought to be able to profit from a rise in the stocks of gold companies as they come the lifeboats of choice on the S.S. Bull Market Rally.

The key will be knowing when to sell, and then what to do with your dollar denominated proceeds. Keep in mind, I'm not predicting the end of the American Way of Life and the Collapse of Western Civilization. I don't believe a major stock market collapse and economic recession/depression will lead to the complete loss of civil order.

But standards of living will fall. And the dollar will get inflated to the moon. Your paper assets will be worth less than your hard assets. And in that case, you ought to own some gold coins. Next week, I'm going to give you a list of just who to contact and what kind to buy. But for now, keep in mind that even if you turned just 2% of your cash into gold coins, it would be better than none at all.

Most of you probably won't do this. You'll worry about looking foolish. Or owning a bunch of gold coins which don't throw off the 1-2% interest you can get in a more socially respectable money market fund. But if and when you need them, it will be awfully nice to have those coins in your pocket. More next week.

As for the today...stock markets will not be helped by the news that August payrolls fell by 93,000. It was the 7th consecutive month of declines in non-farm payrolls. The press seems fascinated by the synchronous decline in payrolls and rise in productivity.

I was a liberal arts major back in my college days (history and literature). But even I have figured out how statistics work. When the number of workers fired goes up, but the quantity of work that gets done remains the same, productivity (output) per worker rises. Yet even then, U.S. workers are NOT the world's most productive workers, at least on an hourly basis.

A study released last week shows that the average Norwegian, Belgian, and yes, Frenchmen beat the U.S. when it comes to output per our. But because the average U.S. worker works an additional three hours per week, the U.S. comes out on top in terms of total productivity per worker. U.S. output per U.S. worker last year was $60,728, according to the report, while Belgium ranked tops in Europe with an output of $54,333 per worker.

When it comes to productivity per hour, the report says,""Norwegians lead the world with an output of $38 per hour worked last year. French workers were in second place, averaging $35 an hour,. Belgians were third at $34, followed by Americans at $32."

Americans stubbornly believe that pervasive use of information technology gives the American worker a decisive advantage in productivity over his foreign counterparts. I admit, IT makes me enormously productive (perhaps too productive, judging my some of your comments, counter productive even). But my job, all kidding aside, is fairly unique.

The fact is, the productivity miracle is a myth, and has been for the duration of the bull market. It's a convenient shibboleth for the CNBC crowd which has been repeated so often its taken for gospel--even though there's no evidence its true.

One by one the myths of the old bull are destroyed. The market can float on a sea of liquidity for awhile. But sooner later, it's going to begin to sink under the weight of America's collossal debt.

Here's the Kosar comment:

"As of Friday's latest report (current through August 26), Commercials have increased their net short position to 62,609 contracts from 50,716 contracts a week earlier. This is Commercials' largest net short position since they initially went net short on June 24, and suggests they have renewed bearish conviction following a few weeks of uncertainty. moreover, this is Commercials' largest net short position since December 17, 2002 (see chart), which preceded the decline into the March 2003 low.

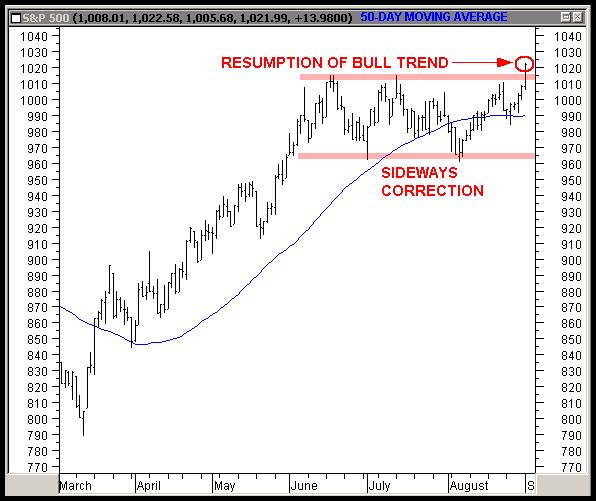

"However, despite an apparent bearish directional bet by Commercial traders, the S&P 500 broke out higher Tuesday from ten weeks of sideways price activity (see chart below). We now interpret this ten-week period as a correction within the bull trend that began at the October 2002 low. Tuesday's close above the 1,015 upper boundary of this correction area indicates the bull trend has resumed, and targets a move to at least 1,065.

Here's the Kosar comment:

"As of Friday's latest report (current through August 26), Commercials have increased their net short position to 62,609 contracts from 50,716 contracts a week earlier. This is Commercials' largest net short position since they initially went net short on June 24, and suggests they have renewed bearish conviction following a few weeks of uncertainty. moreover, this is Commercials' largest net short position since December 17, 2002 (see chart), which preceded the decline into the March 2003 low.

"However, despite an apparent bearish directional bet by Commercial traders, the S&P 500 broke out higher Tuesday from ten weeks of sideways price activity (see chart below). We now interpret this ten-week period as a correction within the bull trend that began at the October 2002 low. Tuesday's close above the 1,015 upper boundary of this correction area indicates the bull trend has resumed, and targets a move to at least 1,065.

DFI may be headed back to post 9-11 rally territory. But I'd be surprised. Instead, I'd look closely at put options. But I would not buy front month contracts. Technically, the index is in the kind of rally you don't want to get in the way of in the short term. But it might make a nice hedge if you have a bullish position in any of the defense stocks I've recommended.

DFI may be headed back to post 9-11 rally territory. But I'd be surprised. Instead, I'd look closely at put options. But I would not buy front month contracts. Technically, the index is in the kind of rally you don't want to get in the way of in the short term. But it might make a nice hedge if you have a bullish position in any of the defense stocks I've recommended.

Tellingly, the SMH (the semiconductor holders) debuted in March of 2000--right at the top of the Nasdaq. Even though they look like a bargain relative to those levels, the reality is that at current multiples, they’re still toxic. And to the extent that they, and other tech stocks, have accounted for the improved performance of the S&P over the summer, the index and the market have an awfully slender reed to lean on.

Tellingly, the SMH (the semiconductor holders) debuted in March of 2000--right at the top of the Nasdaq. Even though they look like a bargain relative to those levels, the reality is that at current multiples, they’re still toxic. And to the extent that they, and other tech stocks, have accounted for the improved performance of the S&P over the summer, the index and the market have an awfully slender reed to lean on.

PLUS

PLUS The lines at KFC were long....they're always long. Instead, I went Chinese, French-style.

The 2000 Domaine du Trapadis Rasteau is a spicey one, best served with spicey Thai-beef.

If you have GERDS, or acid reflux, or hearburn, stick with chicken, original recipe.

The lines at KFC were long....they're always long. Instead, I went Chinese, French-style.

The 2000 Domaine du Trapadis Rasteau is a spicey one, best served with spicey Thai-beef.

If you have GERDS, or acid reflux, or hearburn, stick with chicken, original recipe.

You can describe the process of generating an investment idea with two questions. First, "What?" Second, "So what?"

You've got the what. September is a bad time for markets. And since this a cyclical bullish rally in the midst of secular market, answering the "So what" should tell you, at the least what NOT to own. And if you see any patterns, it can also give you a few new investment ideas.

Let's look at the top ten performing stocks this year that have market caps over $400 million. That's an arbitrary number. But it does help us sort out the outlier small cap stocks whose outperformance this year doesn't tell us much about whether there's a class of stocks with a lot to lose from a correction.

And that, by the way, is what we'Re looking for. Is there a particular sector that gained the most the re-exuberance? When we find it, THAT's the sector to attack. Here are the top ten performers year-to-date, ranked by market cap:

1. NTL Incorporated (NTLI), up 712%, market cap: $2.04 billion

2. XM Satellite Radio (XMSR), up 409%, market cap: $1.69 billion

3. Sonus Networks, Inc. (SONS), up 609%, market cap: $1.59 billion

4. NII Holdings, Inc. (NIHD), up 432%, market cap: $1.29 billion

5. Ask Jeeves, Inc. (ASKJ), up 611%, market cap: $807 million

6. Millicom IntÂl Cellular, (MICC), up 648%, market cap $654 million

7. Dot Hill Systems (HILL), up 431%, market cap: $535 million

8. Westell Techonologies, Inc. (WSTL), up 567%, market cap: $531 million

9. Flamel Technologies, S.A. (ADR), up 554%, market cap: $460 million

10. Verso Technologies, Inc. (VRSO), up 740&, market cap: $403.2 million

Not hard to see the common threads here...disk storage, broadband, packet-based switching, satellite radio, communications. This is Tech Boom, Episode Two. Shouldn't surprise you. Nor should it surprise you that five of these stocks don't have P/E ratios, because they don't have any earnings.

Yet they all are up nicely, and so are the industries they represent. Take a loot the chart below. It shows the Internet architecture holders up 37% in the last 52 weeks. Not bad. Broadband holders are up 54%. The most diverse basket of Internet stocks--the Internet holders--are up 118% in the last year. And Internet infrastructure stocks are up 136%. All this while the S&P is up just 16% in the last year and the Dow up 13%.

FOUR STRONG SECTORS WITH A LOT TO LOSE FROM A BEAR MAULING

You can describe the process of generating an investment idea with two questions. First, "What?" Second, "So what?"

You've got the what. September is a bad time for markets. And since this a cyclical bullish rally in the midst of secular market, answering the "So what" should tell you, at the least what NOT to own. And if you see any patterns, it can also give you a few new investment ideas.

Let's look at the top ten performing stocks this year that have market caps over $400 million. That's an arbitrary number. But it does help us sort out the outlier small cap stocks whose outperformance this year doesn't tell us much about whether there's a class of stocks with a lot to lose from a correction.

And that, by the way, is what we'Re looking for. Is there a particular sector that gained the most the re-exuberance? When we find it, THAT's the sector to attack. Here are the top ten performers year-to-date, ranked by market cap:

1. NTL Incorporated (NTLI), up 712%, market cap: $2.04 billion

2. XM Satellite Radio (XMSR), up 409%, market cap: $1.69 billion

3. Sonus Networks, Inc. (SONS), up 609%, market cap: $1.59 billion

4. NII Holdings, Inc. (NIHD), up 432%, market cap: $1.29 billion

5. Ask Jeeves, Inc. (ASKJ), up 611%, market cap: $807 million

6. Millicom IntÂl Cellular, (MICC), up 648%, market cap $654 million

7. Dot Hill Systems (HILL), up 431%, market cap: $535 million

8. Westell Techonologies, Inc. (WSTL), up 567%, market cap: $531 million

9. Flamel Technologies, S.A. (ADR), up 554%, market cap: $460 million

10. Verso Technologies, Inc. (VRSO), up 740&, market cap: $403.2 million

Not hard to see the common threads here...disk storage, broadband, packet-based switching, satellite radio, communications. This is Tech Boom, Episode Two. Shouldn't surprise you. Nor should it surprise you that five of these stocks don't have P/E ratios, because they don't have any earnings.

Yet they all are up nicely, and so are the industries they represent. Take a loot the chart below. It shows the Internet architecture holders up 37% in the last 52 weeks. Not bad. Broadband holders are up 54%. The most diverse basket of Internet stocks--the Internet holders--are up 118% in the last year. And Internet infrastructure stocks are up 136%. All this while the S&P is up just 16% in the last year and the Dow up 13%.

FOUR STRONG SECTORS WITH A LOT TO LOSE FROM A BEAR MAULING

If you're looking for stocks to UNDER perform, or just get shellacked in September, I'd start with the 10 stocks on my list above. But if you're looking to make some money out of it, I wouldn't bother shorting any of them.

I'd go after the holders--the baskets of stocks. They have leverage on both the upside and the downside. And because they've gotten so far ahead of the broad indexes on the way up, they'll give up the most ground on the way back down.

Incidentally, none of the stocks on my top ten best-performers are holdings in any of the holders I've mentioned. And this is a point worth making: when stocks rise for no rhyme or reason, there's no intelligent way to about selecting them. What would you look for? Not value.

You'd look for the stocks participating in the mania. And even then, if you're picking single stocks, you could be wrong. But what you DO no is that when they come back down, they'll come down hard. And on the downside, you don't have to take the risk of shorting individual stocks. You have the luxury of hindsight.

In this case, you can clearly see that it's a handful of technology sectors that benefited the most in the last year. To profit on the downside, you simply buy put options on proxy indexes--baskets of stocks which represent that sector. You've targeted the idea and lowered your risk a the same time.

If you're looking for stocks to UNDER perform, or just get shellacked in September, I'd start with the 10 stocks on my list above. But if you're looking to make some money out of it, I wouldn't bother shorting any of them.

I'd go after the holders--the baskets of stocks. They have leverage on both the upside and the downside. And because they've gotten so far ahead of the broad indexes on the way up, they'll give up the most ground on the way back down.

Incidentally, none of the stocks on my top ten best-performers are holdings in any of the holders I've mentioned. And this is a point worth making: when stocks rise for no rhyme or reason, there's no intelligent way to about selecting them. What would you look for? Not value.

You'd look for the stocks participating in the mania. And even then, if you're picking single stocks, you could be wrong. But what you DO no is that when they come back down, they'll come down hard. And on the downside, you don't have to take the risk of shorting individual stocks. You have the luxury of hindsight.

In this case, you can clearly see that it's a handful of technology sectors that benefited the most in the last year. To profit on the downside, you simply buy put options on proxy indexes--baskets of stocks which represent that sector. You've targeted the idea and lowered your risk a the same time.

PLUS

PLUS

Source, Consuming Industries Trade Action Coalition Steel Task Force

The article goes on...

"He did not single out any countries for increased scrutiny, but U.S. manufacturers are pressuring the Bush administration to protect American jobs against what many see as unfair Japanese and Chinese currency policies.

"U.S. companies complain Japan keeps its yen currency artificially low by intervening in currency markets to prevent its appreciation, while China's fixed currency peg has the same effect of giving its products an unfair trade advantage.

"Major U.S. business and labor groups said on Friday they might ask the White House for an investigation of alleged currency manipulation by China, a move that could trigger trade sanctions if a negotiated settlement cannot be reached.

"The trade complaint by the National Association of Manufacturers and some 80 other groups would be the first of its kind based on currency intervention, experts said.

"The so-called Section 301 complaint, if filed, could markedly escalate the bilateral dispute, which U.S. Treasury Secretary John Snow plans to raise with Chinese officials in meetings in Beijing this week."

Shame on those Chinese for manipulating the value of their currency. The nerve. They must pay.

But how can we make them pay without, you know, causing them to invest their dollars elsewhere? After all, we kind of need those dollars to, you know, finance our, mmmph, you know,

Source, Consuming Industries Trade Action Coalition Steel Task Force

The article goes on...

"He did not single out any countries for increased scrutiny, but U.S. manufacturers are pressuring the Bush administration to protect American jobs against what many see as unfair Japanese and Chinese currency policies.

"U.S. companies complain Japan keeps its yen currency artificially low by intervening in currency markets to prevent its appreciation, while China's fixed currency peg has the same effect of giving its products an unfair trade advantage.

"Major U.S. business and labor groups said on Friday they might ask the White House for an investigation of alleged currency manipulation by China, a move that could trigger trade sanctions if a negotiated settlement cannot be reached.

"The trade complaint by the National Association of Manufacturers and some 80 other groups would be the first of its kind based on currency intervention, experts said.

"The so-called Section 301 complaint, if filed, could markedly escalate the bilateral dispute, which U.S. Treasury Secretary John Snow plans to raise with Chinese officials in meetings in Beijing this week."

Shame on those Chinese for manipulating the value of their currency. The nerve. They must pay.

But how can we make them pay without, you know, causing them to invest their dollars elsewhere? After all, we kind of need those dollars to, you know, finance our, mmmph, you know,  John says, “Thursday’s rally in Treasuries also resulted in a bullish breakout in December 10-year note futures and in cash 30-year T-bonds. In 10-year futures this breakout targets 113 16/32 as a minimum target, as long as support near 109-25 loosely contains below the market as support (see chart above). In cash 30-year T-bonds this breakout targets 4.91% as long as the 5.27% area contains as support.”

If this rally in bonds is for real, traders should look to buy calls on IEF and TLT. The bond market may be getting a little boost from the Swedish scare in the euro currency market right now. Sweden is set to vote on entering the euro in less than two weeks. All the early polls show a “no” vote.

IF that happens, you could easily see the euro lose 10% to the dollar in the next month. A no vote, coupled with

John says, “Thursday’s rally in Treasuries also resulted in a bullish breakout in December 10-year note futures and in cash 30-year T-bonds. In 10-year futures this breakout targets 113 16/32 as a minimum target, as long as support near 109-25 loosely contains below the market as support (see chart above). In cash 30-year T-bonds this breakout targets 4.91% as long as the 5.27% area contains as support.”

If this rally in bonds is for real, traders should look to buy calls on IEF and TLT. The bond market may be getting a little boost from the Swedish scare in the euro currency market right now. Sweden is set to vote on entering the euro in less than two weeks. All the early polls show a “no” vote.

IF that happens, you could easily see the euro lose 10% to the dollar in the next month. A no vote, coupled with