One day a week I write an big-picture investment overview for subscribers to my monthly advisory,

Strategic Investment. Today was that day. And since I got in late from Germany, I've decided that instead of writing a sepate set of blog posts, I'll post here what I typically send in the weekly.

It won't always happen this way. But today it did. Full time blogging returns tomorrow.

Regards,

Dan

Strategic Investment

Wednesday, September 24, 2003

Paris, France

The Chocolate Countries

***Bad Dollar, Good Asia

***De Gaulle on Currency Regimes

***The Marginal Treasury Seller and the Marginal Chinese Buyer

***Gold Consolidation and Speculative Unwinding

***Heat Wave Deaths, Ownership, and Stewardship

Have just returned from an overnight trip to Bonn to hear a speech from Robert Miles. Miles is an expert on Warren Buffett. He was speaking to a group of German investors about Buffett’s investment secrets and management techniques. A few thoughts below.

And by the way, this was my first time through Germany and Belgium. I guess you could say I made a tour of the “Chocolate Countries” in a few days. Belgium I only passed through (although the vaunted high-speed rail system broke down for about two hours yesterday just outside Liege.) But Germany is a country I’m eager to go back to.

The mists on the Rhine this morning heading out of Bonn had me thinking of “The Sorrows of Young Werther” and Beethoven (who was born in Bonn) and all sorts of “romantic” associations. Odd to match that image of Germany with the image of the overweight woman in the form fitting leopard skin top who was singing in the Piano Bar at my hotel last night. She fancied old Peter Cetera tunes sung at a slow beat while her husband bashed out the melody on an 80s synthesizer. But the beer was good.

Now…on the investment world…and by the way, with our gold stocks and Asian funds we’re in great position to profit from the weakening dollar and the shift of capital flows to Asia. The daily details of the transition are important (and I’m covering those in Strategic Insider). But the more important thing is to make sure you’ve got your analysis of the big trend right and have made the right investments.

***Bad Dollar, Good Asia

A practical concern about the G-7’s weekend decision to let the dollar slide against the yen is what will happen to Japanese stocks. I’ve written a fuller analysis in the October issue of SI, which ought to hit the webstands later this week. But there are really two sides to this story, the U.S. bond market and the Japanese equity market.

The U.S. bond market got spooked at the G-7 announcement. Bonds tacked on 15 basis points Monday as investors sold off (remember bond yields move in the opposite direction of prices.) It was a double whammy for the bond market. First whammy being that Japan intervenes to support its currency by selling yen and using the proceeds (and its dollar reserves) to buy U.S. bonds. Weaken the yen, strengthen the dollar, keep exports to the U.S. cheap. That’s the Japanese strategy.

If they stop intervening to keep their currency weak relative the dollar, as the G-7 wishes, it means they will buy fewer U.S. bonds. The same would be true for the Chinese, of course, if they decided to let the yuan “float” against the dollar. They’d buy fewer U.S. bonds too. This alone would be enough to affect the U.S. bond market. Take away two of your three biggest buyers and suddenly you have to raise yields to pay for your wars.

But the second whammy for the U.S. bond market is that a weaker dollar makes all dollar-denominated assets, including Treasury bonds, less desirable. What investor wants to own bonds that don’t pay a competitive yield and are priced in a declining currency? The bond market recovered some today. But don’t count on it lasting (more below).

The other side of the dollar question is Japan and its stock market. The Nikkei sold off 4% on Monday, and for good reason. Japan exports its way to prosperity.

Letting its currency strengthen makes its goods more expensive overseas, which makes Japanese exporters less competitive, which presumably leads to lower profits for Japanese firms…which equity investors don’t like. Hence, the instant reaction.

However, over the long-term, I believe a stronger yen is not a negative for Japanese stocks. It may halt some of Japan’s positive economic momentum in the here and now. But hold on to EWJ and our other Asian funds. These will be the best way for you to profit from the structural rebalancing of the global economy.

I know. I know. I can’t just make a claim like that and not prove it. And a lot of the proof will be in your October issue of SI. But to really understand the best reason for being bullish on Japan and Asia…you have to understand Charles De Gaulle.

***De Gaulle on Currency Regimes

"There can be no other criterion, no other standard than gold. Yes, gold which never changes, which can be shaped into ingots, bars, coins, which has no nationality and which is eternally and universally accepted as the unalterable fiduciary value par excellence."

No, it wasn’t Alan Greenspan who said that. It was Charles De Gaulle. In 1968, De Gaulle knew the dollar standard was a racket that favored American consumers. He said the dollar’s status as the world’s reserve currency was an “exorbitant privilege” for the American economy.

He took the American government at its word and began redeeming his paper dollars for the gold in Fort Knox. When De Gaulle did this in 1968, it caused a mini run on U.S. gold that forced Nixon to close the gold window three years later.

De Gaulle didn’t restore the gold standard. In fact, by speeding up the end of the Breton Woods agreement, he actually helped usher in the era of fiat money backed by nothing: the dollar standard we live under today.

But he showed that it only takes a change at the margin to precipitate the demise of a currency regime. All it takes is one prominent seller to call the bluff behind the perceived economic strength that backs a paper currency. De Gaulle called the American’s bluff by forcing them to cough up gold. Nixon knew that real gold was worth a lot more than U.S. paper, so he shut the whole charade down.

Fast forward to today and the dollar standard. What’s the backbone of the dollar standard…? It’s the unshakeable faith the world’s investors have in U.S. bonds.

The Administration apparently thinks it can engineer an “orderly” devaluation of the dollar without causing foreign bondholders to sell their U.S. bonds.

Currency markets rarely do anything in an orderly fashion, though, especially at the extremes, when one currency regime ends and another begins. Just ask John Major and the Bank of England about insulating a currency from market forces.

Nearly 11 years ago to the day (September 22nd, 1992) The Bank of England tried to manage an orderly entry of the pound sterling into the European Exchange Rate Mechanism. But George Soros knew the pound was already overvalued. The market always knows. Soros figured, “Why wait?”

He sold sterling in the futures markets, creating supply. Creating new supply has the effect of bringing prices down. The Bank of England countered by raising interest rates to support the currency. A higher yield, it figured, would create demand, offsetting the extra supply Soros was brining on line.

Remember, this Bank knew the pound was too strong. But this was to be an orderly decline. Radical adjustments are disruptive. Investors lose confidence if a currency loses too much value too fast. They start selling other assets denominated in that currency. Currency sell offs lead to stock market sell offs. Stock market sell offs lead to lost elections.

Soros kept selling pounds though, and by the end of the day, the Bank of England was forced to renege on the rate increase. The Bank was caught in the awkward position of admitting through its public actions that the currency it managed was not worth as much as it had said. And it couldn’t afford to support it any longer. But it was forced to abandon its position because Soros put money behind the opposite position, that the pound was overvalued and MUST correct. Soros made a billion dollars in one day.

***The Marginal Treasury Seller and the Marginal Chinese Buyer

Who will be the first to sell the dollar? Who will panic first so as to avoid the rush later?

At a certain point, foreign bondholders will not tolerate owning the debt of chronic spender who pays little interest and whose currency is declining in value. Then the selling will begin. It will only take one seller at the margin to initiate the move.

The only counter argument I’ve heard against the end of the dollar standard is that global bond investors simply don’t have an alternative to U.S. bonds. Everyone is tied to the dollar’s fate. Too many people have too much to lose from a falling dollar and a sell off in Treasuries.

The dollar is too big to fail.

But this is exactly the state of affairs when a currency regime ends: things reach a paradoxical state of paralysis. No one can afford to start selling dollars because everyone owns them. But the dollar cannot retain value and be worth owning when the U.S. keeps printing more AND running deficits. No one can afford the end of the dollar standard. And no one can afford the continuation of the dollar standard.

The whole dollar standard rests on an unsustainable economic imbalance…that of U.S. consumption and foreign production teaming up to make the world rich and prosperous. The correction of the imbalance in the U.S. is obvious, reduced consumption and liquidation of debt. But it’s the correction of the foreign imbalance that shows us what replaces the dollar standard.

The Asian growth model depends on U.S. consumption. Without it, to whom will Asia export? That question is now being answered. Itself. If American’s can’t sustain the pace of consumption, then Asia will have to consume more itself.

This is starting to happen anyway, simply by virtue of rising incomes in China and rising standards of living. Perhaps it’s human nature that after reaching a certain level of material comfort, people tend to hoard less and want more. But it’s conceivable that at some point Asian owners of U.S dollar currency reserves and U.S. treasury bonds will decide to take their losses and begin investing in each other and their own consumption growth.

The dollar will be shed because U.S. consumption will no longer be the engine of Asian growth.

Of course there will still be disruptions in Asia. The Chinese have massive debt. But 19th century America had its own share of financial crises, too (the years 1837 to 1842 saw the REAL first Great Depression, as you’ll see in my lead article for October). Yet the whole time America was becoming the world’s largest producer AND consumer of raw materials and the world’s largest producer and consumer of finished goods.

The Chinese economy is so large that an increase in consumption in the margin will be enough to shift the structural balance in Asia and render the dollar a lot less important to Asian growth. There’s a lot more to the story…but you’ll have to wait for the October issue of SI, especially the excellent piece by Marc Faber. Meanwhile, stay long Asia.

***Gold Consolidation and Speculative Unwinding

Large speculative gold futures traders have scaled back some of their massively long position, even while commercials have maintained a large short position. Yet gold keeps rising. I think there is a near-term possibility for some gold selling. I’ve made some recommendations in the October issue on how to hedge this.

But don’t be confused about my long-term opinion of gold stocks.

Even if dollar-denominated assets (U.S. stocks) get sold off, gold stocks should do well. Yes, many of them report their earnings in dollars. But gold stocks are an equity investors’ quickest lifeboat in a sinking market. And if bullion prices rise as high as I think they could, gold stocks should hold up fine. Hold them. And buy even more on weakness.

Another good sign is that the gold industry may be seeing the first signs of consolidation. AngloGold and Randgold are in a bidding war for Ashanti. When the gold majors start scarfing up the junior miners, the bull market in gold has entered a whole new phase.

***Heat Wave Deaths, Ownership, and Stewardship

Something had been bothering me about Jacques Chirac’s statement that all of France was to blame for the summer heat wave deaths. And last night at Robert Miles’ Buffett lecture I figured it out what it was.

Miles said that Warren Buffett’s single greatest nightmare is not a derivatives meltdown or the mass resignation of all his CEOs or crash in the dollar. It’s attracting the wrong kind of shareholder.

Buffett wants owners for his company, not traders. He’s looking for partners who commit capital for the long haul. I don’t have my numbers in front of me but Miles said, I believe, that the average Berkshire shareholder holds his stock for 12 years. I’ll check tomorrow. But compare that the average holding period for a Nasdaq stock: 6 months. Or a Dow stock: 12 months.

There’s a cost to having a revolving door at your shareholder meetings. It means you must constantly explain your business and justify your management decisions to new shareholders instead of explaining your strategy for next year to your existing shareholders.

Buffett would rather his shareholders consider themselves owners. Which got me to thinking about the idea of ownership itself.

Ownership, as the saying goes, leads to stewardship. The inverse of this saying is known as the tragedy of the commons.

The tragedy of the commons illustrates the principle that public ownership of a resource leads to the destruction or inefficient use of the resource. Use a public grazing area as an example. Under “common” or public ownership, each individual sheep herder is actually incentivized to get as many of his sheep on the range as he can, even if means eating up all the grass. If he doesn’t do it, someone else will.

There’s no penalty of wasting the resource and no incentive for preserving it.

Since no one person “owns” the commons, each individual is perversely encouraged to get as much as he can as quickly as he can. No cost. And the longer you wait to gorge, the less you’ll get when you decide to quit being conscientious.

Now…what does this have to do with Chirac you ask? Chirac and the French establishment used the line that “we are all responsible” for the neglect of the elderly, after it was revealed that over 10,000 French men and women died from the summer heat wave.

In other words, the 10,000 deaths are not any one particular person’s fault…”we are all to blame” Chirac was saying. But isn’t this just the tragedgy of the commons in a sociological (or socialist) context?

If moral obligations to look after your family or neighbors are “socialized” through government programs, it’s the failure of the institutions and not the sons and daughters of the dead, right? And in France, much of the public outrage was directed at the government.

“Why didn’t the government do more?” “Why did the health services fail?” “What is the government’s solution?”

No one bothers to hold himself or herself personally accountable. If you’re only obligated to someone “socially,” that is through taxes which you pay to the State, which then is kind and charitable on your behalf, I’d say you’re not really obligated at all. You’ve abdicated your real abdication to others by contracting it out to a third party.

You saw some of that in Sweden too, where no one stopped the killer of the Foreign Minister as he walked out of the department store (or even as he committed the crime and took a life in front of passersby.) The press report, which may not be indicative of the overall mood, instead lamented the lack of police presence and pointed out how it would now be necessary for public officials to have more bodyguards.

Someone should have done something. Someone

else.

Does socialism encourage people to disown their moral or ethical obligations to one another? Looks like it to me. By making the State the middleman in our relationships with one another, we get the convenient benefit of not having to actually feed the hungry, care for the sick or give alms to the poor and look them in the eye…yet we get all the pleasure of devoting a portion of our income to a government that does these things in our name. Freedom and self-satisfaction without the obligation of moral responsibility.

Pretty enlightened.

Best Regards,

Dan Denning

P.S. It might not even take a bond sell off to see a crash in the bond market. It might just be the falling dollar taking down U.S. assets with it. In that case, bond investors could hold on their Treasuries and hope that they’d at least get some kind of return on them later. But a default is also possible. In fact, it’s what usually happens when a government can’t pay the interest on a sea of a bad debt.

Just this week Argentina stuck it to bondholders…again. Argentina is trying to restructure $95 billion in defaulted bonds. The FT reports that the “government proposed a 75% reduction in the face value of the bonds and declined to pay the interest accrued since the 2001 default. In exchange, it offered investors a new choice of three bonds to replace the 152 non-performing securities.”

Naturally, bondholders were…not pleased. They claim the Argentines are trying to rewrite the rules. And of course that’s true. That’s what governments always do when they can’t afford to keep the promises they’ve made…they change the rules…devalue the currency, default on the bonds.

Just because the U.S. bond market is bigger and integral to the dollar centric world doesn’t mean it won’t suffer the same fate. Ten years from now, it will be the Japanese and Chinese grousing about new U.S. proposals to restructure the defaulted bonds. Perhaps we’ll appeal to the IMF for a loan. Or perhaps it will finally be America’s turn to ask the world to forgive our debts as we’ve forgiven theirs.

Copyright 2003 Agora Publishing

The Strategic Investment Weekly Update You may not forward,

reprint or post any of the material you read here as it

contains information exclusively provided for the benefit

of subscribers to Strategic Investment . However, brief

passages and quotes may be used within the body of other

articles and reviews, with proper attribution.

Next is the bond bubble. Investors figured if stocks weren’t going to go up 40% each year, it was time to get in bonds. And in they went. But when the Fed said this summer that it was more afraid of deflation than inflation, and would keep rates low for a “considerable” time, the bond market cratered.

Then it was bonds...

Next is the bond bubble. Investors figured if stocks weren’t going to go up 40% each year, it was time to get in bonds. And in they went. But when the Fed said this summer that it was more afraid of deflation than inflation, and would keep rates low for a “considerable” time, the bond market cratered.

Then it was bonds...

And now, we have one last sector of the market that is supported by lower rates, housing. The chart below shows the iShares Dow Jones U.S. Real Estate Index Fund. It’s designed to mimic the performance of the Dow Jones Real Estate Index. The fund holds a basket of real estate investment trusts. It’s been a big beneficiary of the confidence investors having in rising real estate values and a strong housing market.

And now it's real estate and housing...

And now, we have one last sector of the market that is supported by lower rates, housing. The chart below shows the iShares Dow Jones U.S. Real Estate Index Fund. It’s designed to mimic the performance of the Dow Jones Real Estate Index. The fund holds a basket of real estate investment trusts. It’s been a big beneficiary of the confidence investors having in rising real estate values and a strong housing market.

And now it's real estate and housing...

Of course there are other sectors of the market that have benefited from the low-rate environment. Financial and bank stocks have used the low rates to borrow and invest heavily in the stock market, especially in derivatives. There are a lot of “stealth financial” stocks that derive a good chunk of their earnings from operations completely unrelated to the part of their business in which they have a durable competitive advantage.

But for the better part of the last 10 years, it has paid to turn your company into a quasi-hedge fund. Take on debt. Take on leverage. When your cost of servicing it is low, and the market returns are high, it’s a good trade.

Not anymore. And that’s why the new trade of the decade is to sell the dollar…and buy gold. When financial economies collapse….

They look a lot like this…

Of course there are other sectors of the market that have benefited from the low-rate environment. Financial and bank stocks have used the low rates to borrow and invest heavily in the stock market, especially in derivatives. There are a lot of “stealth financial” stocks that derive a good chunk of their earnings from operations completely unrelated to the part of their business in which they have a durable competitive advantage.

But for the better part of the last 10 years, it has paid to turn your company into a quasi-hedge fund. Take on debt. Take on leverage. When your cost of servicing it is low, and the market returns are high, it’s a good trade.

Not anymore. And that’s why the new trade of the decade is to sell the dollar…and buy gold. When financial economies collapse….

They look a lot like this…

You can see that even in Japan, there were two or three false rallies in the middle of a brutal bear market. And it's true, even in a secular bear market, you get powerfull rallies. You can profit from those as a trader. But don't mistake them for new bull markets. In other words, when you see a chart like the one below, remind yourself to look the one at above.

Following in Japan's Footsteps

You can see that even in Japan, there were two or three false rallies in the middle of a brutal bear market. And it's true, even in a secular bear market, you get powerfull rallies. You can profit from those as a trader. But don't mistake them for new bull markets. In other words, when you see a chart like the one below, remind yourself to look the one at above.

Following in Japan's Footsteps

To find the new bull markets, you have to recognize the big shifts when they're happening. And right now, we're shifting away from the dollar and into a brave new world of gold and Asia.

Go east.

Get gold.

To find the new bull markets, you have to recognize the big shifts when they're happening. And right now, we're shifting away from the dollar and into a brave new world of gold and Asia.

Go east.

Get gold.

I remember reading many times in the past year that the BOJ

would not allow the yen to drop below 115 per dollar, and

now it's at 112. There's a lot of pressure from the G7 to

float the paper, but Japan can be a stubborn SOB when it

comes to keeping exports competitive. What else does the

island have?

Regardless of your or my position on the long

term sustainability of the Japanese economy in a weaker dollar

climate, the BOJ doesn't seem to see it that way. I, for one,

am betting that the dollar will continue its bearish trajectory.

Betting for real, as in hoarding yen for a big transfer back to a

U.S. bank account when the rate drops below 100. How long

will I have to wait? I thought a long time, but that short-term

chart is pointing hard in the down direction.

With the dollar weakening, gold is shining brighter. I agree with

you on that score as well. Time to get into a gold fund.

I second your general assessment that Asian growth makes

for a good investment. I deduce that you've suggested EWJ,

among others. That's prudent. Since May, it's up from about

$6.50 to roughly $9, if memory serves. That was after a long

sideways action around $7 that finally broke out.

Before I sign off, it's a coincidence that I spoke a few days ago

with Herr Neering, our man in Germany. [also an old high

school friend who was in the Army in Germany, married a German

woman, and has settled down there.]

He was a staunch supporter of Bush before and during the Iraq war.

His neighbors attacked him with all the textbook anti-American arguments

and Jim responded with the textbook pro-American rebuttals.

Now that there seem to be no WMD, and we still haven't

found Bin Laden, and the USA is sinking into an ocean of debt,

Herr Neering feels taken. He's angry and looking for a new

president. The capper was when Bush showed up to the U.N.

hat in hand to ask for help cleaning up the mess he created

without U.N. approval.

I couldn't help agreeing with Jim. Things become all the more

difficult to stomach in this part of the world when considering

the N. Korea situation. Let's see, no weapons equals all-out

war in Iraq. Known weapons equals months of talking in

N. Korea. Did you know that the situation is so tense that

Japan -- the most anti-nuclear country on Earth because of

Hiroshima and Nagasaki -- is considering arming itself with

nuclear missiles? Many people don't know that. It's not a

go yet because there is tremendous resistance, but a lot of

people have noted that the U.S. is preoccupied with the

Middle East and that minutes lost waiting for help as Pyongyang

targets Tokyo could mean the end of Tokyo. Time needed to go from

zero nukes to a formidable arsenal? One month. Japan is only

toothless because of its treaties with the U.S. and its own

anti-militarism.

Sayonara,

Jason

I remember reading many times in the past year that the BOJ

would not allow the yen to drop below 115 per dollar, and

now it's at 112. There's a lot of pressure from the G7 to

float the paper, but Japan can be a stubborn SOB when it

comes to keeping exports competitive. What else does the

island have?

Regardless of your or my position on the long

term sustainability of the Japanese economy in a weaker dollar

climate, the BOJ doesn't seem to see it that way. I, for one,

am betting that the dollar will continue its bearish trajectory.

Betting for real, as in hoarding yen for a big transfer back to a

U.S. bank account when the rate drops below 100. How long

will I have to wait? I thought a long time, but that short-term

chart is pointing hard in the down direction.

With the dollar weakening, gold is shining brighter. I agree with

you on that score as well. Time to get into a gold fund.

I second your general assessment that Asian growth makes

for a good investment. I deduce that you've suggested EWJ,

among others. That's prudent. Since May, it's up from about

$6.50 to roughly $9, if memory serves. That was after a long

sideways action around $7 that finally broke out.

Before I sign off, it's a coincidence that I spoke a few days ago

with Herr Neering, our man in Germany. [also an old high

school friend who was in the Army in Germany, married a German

woman, and has settled down there.]

He was a staunch supporter of Bush before and during the Iraq war.

His neighbors attacked him with all the textbook anti-American arguments

and Jim responded with the textbook pro-American rebuttals.

Now that there seem to be no WMD, and we still haven't

found Bin Laden, and the USA is sinking into an ocean of debt,

Herr Neering feels taken. He's angry and looking for a new

president. The capper was when Bush showed up to the U.N.

hat in hand to ask for help cleaning up the mess he created

without U.N. approval.

I couldn't help agreeing with Jim. Things become all the more

difficult to stomach in this part of the world when considering

the N. Korea situation. Let's see, no weapons equals all-out

war in Iraq. Known weapons equals months of talking in

N. Korea. Did you know that the situation is so tense that

Japan -- the most anti-nuclear country on Earth because of

Hiroshima and Nagasaki -- is considering arming itself with

nuclear missiles? Many people don't know that. It's not a

go yet because there is tremendous resistance, but a lot of

people have noted that the U.S. is preoccupied with the

Middle East and that minutes lost waiting for help as Pyongyang

targets Tokyo could mean the end of Tokyo. Time needed to go from

zero nukes to a formidable arsenal? One month. Japan is only

toothless because of its treaties with the U.S. and its own

anti-militarism.

Sayonara,

Jason

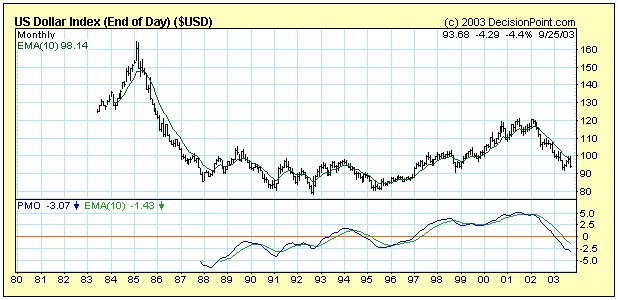

The Plaza Accord did succeed in bringing the dollar down. However, it’s worth pointing out that it did NOT succeed in readjusting the main imbalance of the U.S. economy. In fact, that imbalance is still with us today….too much global reliance on U.S. consumption. And so now, the G7 meets last week to again ask for an orderly decline in the dollar as the Plaza Accords stated, to “better reflect fundamental economic conditions.”

How far the dollar index declines this time depends on just how bad “fundamental economic conditions in the U.S. are.” I believe they’re much worse than they were in 1985. And so the dollar index could plunge to new historic lows. Buying options on dollar index futures would be one way to profit.

The only caveat is that a big influence on the value of the dollar right now is not measured by the dollar index, namely the Chinese currency. Since the Chinese do not allow the yuan to trade freely, its essentially acting as a giant sword of Damocles in currency markets. The day the yuan floats is the day dollar depreciation goes into fifth gear.

It’s also the day that the Chinese bad loan problems explode into a Chinese banking crisis. And I don’t believe the Chinese are ready to try and deal with bad loans in a strengthening currency. The worst scenario for a debtor is to have to pay off loans in a currency that’s gaining in purchasing power. You borrowed in a weak currency but must pay off in strong one. Not a good scenario. But even without the de-pegging of the yuan…the dollar index will be under heavy pressure.

A Falling Dollar Means Rising Interest Rates, Right?

The second and third ways to profit from a falling dollar depend on a proxy relationship. That is, other than the forex markets, there is no one to one way for you to directly invest in a falling dollar. There are other relationships, though, that are what I call dollar proxies. Specifically, there are interest rates and bond prices.

When a currency falls, in theory anyway, interest rates usually rise. A government whose currency is falling apart tries to make it more attractive by raising the yield it pays on government debt. It attempts to make assets denominated in that currency more attractive by making them pay more to potential investors. And if the government doesn’t raise rates, the market will do it by selling off bonds and driving yields up.

And so, in theory, you would normally expect to see a falling U.S. dollar accompanied by rising U.S. interest rates. That’s the theory anyway. The fact is, the Fed and the Bush administration are doing everything they can to engineer a weaker dollar WITHOUT causing a rise in long-term rates.

The problem, from the Bush/Greenspan perspective is that rising long-term rates pose two enormous problems. First, rising long-term rates make it more expensive to service existing outstanding U.S. debt. The federal government has paid out $161 billion in interest this year on the spectrum of debt (3,7,10, 30-year) issued by the Treasury.

However, according to the White House’s own report on the 2004 budget, just a one percent rise in interest rates would nearly double that figure by 2008. The White House projects that a 1% rise in interest rates would add $8.7 billion in interest expense for the rest of calendar year 2003, $21 billion in 2004, $30.5 billion in 2005, $36.4 billion in 2006, $41.8 billion in 2007, and $47.2 billion in 2008…for a grand total of $154.9 billion in the next 5 years. And to meet this added interest expense, the government would, of course, have to float even more bonds…also at the higher interest rate.

Sounds like a nightmare doesn’t it? Having to issue more debt at higher interest rates to pay off your existing debt, all because your currency is falling and rates are rising. In fact, it’s not just the Federal government that’s vulnerable to rising rates. It’s the whole low-rate leveraged U.S. economy, mostly because of the huge debt over-hang I’ve been haranguing about ad nauseam.

Let me give Bill Gross of PIMCO a turn at the podium, “Up to now, with yields declining and home mortgages, car loans, and all sorts of debt being discounted to near 0% yields, the debt levels have not mattered….If you don’t pay any interest on it [the debt], there’s no limit to the amount businesses and consumers can borrow and spend. My point exactly: if and when rates do go up, we will all care--the leverage will work in reverse, the economy will founder.”

The group that cares the most right now is the Bush administration and the Fed. Rising rates will be bad for businesses and consumers who have too much debt. But they will be disastrous for the Federal government and its currency, the dollar.

How can the Fed and Bush talk down the dollar but prevent long-term rates from rising? Well…they can do what they Japanese did and buy tons and tons and more tons of U.S. bonds. But my guess is that no amount of intervention by the Fed--even unorthodox and unconventional means--can prevent long-term rates from rising.

The U.S. government is a credit risk. Its bonds are no longer a safe haven. The yield must rise. Bondholders must get paid for the risk of owning the assets of a country whose currency is weaker.

Which brings us back to profiting from dollar. If bond yields must go up, bond prices will go down (bond prices and yields move in opposite directions.) This leaves you with two specific ways to profit. First by betting on rising yields. Second by betting on falling prices.

The falling prices scenario is easy to invest in and I’ve already recommended several ways to do it. Below is a chart of the 30-year Lehman bond fund (TLT), as well as the 10-year fund (IEF). If yields rise, bond prices will fall. And as these two investments reflect bond prices, they’ll fall, just as they did this summer when yields rose.

The solution for falling bond prices? Buy puts on TLT and IEF.

The Plaza Accord did succeed in bringing the dollar down. However, it’s worth pointing out that it did NOT succeed in readjusting the main imbalance of the U.S. economy. In fact, that imbalance is still with us today….too much global reliance on U.S. consumption. And so now, the G7 meets last week to again ask for an orderly decline in the dollar as the Plaza Accords stated, to “better reflect fundamental economic conditions.”

How far the dollar index declines this time depends on just how bad “fundamental economic conditions in the U.S. are.” I believe they’re much worse than they were in 1985. And so the dollar index could plunge to new historic lows. Buying options on dollar index futures would be one way to profit.

The only caveat is that a big influence on the value of the dollar right now is not measured by the dollar index, namely the Chinese currency. Since the Chinese do not allow the yuan to trade freely, its essentially acting as a giant sword of Damocles in currency markets. The day the yuan floats is the day dollar depreciation goes into fifth gear.

It’s also the day that the Chinese bad loan problems explode into a Chinese banking crisis. And I don’t believe the Chinese are ready to try and deal with bad loans in a strengthening currency. The worst scenario for a debtor is to have to pay off loans in a currency that’s gaining in purchasing power. You borrowed in a weak currency but must pay off in strong one. Not a good scenario. But even without the de-pegging of the yuan…the dollar index will be under heavy pressure.

A Falling Dollar Means Rising Interest Rates, Right?

The second and third ways to profit from a falling dollar depend on a proxy relationship. That is, other than the forex markets, there is no one to one way for you to directly invest in a falling dollar. There are other relationships, though, that are what I call dollar proxies. Specifically, there are interest rates and bond prices.

When a currency falls, in theory anyway, interest rates usually rise. A government whose currency is falling apart tries to make it more attractive by raising the yield it pays on government debt. It attempts to make assets denominated in that currency more attractive by making them pay more to potential investors. And if the government doesn’t raise rates, the market will do it by selling off bonds and driving yields up.

And so, in theory, you would normally expect to see a falling U.S. dollar accompanied by rising U.S. interest rates. That’s the theory anyway. The fact is, the Fed and the Bush administration are doing everything they can to engineer a weaker dollar WITHOUT causing a rise in long-term rates.

The problem, from the Bush/Greenspan perspective is that rising long-term rates pose two enormous problems. First, rising long-term rates make it more expensive to service existing outstanding U.S. debt. The federal government has paid out $161 billion in interest this year on the spectrum of debt (3,7,10, 30-year) issued by the Treasury.

However, according to the White House’s own report on the 2004 budget, just a one percent rise in interest rates would nearly double that figure by 2008. The White House projects that a 1% rise in interest rates would add $8.7 billion in interest expense for the rest of calendar year 2003, $21 billion in 2004, $30.5 billion in 2005, $36.4 billion in 2006, $41.8 billion in 2007, and $47.2 billion in 2008…for a grand total of $154.9 billion in the next 5 years. And to meet this added interest expense, the government would, of course, have to float even more bonds…also at the higher interest rate.

Sounds like a nightmare doesn’t it? Having to issue more debt at higher interest rates to pay off your existing debt, all because your currency is falling and rates are rising. In fact, it’s not just the Federal government that’s vulnerable to rising rates. It’s the whole low-rate leveraged U.S. economy, mostly because of the huge debt over-hang I’ve been haranguing about ad nauseam.

Let me give Bill Gross of PIMCO a turn at the podium, “Up to now, with yields declining and home mortgages, car loans, and all sorts of debt being discounted to near 0% yields, the debt levels have not mattered….If you don’t pay any interest on it [the debt], there’s no limit to the amount businesses and consumers can borrow and spend. My point exactly: if and when rates do go up, we will all care--the leverage will work in reverse, the economy will founder.”

The group that cares the most right now is the Bush administration and the Fed. Rising rates will be bad for businesses and consumers who have too much debt. But they will be disastrous for the Federal government and its currency, the dollar.

How can the Fed and Bush talk down the dollar but prevent long-term rates from rising? Well…they can do what they Japanese did and buy tons and tons and more tons of U.S. bonds. But my guess is that no amount of intervention by the Fed--even unorthodox and unconventional means--can prevent long-term rates from rising.

The U.S. government is a credit risk. Its bonds are no longer a safe haven. The yield must rise. Bondholders must get paid for the risk of owning the assets of a country whose currency is weaker.

Which brings us back to profiting from dollar. If bond yields must go up, bond prices will go down (bond prices and yields move in opposite directions.) This leaves you with two specific ways to profit. First by betting on rising yields. Second by betting on falling prices.

The falling prices scenario is easy to invest in and I’ve already recommended several ways to do it. Below is a chart of the 30-year Lehman bond fund (TLT), as well as the 10-year fund (IEF). If yields rise, bond prices will fall. And as these two investments reflect bond prices, they’ll fall, just as they did this summer when yields rose.

The solution for falling bond prices? Buy puts on TLT and IEF.

But what about rising yields? You can also buy a CBOE listed interest rate option on the 10-year bond. The ticker symbol is TNX. TNX moves up when yields go up, in other words its performance is positively correlated to rising yields (while IEF and TLT are positively correlated to rising bond prices).

So, if you bought the theory that interest rates must rise, and therefore bond yields, you’d be a call buyer on TNX. A yield-based call option buyer profits if as, CBOE’s site explains, “the underlying interest rate rises above the strike price plus the premium paid for the call.”

To Bet on Rising Rates, Buy TNX Calls

But what about rising yields? You can also buy a CBOE listed interest rate option on the 10-year bond. The ticker symbol is TNX. TNX moves up when yields go up, in other words its performance is positively correlated to rising yields (while IEF and TLT are positively correlated to rising bond prices).

So, if you bought the theory that interest rates must rise, and therefore bond yields, you’d be a call buyer on TNX. A yield-based call option buyer profits if as, CBOE’s site explains, “the underlying interest rate rises above the strike price plus the premium paid for the call.”

To Bet on Rising Rates, Buy TNX Calls

The price on TNX is calculated by multiplying the price of the most recently auctioned bond by 10. The index currently trades at 41.02, implying a yield of 4.10 on the most recently auctioned 10-year note.

Yesterday’s ten-year notes closed at a yield of 4.09%. Multiply that times ten and you get 40.90, implying that TNX trades a slight premium to the actual ten year note, which is perhaps why TNX fell eight tenths of one percent yesterday.

Still, as an options trader, this would be a fairly straightforward proposition. If you’re betting that a falling dollar leads to rising rates, you’d buy calls on TNX. For example if rates rise by 1%, TNX would trade over 50, or almost 25% above its current price. Leverage that with an in-the-money-call, and voila. you’ve got a simple way to benefit from a rising rates and a falling dollar.

As you can see, the easiest way to hedge against a falling dollar is to buy gold. But if you want to get more exotic, buy put options on dollar index futures. If you’re interested in doing that, call the folks at Fox Investments. They can execute the trades for you. From overseas, call 312-528-3000. From the U.S. call 1-800-621-0265.

Beyond that, for falling bond prices, buy put options on TLT and IEF. And for rising yields, calls on TNX. It’s a trade I’ll be making in

The price on TNX is calculated by multiplying the price of the most recently auctioned bond by 10. The index currently trades at 41.02, implying a yield of 4.10 on the most recently auctioned 10-year note.

Yesterday’s ten-year notes closed at a yield of 4.09%. Multiply that times ten and you get 40.90, implying that TNX trades a slight premium to the actual ten year note, which is perhaps why TNX fell eight tenths of one percent yesterday.

Still, as an options trader, this would be a fairly straightforward proposition. If you’re betting that a falling dollar leads to rising rates, you’d buy calls on TNX. For example if rates rise by 1%, TNX would trade over 50, or almost 25% above its current price. Leverage that with an in-the-money-call, and voila. you’ve got a simple way to benefit from a rising rates and a falling dollar.

As you can see, the easiest way to hedge against a falling dollar is to buy gold. But if you want to get more exotic, buy put options on dollar index futures. If you’re interested in doing that, call the folks at Fox Investments. They can execute the trades for you. From overseas, call 312-528-3000. From the U.S. call 1-800-621-0265.

Beyond that, for falling bond prices, buy put options on TLT and IEF. And for rising yields, calls on TNX. It’s a trade I’ll be making in

On September 3rd, I made the following comment in my weekly e-mail to Strategic Investment subscribers:

"from an investment perspective, the large-cap defense stocks have the most to lose from this development. Big dollar Pentagon contracts are the bread and butter of the big 5 defense contractors. Without them, look out below.

"AMEX lists a defense index (DFI) that includes all the big names in the industry (Raytheon, Boeing, Lockheed Martin, Northrop, and General Dynamics). DFI is making new 52-week highs on a daily basis in the last week. And it's not far below the high it made in its post 9-11 run up.

"I'd look closely at put options. But I would not buy front month contracts. Technically, the index is in the kind of rally you don't want to get in the way of in the short term. But it might make a nice hedge if you have a bullish position in any of the defense stocks I've recommended."

My mistake? Not buying the puts. Granted, DFI puts aren't exactly liquid. So it's not a whopper of a mistake. I'm eager for the day when indexes like DFI reach a critical mass of investor interest. By then, we'll have accumulated a precise repertoire of trades to benefit from moves like the one below.

And speaking of that move...DFI went up almost 200 points from it's March launching pad to its recent high. If it gives up half that, it could decline, rather quickly, to about 514.50.

That's an interesting level. A year ago the index stopped for a breather at around 514 before heading down to its March level of 415. And it paused for breath there in May on its way up to a new high. It could be a natural place for it to test the strength of this bull run.

On September 3rd, I made the following comment in my weekly e-mail to Strategic Investment subscribers:

"from an investment perspective, the large-cap defense stocks have the most to lose from this development. Big dollar Pentagon contracts are the bread and butter of the big 5 defense contractors. Without them, look out below.

"AMEX lists a defense index (DFI) that includes all the big names in the industry (Raytheon, Boeing, Lockheed Martin, Northrop, and General Dynamics). DFI is making new 52-week highs on a daily basis in the last week. And it's not far below the high it made in its post 9-11 run up.

"I'd look closely at put options. But I would not buy front month contracts. Technically, the index is in the kind of rally you don't want to get in the way of in the short term. But it might make a nice hedge if you have a bullish position in any of the defense stocks I've recommended."

My mistake? Not buying the puts. Granted, DFI puts aren't exactly liquid. So it's not a whopper of a mistake. I'm eager for the day when indexes like DFI reach a critical mass of investor interest. By then, we'll have accumulated a precise repertoire of trades to benefit from moves like the one below.

And speaking of that move...DFI went up almost 200 points from it's March launching pad to its recent high. If it gives up half that, it could decline, rather quickly, to about 514.50.

That's an interesting level. A year ago the index stopped for a breather at around 514 before heading down to its March level of 415. And it paused for breath there in May on its way up to a new high. It could be a natural place for it to test the strength of this bull run.

Let me summarize: Wall Street now makes it possible for your to cheaply take a short position on the largest train wreck in modern financial history. You can be short the entire financial economy (financial economy vs. real economy) in just one single investment. Talk about a risk to return ratio!! You get to finally be a counter party to all those horrible derivative risks…but you can do it over the counter for less than $500.

Seriously, no word yet on if or when you’ll be able to trade options on the new PGI. For the record, the name of the index is the Lehman Aggregate Index (AGG). Nearly 70% of the funds holdings are rated triple A or better.

The real interesting breakdown is by sector.

·U.S. Government: 34.04%

U.S. Treasury- 21.87%

U.S. Agency- 12.16%

·U.S. Credit

Corporate- 23.23%

Non-corporate- 4.23%

·Securitized: 38.50%

CMBS- 2.51%

ABS- 1.81%

MBS Fixed Rate- 34.17%

Although I’m not a bond expert, I’m assuming the advantage of owning a fixed rate Mortgage Backed Security is that at a fixed rate, the mortgage borrower (whose payment passes through a bank to you) is less likely to refinance and pay off all at once. In other words, the fixed-rate mortgage back is less “callable” than other mortgage bonds, and thus, less likely to be repaid in full if interest rates change.

That said, that’s a whopping amount of risk in the housing market. I’ll try and get a closer peak and the bonds holding sin the next few days. But at first blush, this fund has a big fat bulls eye on it in a rising rate environment.

Speaking of which…the Fed is going to have its hands full keeping rates from rising with the new “not-as-strong-dollar” policy. You can see that Lehman’s 30-year bond PGI (TLT), hasn’t fared too well as investors dump bonds and push rates up.

This from the boys at briefing.com,

“The direct, near-term implication for the Treasury market is that the Bank of Japan and other - primarily Asian - central banks will not be motivated to purchase and hold Treasury securities as a means of preventing their respective home currencies from appreciating in value too far, too fast vis-à-vis the dollar. To add insult to injury, Fed Governor Bernanke said this morning that he sees a "definite pick-up in growth" and that this looks to be a "very strong quarter". Although this morning's initial downtick had come amid relatively light volume, we're hearing that selling activity accelerated a bit following Bernanke's comments.”

Intraday Bond-Whipping for the 10-Year

Let me summarize: Wall Street now makes it possible for your to cheaply take a short position on the largest train wreck in modern financial history. You can be short the entire financial economy (financial economy vs. real economy) in just one single investment. Talk about a risk to return ratio!! You get to finally be a counter party to all those horrible derivative risks…but you can do it over the counter for less than $500.

Seriously, no word yet on if or when you’ll be able to trade options on the new PGI. For the record, the name of the index is the Lehman Aggregate Index (AGG). Nearly 70% of the funds holdings are rated triple A or better.

The real interesting breakdown is by sector.

·U.S. Government: 34.04%

U.S. Treasury- 21.87%

U.S. Agency- 12.16%

·U.S. Credit

Corporate- 23.23%

Non-corporate- 4.23%

·Securitized: 38.50%

CMBS- 2.51%

ABS- 1.81%

MBS Fixed Rate- 34.17%

Although I’m not a bond expert, I’m assuming the advantage of owning a fixed rate Mortgage Backed Security is that at a fixed rate, the mortgage borrower (whose payment passes through a bank to you) is less likely to refinance and pay off all at once. In other words, the fixed-rate mortgage back is less “callable” than other mortgage bonds, and thus, less likely to be repaid in full if interest rates change.

That said, that’s a whopping amount of risk in the housing market. I’ll try and get a closer peak and the bonds holding sin the next few days. But at first blush, this fund has a big fat bulls eye on it in a rising rate environment.

Speaking of which…the Fed is going to have its hands full keeping rates from rising with the new “not-as-strong-dollar” policy. You can see that Lehman’s 30-year bond PGI (TLT), hasn’t fared too well as investors dump bonds and push rates up.

This from the boys at briefing.com,

“The direct, near-term implication for the Treasury market is that the Bank of Japan and other - primarily Asian - central banks will not be motivated to purchase and hold Treasury securities as a means of preventing their respective home currencies from appreciating in value too far, too fast vis-à-vis the dollar. To add insult to injury, Fed Governor Bernanke said this morning that he sees a "definite pick-up in growth" and that this looks to be a "very strong quarter". Although this morning's initial downtick had come amid relatively light volume, we're hearing that selling activity accelerated a bit following Bernanke's comments.”

Intraday Bond-Whipping for the 10-Year

And this from my macro trader oracle, Greg Weldon: “Officialdom is losing control. Integrity is being questioned. Assets held in USD are being liquidated. A re-balancing may ultimately take place, regardless of the direction and stance taken by central banks, and it will not be pretty, from the global economic perspective, during the interim period of time. Indeed, be careful what you ask for … YOU JUST MIGHT ‘GET IT’.”

Of Other Risk

Of course it’s not just the U.S. Treasury on the line. It’s bonds that enjoy the implied guarantee of the Federal government as well, including Fannie Mae and Freddie Mac, whose outstanding debt exceeds that of the U.S. government.

Could Fannie Mae and Freddie Mac contribute to the take-down of the dollar? Or would they be among its victims? I’ll be exploring that later. But for now, enjoy these passages I gleaned from the White House’s own report on the 2004 budget called Analytical Perspectives. It includes this bit on the GSEs.

"The Federal Government also enhances credit availability for targeted sectors indirectly through Government-Sponsored Enterprises (GSEs)—privately owned companies and cooperatives that operate under Federal charters. GSEs provide direct loans and increase liquidity by guaranteeing and securitizing loans. Some GSEs have become major players in the financial market. In 2002, the face value of GSE lending totaled $3.6 trillion. In return for serving social purposes, GSEs enjoy many privileges, which differ across GSEs.

EMPHASIS ADDED HERE IS MINE:

"In general, GSEs can borrow from Treasury in amounts ranging up to $4 billion at Treasury’s discretion, GSEs’ corporate earnings are exempt from state and local income taxation, GSE securities are exempt from SEC registration, and banks and thrifts are allowed to hold GSE securities in unlimited amounts and use them to collateralize public deposits. These privileges leave many people with the impression that their securities are risk-free. GSEs, however, are not part of the Federal Government, and their securities are not federally guaranteed. By law, the GSEs’ securities carry a disclaimer of any U.S. obligation."

So, it appears that the U.S. government has no obligation to bail out Fannie and Freddie, even though its implied guarantee and granting of privileges have allowed the two GSEs to create trillions in new debt based on the mortgages of millions of new American homeowners. This debt is held by thousands of investors, hedge funds, and firms as a way to balance other interest rate risks.

Would Uncle Sam really let Freddie and Fannie sink and sell out all those bond holders? And would then own the notes on all the Freddie and Fannie-issued mortgages? Uncle Sam as landlord? Just asking…

And this from my macro trader oracle, Greg Weldon: “Officialdom is losing control. Integrity is being questioned. Assets held in USD are being liquidated. A re-balancing may ultimately take place, regardless of the direction and stance taken by central banks, and it will not be pretty, from the global economic perspective, during the interim period of time. Indeed, be careful what you ask for … YOU JUST MIGHT ‘GET IT’.”

Of Other Risk

Of course it’s not just the U.S. Treasury on the line. It’s bonds that enjoy the implied guarantee of the Federal government as well, including Fannie Mae and Freddie Mac, whose outstanding debt exceeds that of the U.S. government.

Could Fannie Mae and Freddie Mac contribute to the take-down of the dollar? Or would they be among its victims? I’ll be exploring that later. But for now, enjoy these passages I gleaned from the White House’s own report on the 2004 budget called Analytical Perspectives. It includes this bit on the GSEs.

"The Federal Government also enhances credit availability for targeted sectors indirectly through Government-Sponsored Enterprises (GSEs)—privately owned companies and cooperatives that operate under Federal charters. GSEs provide direct loans and increase liquidity by guaranteeing and securitizing loans. Some GSEs have become major players in the financial market. In 2002, the face value of GSE lending totaled $3.6 trillion. In return for serving social purposes, GSEs enjoy many privileges, which differ across GSEs.

EMPHASIS ADDED HERE IS MINE:

"In general, GSEs can borrow from Treasury in amounts ranging up to $4 billion at Treasury’s discretion, GSEs’ corporate earnings are exempt from state and local income taxation, GSE securities are exempt from SEC registration, and banks and thrifts are allowed to hold GSE securities in unlimited amounts and use them to collateralize public deposits. These privileges leave many people with the impression that their securities are risk-free. GSEs, however, are not part of the Federal Government, and their securities are not federally guaranteed. By law, the GSEs’ securities carry a disclaimer of any U.S. obligation."

So, it appears that the U.S. government has no obligation to bail out Fannie and Freddie, even though its implied guarantee and granting of privileges have allowed the two GSEs to create trillions in new debt based on the mortgages of millions of new American homeowners. This debt is held by thousands of investors, hedge funds, and firms as a way to balance other interest rate risks.

Would Uncle Sam really let Freddie and Fannie sink and sell out all those bond holders? And would then own the notes on all the Freddie and Fannie-issued mortgages? Uncle Sam as landlord? Just asking…

The Japanese Central Bank sold about $80.5 billion in yen in the first seven months of the year to keep the yen down. It’s going to be a lot harder for them to fight the market and successfully intervene to weaken the yen if traders think the yen is getting stronger against the dollar.

However, I doubt the Japanese are willing to allow the Yen to get too strong and start threatening their stock market rally. The Japanese economy grew at 3.9% in the second quarter. After 12 years of a soft-slow motion depression, you’d think they’d be unwilling to sacrifice their vulnerable recovery for the sake of George Bush’s reelection efforts…

…Then again…Junichiro Koizumi just won reelection to his party’s leadership and cleaned house in his cabinet. He may be feeling secure enough in his political fortunes to do something nice for Bush. He needs the U.S. at his side on North Korea, as well.

The nice thing he could do is let the yen strengthen to the point that a weaker dollar started to have some effect on the U.S. economy prior to next year’s election. The easiest effect to achieve would be higher corporate profits for U.S. multinationals between now and next November.

For example, Bloomberg reports that, “Coca-Cola Co.'s second-quarter profit increased 11 percent, with the dollar's slide accounting for 3 percentage points. Caterpillar Inc. said in July second-quarter earnings doubled and full-year profit will be more than forecast, partly because of currency-related gains.”

It’s a side benefit for Bush that a weaker dollar helps Detroit even as it hurts Toyota. What’s good for Detroit might be good for Michigan. And if it’s good for Michigan before next November, that’s good for Bush.

Michigan has 18 electoral votes. Illinois has 22. Both went for Gore in 2000. And even Michigan’s Republican congressmen are urging Bush to scrap the steel tariffs he imposed two years ago. A cynic would say he imposed those tariffs to win votes in steel-producing states, or to gain electoral votes in West Virginia (5 votes), Ohio (21 votes) , Pennsylvania (23 votes), and Indiana (12 votes).

The problem is, the tariffs have hurt steel-CONSUMING states. The U.S. International Trade Commission said in its report on Friday that the steel tariffs have resulted in a $680 million loss to U.S. business. A Republican congressman from Michigan claims that for every one steelworker job saved, three to seven jobs have been lost in steel consuming industries as a result of higher steel costs.

Regardless of the domestic politics involved, the weaker dollar ought to lead to rising earnings in the fourth quarter of this year and the first and second of next year should be supportive of higher stock prices--if Wall Street gets behind the hype. I doubt that even a sustained weaker dollar will lead to a turnaround in the jobs numbers, though. What’s more likely is that the pace of job losses may slow enough for Bush to say that we’ve turned the corner and the worst is behind us.

As I’ve said before here, even a much weaker dollar is not going to make U.S. industry suddenly more competitive with Chinese industry. And besides, it’s U.S. industry that’s decided to move to China anyway. If profits for multinationals are helped by cheap labor but hurt by a strong dollar, how will they change materially if they are helped by a weaker dollar but hurt by falling exports to the U.S.?

The truth is, most multinationals can only hedge currency risk, they can’t eliminate it. Will U.S.-based manufacturers really benefit if good made in China are now more expensive? Or will the rising prices simply cause consumers to consume less…defeating the whole purpose of trying to use politics to manage the marketplace?

Stock Market Implications

A weaker dollar is not necessarily better for corporate profits, once you factor in the reduced consumption that will come from higher prices for imported goods. Will consumers suddenly decide to buy the overpriced America-made refrigerator instead of the Chinese refrigerator because they are now roughly the same in price? Or will he not buy anything at all?

We’ll have to see. But my guess is that in the long run, the lowest cost producer wins. You can inflate prices through currency exchange rates. But ultimately, there are very few industries in which the U.S. will have the lowest labor cost. That means when you come down to it, somebody else is always going to beat America on price, and maybe on quality. And with so many countries in the world now producing manufactured goods…the future doesn’t bode well for strictly American-based industries.

But I digress. Stocks are the issue. The irony in the whole weaker dollar paradigm is that while it might make U.S. companies more competitive, it makes U.S. stocks less attractive. Who wants to own assets in a currency that’s losing value? And when you throw in the stock market’s sky-high recent valuations, now is a good time to take profits for foreign buyers.

What the Fed desperately hopes is that it can talk down the dollar without spooking a sell-off in U.S. bonds and sky-high long-term yields. A sell-off in the dollar with a collapsing bond market would bring the whole U.S. financial house of cards down.

Down would go housing, supported by historically-low mortgage rates. Blown up would be the bets of mortgage lenders. And up would go the cost of capital for businesses already reluctant to invest in a recovery they’re not confident in.

The only way the Fed can accomplish this is by promising to buy bonds. If the Fed buys bonds, it keeps interest rates low AND gets a weaker dollar. Presumably, Fed bond buying reassures foreign governments that there’s no need to liquidate U.S. bond holdings--even though the dollar is falling…no need at all.

You get the feeling that if you were a fly on the wall in a meeting of the world’s central bankers they would all nervously agree out loud that supporting a gradual decline in the dollar was, ideally, the best way to bring about the structural rebalancing of the world’s economy.

But in the back of their mind, you’d have to wonder how many of them are thinking of the moment when they realize they’re being asked to finance America’s twin deficits and take all the risk for it, all while getting a low rate of return in a currency that’s losing value.

In a T-Bond sell off, the guy who sells the most first loses the least…and everyone knows this…the question is, who will make the first move….and what will spark it?

And also, get gold.

The Japanese Central Bank sold about $80.5 billion in yen in the first seven months of the year to keep the yen down. It’s going to be a lot harder for them to fight the market and successfully intervene to weaken the yen if traders think the yen is getting stronger against the dollar.

However, I doubt the Japanese are willing to allow the Yen to get too strong and start threatening their stock market rally. The Japanese economy grew at 3.9% in the second quarter. After 12 years of a soft-slow motion depression, you’d think they’d be unwilling to sacrifice their vulnerable recovery for the sake of George Bush’s reelection efforts…

…Then again…Junichiro Koizumi just won reelection to his party’s leadership and cleaned house in his cabinet. He may be feeling secure enough in his political fortunes to do something nice for Bush. He needs the U.S. at his side on North Korea, as well.

The nice thing he could do is let the yen strengthen to the point that a weaker dollar started to have some effect on the U.S. economy prior to next year’s election. The easiest effect to achieve would be higher corporate profits for U.S. multinationals between now and next November.

For example, Bloomberg reports that, “Coca-Cola Co.'s second-quarter profit increased 11 percent, with the dollar's slide accounting for 3 percentage points. Caterpillar Inc. said in July second-quarter earnings doubled and full-year profit will be more than forecast, partly because of currency-related gains.”

It’s a side benefit for Bush that a weaker dollar helps Detroit even as it hurts Toyota. What’s good for Detroit might be good for Michigan. And if it’s good for Michigan before next November, that’s good for Bush.

Michigan has 18 electoral votes. Illinois has 22. Both went for Gore in 2000. And even Michigan’s Republican congressmen are urging Bush to scrap the steel tariffs he imposed two years ago. A cynic would say he imposed those tariffs to win votes in steel-producing states, or to gain electoral votes in West Virginia (5 votes), Ohio (21 votes) , Pennsylvania (23 votes), and Indiana (12 votes).

The problem is, the tariffs have hurt steel-CONSUMING states. The U.S. International Trade Commission said in its report on Friday that the steel tariffs have resulted in a $680 million loss to U.S. business. A Republican congressman from Michigan claims that for every one steelworker job saved, three to seven jobs have been lost in steel consuming industries as a result of higher steel costs.

Regardless of the domestic politics involved, the weaker dollar ought to lead to rising earnings in the fourth quarter of this year and the first and second of next year should be supportive of higher stock prices--if Wall Street gets behind the hype. I doubt that even a sustained weaker dollar will lead to a turnaround in the jobs numbers, though. What’s more likely is that the pace of job losses may slow enough for Bush to say that we’ve turned the corner and the worst is behind us.

As I’ve said before here, even a much weaker dollar is not going to make U.S. industry suddenly more competitive with Chinese industry. And besides, it’s U.S. industry that’s decided to move to China anyway. If profits for multinationals are helped by cheap labor but hurt by a strong dollar, how will they change materially if they are helped by a weaker dollar but hurt by falling exports to the U.S.?

The truth is, most multinationals can only hedge currency risk, they can’t eliminate it. Will U.S.-based manufacturers really benefit if good made in China are now more expensive? Or will the rising prices simply cause consumers to consume less…defeating the whole purpose of trying to use politics to manage the marketplace?

Stock Market Implications

A weaker dollar is not necessarily better for corporate profits, once you factor in the reduced consumption that will come from higher prices for imported goods. Will consumers suddenly decide to buy the overpriced America-made refrigerator instead of the Chinese refrigerator because they are now roughly the same in price? Or will he not buy anything at all?

We’ll have to see. But my guess is that in the long run, the lowest cost producer wins. You can inflate prices through currency exchange rates. But ultimately, there are very few industries in which the U.S. will have the lowest labor cost. That means when you come down to it, somebody else is always going to beat America on price, and maybe on quality. And with so many countries in the world now producing manufactured goods…the future doesn’t bode well for strictly American-based industries.

But I digress. Stocks are the issue. The irony in the whole weaker dollar paradigm is that while it might make U.S. companies more competitive, it makes U.S. stocks less attractive. Who wants to own assets in a currency that’s losing value? And when you throw in the stock market’s sky-high recent valuations, now is a good time to take profits for foreign buyers.

What the Fed desperately hopes is that it can talk down the dollar without spooking a sell-off in U.S. bonds and sky-high long-term yields. A sell-off in the dollar with a collapsing bond market would bring the whole U.S. financial house of cards down.

Down would go housing, supported by historically-low mortgage rates. Blown up would be the bets of mortgage lenders. And up would go the cost of capital for businesses already reluctant to invest in a recovery they’re not confident in.

The only way the Fed can accomplish this is by promising to buy bonds. If the Fed buys bonds, it keeps interest rates low AND gets a weaker dollar. Presumably, Fed bond buying reassures foreign governments that there’s no need to liquidate U.S. bond holdings--even though the dollar is falling…no need at all.

You get the feeling that if you were a fly on the wall in a meeting of the world’s central bankers they would all nervously agree out loud that supporting a gradual decline in the dollar was, ideally, the best way to bring about the structural rebalancing of the world’s economy.

But in the back of their mind, you’d have to wonder how many of them are thinking of the moment when they realize they’re being asked to finance America’s twin deficits and take all the risk for it, all while getting a low rate of return in a currency that’s losing value.

In a T-Bond sell off, the guy who sells the most first loses the least…and everyone knows this…the question is, who will make the first move….and what will spark it?

And also, get gold.