It is just now dawning on middle class Europeans and Americans that while rising standards of living and prosperity all over the world are worthy humanitarian goals, they have real economic consequences. Consequences that are going to make getting and keeping wealth a lot tougher in Europe in America.

The most obvious consequence is the one getting all the headlines: the jobs/wealth transfer as the global division of labor rewards the low-cost East and guts the high-cost West. It's true within Europe as the EU expands east. And it's been true in the U.S. ever since NAFTA, and even more so now with the rise of outsourcing in Asia.

Less obvious is an even bigger threat that goes beyond jobs. There's a geopolitical game of grand strategy underway to secure the world's raw materials. Rising middle class societies consume energy and raw materials in huge quantities.

Now that India, China, Indonesia, and others are coming into their own economically, it means there are more competitors for scarce resources. And it means that competition might be more than economic. Without noticing it, we may have quietly entered a new age of total economic warfare for commodities.

If you're an investor in a country without large energy reserves (or solid friendships with countries that DO have them), you may be a lot closer to a radical change in your standard of living than you realize. A report published by the

Fleet Street Letter here in London revealed that in the event of an interruption in natural gas supplies, England has less than 48 hours of energy reserves at peak energy demand. That's not much margin for error--even in a world that wasn't threatened constantly by terrorism or the budding rivalries of ambitious and not necessarily friendly competitor nation states.

If you're an investor in the raw materials themselves, the Age of Scarcity can at least provide you with a measure of personal prosperity. You may not know who's ultimately going to win the war for the world's oil. But you know that the contest for it will see prices rise. And not just for oil.

The secular bull market in commodities which began two years ago has some very powerful forces behind it--forces that could make patient investors very wealthy. More on this in the April issue. As you might guess, I'm very bullish on closed-end commodity funds and exchange traded funds and will have several new recommendations that make it easy for you to buy the entire energy sector in one single stock.

Meanwhile, there's also a new world energy order to figure out--something I'll be doing here at the

Insider day by day and week by week. Today, we'll finish with a quote from what looks to me like a Korean website called donga.com on a potential conflict between the U.S. and China over...oil. Emphasis added is mine.

"China is putting all efforts into securing a supply of energy from across the world. In January, China and Saudi Arabia entered into a contract to jointly explore and produce natural gas.

China and Saudi Arabia’s state-owned Aramco formed a $3 billion petroleum chemical joint venture. All these moves make the U.S. uneasy as it depends on two key allies in the region, Saudi Arabia and Egypt, for control of the Middle East. Some signs suggest that Saudi Arabia and China are developing a weapons-for-oil deal.

"A government-sponsored energy policy group in the U.S. estimated that the U.S.’s dependence on foreign oil, which rose to 50 percent in 2003 from 30 percent in 1985, will reach 70 percent by 2020.

"

This is why the U.S. sees China’s search for stable energy sources as a challenge to its world hegemony. Along with the conflict over trade, military rivalry, and the space development race, the competition over energy will be an important axis of the U.S-China competition over international dominance. It explains why China does not support the war in Iraq. "

By the way, notice that the authors of the piece assume that the U.S. aspires to or has "world hegemony." I'm not sure how many Americans are aware of just how distrustful of American motives most other people in the world are right now, not just North Koreans. In fact, a Pew Research poll released today showed that most people outside America view the war in Iraq as an American effort to control Middle Eastern oil and dominate the world. Some Americans probably think that too, of course.

But the point is, there is probably far more disagreement over the War on Terror today in the West than there was even one year ago. Europe seems invigorated to take a new approach and exercise some diplomatic muscle. Whether it will work or not is a differnt matter. I have my doubts about "muscular pacifism." Bit it will certainly make for an interesting spring, summer, and U.S. election.

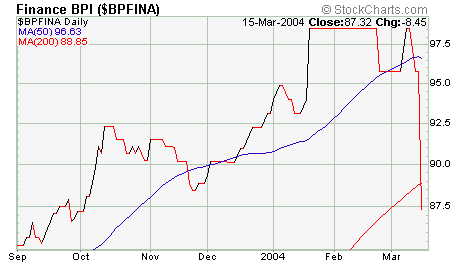

If you're looking for confirmation that financials and financial services are breaking down....check out the three iShare charts below.

First, IYF, the Dow Jones U.S. Financial Sector Index Fund (38% banks, 21% diversified financials, 20.8% insurance, 11.4% securities brokers, 7.8% real estate.)

If you're looking for confirmation that financials and financial services are breaking down....check out the three iShare charts below.

First, IYF, the Dow Jones U.S. Financial Sector Index Fund (38% banks, 21% diversified financials, 20.8% insurance, 11.4% securities brokers, 7.8% real estate.)

Next, IYG, the Dow Jones U.S. Financial Services Index Fund (54% banks, 29% diversified financials, 16% securities brokers)

Next, IYG, the Dow Jones U.S. Financial Services Index Fund (54% banks, 29% diversified financials, 16% securities brokers)

And finally, IXG, the S&P Global Financials Sector Index Fund (49% banks, 26.9% diversified financials, 19% insurance, and 3.5% real estate.)

And finally, IXG, the S&P Global Financials Sector Index Fund (49% banks, 26.9% diversified financials, 19% insurance, and 3.5% real estate.)

How do you trade it? Right now, XLF and XBD are the only of the indexes shown above that show any significant options activity. Odd that so many ETFs make it possible to trade all sorts of sectors...except financials and broker dealers.

Absent an index or sector put, you can cherry pick and go after the highest flyers. How about Bank of America? It's out $675 million (to be split with its new partner Fleet Boston) for granting high dollar clients the right to do some late trading in mutual funds. Is that priced into the stock? Is a slow-down in mortgage lending? Is a surge in credit defaults...or derivatives losses...or equity losses?

How do you trade it? Right now, XLF and XBD are the only of the indexes shown above that show any significant options activity. Odd that so many ETFs make it possible to trade all sorts of sectors...except financials and broker dealers.

Absent an index or sector put, you can cherry pick and go after the highest flyers. How about Bank of America? It's out $675 million (to be split with its new partner Fleet Boston) for granting high dollar clients the right to do some late trading in mutual funds. Is that priced into the stock? Is a slow-down in mortgage lending? Is a surge in credit defaults...or derivatives losses...or equity losses?